Best Accounting Practice Management Software

Best accounting practice management software are office tools, receipt bank, saasant transactions, and aero workflow. It assists companies in keeping track of all earnings, spending, and other financial transactions.

Connect With Your Personal Advisor

List of 20 Best Accounting Practice Management Software

Cloud Accounting Software Making Billing Painless

A variety of features in Freshbooks' user-friendly and simple accounting practice management system can assist freelancers and small enterprises in better managing their finances. Users of Freshbooks can quickly and simply produce invoices with a professional appearance. The software provides editable invoice templates, automated reminders for payments, and support for accepting payments online. Read FreshBooks Reviews

Starting Price: Starting Price: $15.00 Per Month

Recent Review

"FreshBooks: The Simple and Intuitive Accounting Solution for Small Businesses" - Ayoub El Fahim

Wave Accounting, a cloud-based accounting practice software can be used by small business owners, independent contractors, and entrepreneurs. Businesses can manage employee salaries and benefits thanks to Wave Accounting's payroll management features. The program also has a receipt tracking module that enables users to scan and upload receipts for use in producing expenditure reports and keeping tabs on spending. Read Wave Accounting Reviews

Starting Price: Available on Request

Recent Review

"One of the best application to manage your accounts" - Vishit Chhatrapati

| Pros | Cons |

|---|---|

|

Detailing the features, flow of the application and seamless process |

for my usage, it's working perfectly fine. |

|

Advanced integration with high-end scalability. Invoicing payroll is seamless and prompt, accurate sales report generations. |

The app only comes with a support for IOS and Android. They should expand its usability. |

Kashflow, an accounting practice management software, is used by various small businesses in the UK. Accounting, invoicing, spending monitoring, and payroll administration are just a few of the capabilities that the software provides to assist in managing finances. Users of Kashflow can now create and send invoices to clients using the invoicing module. Read Kashflow Reviews

Starting Price: Starting Price: $9.24 Per Month

Recent Review

"Accounts review" - Linda Robinson

| Pros | Cons |

|---|---|

|

Easy to use, straightforward instructions |

You cannot always get all the reports that you want or need |

SlickPie is the best practice management software for accountants and has a simple, intuitive interface that makes it easy for users to navigate and complete accounting tasks. Additionally, it provides a wide range of customized templates and reports to aid firms in properly managing their finances. Moreover, it has a plethora of features, such as invoicing, billing, spending monitoring, and financial reporting, available in the software to assist in managing finances. Read SlickPie Reviews

Starting Price: Starting Price: $$0.00 Month

Recent Review

"Best accounting app I have tried" - Gerald Butterton

Category Champions | 2023

Sage 50Cloud is an accounting practice software that helps small and medium-sized businesses to manage their financial operations with ease. The platform is made to offer accountants a complete answer to all of their bookkeeping requirements. This accounting software also has a payroll module that enables users to create paychecks, manage employee payments, and compute taxes and other deductions. Read Sage 50cloud Reviews

Starting Price: Starting Price: $50.58 Per Month

Recent Review

"Excellent service" - Lynne Smit

| Pros | Cons |

|---|---|

|

It is easy to use. |

It should accommodate other languages like Afrikaans. |

|

User Interface and ease of usage |

Stable version of applications |

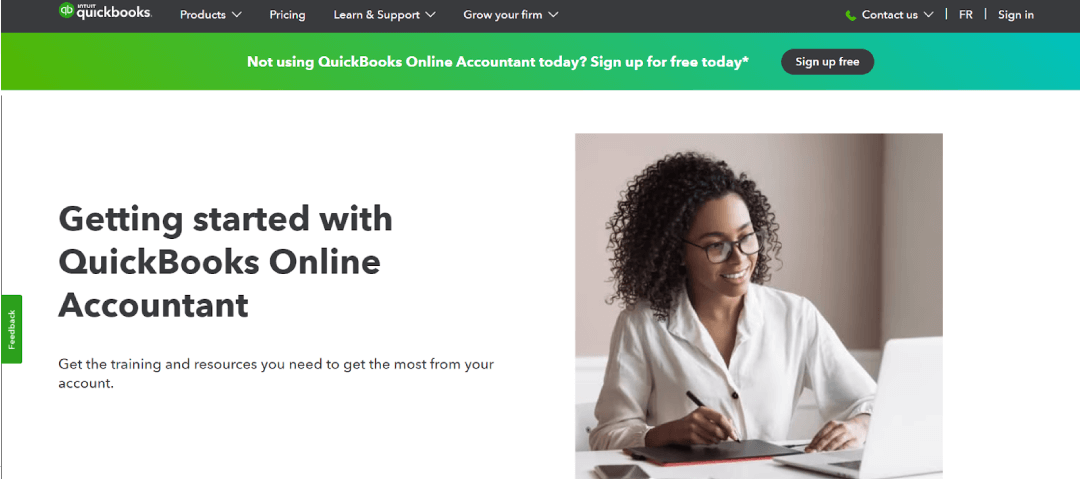

Canopy is an accounting firm management software designed to streamline the work of tax and accounting professionals. A unified client management system provided by Canopy enables businesses to keep track of all client data, including contact information, tax records, and communication history. Learn more about Canopy

Starting Price: Available on Request

Category Champions | 2023

Software by Jetpack Workflow

Jetpack Workflow is a practice management software for accounting firms designed to automate and streamline workflow. The software offers various features and tools to manage clients, deadlines, tasks, and team collaboration. Jetpack Workflow is a powerful tool for accounting firms looking to streamline their workflow and improve team collaboration. Learn more about Jetpack Workflow

Starting Price: Starting Price: $40 Per Month

Contenders | 2023

OfficeTools is an accounting firm management software designed to help accounting professionals manage their workflows and improve client relationships. The client management tool in OfficeTools is one of its key components. The program offers a central spot for organizing customer information, such as contact information, notes, and files. Users can quickly keep track of their client interactions, set up appointments, issue bills, and remind customers to make payments. Learn more about OfficeTools

Starting Price: Available on Request

Karbon is an online practice management software for accountants. It provides numerous functionalities to assist accounting businesses in streamlining their work processes, collaborating with clients and team members, and effectively managing their assignments and projects. Accounting firms may better manage their emails with Karbon's unified email inbox. Learn more about Karbon

Starting Price: Starting Price: $70 Per Month

Emergents | 2023

Suralink is a fully featured Audit Management Software designed to serve Enterprises, Agencies. Suralink provides end-to-end solutions designed for Web App. This online Audit Management system offers Dashboard at one place. Learn more about Suralink

Starting Price: Starting Price: $27 Per Month

Emergents | 2023

BlackLine is a cloud-based accounting practice software that is designed for mid-size to large organizations. The software offers a range of features to help manage financial operations, including account reconciliation, financial management, and intercompany accounting. Its account reconciliation module automates the entire process and eliminates the need for manual effort. Learn more about BlackLine

Starting Price: Available on Request

With FloQast, accounting teams integrate their existing Excel checklists into the application for cloud-based collaboration that automates TB tie-outs to significantly improve your month-end close process. Read FloQast Reviews

Starting Price: Starting Price: $150 User/Month

Recent Review

"Complete reconciliation tool" - Nikita Surana

| Pros | Cons |

|---|---|

|

Numbers are updated on real time basis and uploading of files does not require much time. |

As such no cons, I feel the product is the best in the market. |

Emergents | 2023

Import, Delete & Export Software for QuickBooks

An intuitive and powerful automation tool for importing, exporting and deleting transactions & lists into QuickBooks.SaasAnt Transactions is packed with an advanced and powerful import setting to cater to the comprehensive needs of importing file-based transactions. Learn more about SaasAnt Transactions (Desktop)

Starting Price: Starting Price: $99 Per Year

Emergents | 2023

Veryfi is an accounting practice software that is intended to automate and streamline financial procedures. A number of accounting-related capabilities, such as cost management, time tracking, and financial reporting, are provided by the software. Strong security features are provided by Veryfi to safeguard private financial information. For further protection, the software supports multi-factor authentication and encrypts all data while it is in use and while it is at rest. Learn more about Veryfi

Starting Price: Starting Price: $14 Per Month Per User

Emergents | 2023

Aero Workflow is a cloud-based accounting practice software designed to help accounting firms manage their workflow processes more efficiently. The software offers a range of features to streamline workflows, including task management, document management, and time tracking. For firms that want to streamline their accounting processes, this is the best accounting practice management software. Learn more about Aero Workflow

Starting Price: Available on Request

Zoho Books is an accounting firm practice management software that is designed to help small businesses and accounting firms manage their finances more efficiently. It provides a plethora of features for reporting, project management, time tracking, expenditure monitoring, and invoicing. The program offers instruments for logging spending, classifying expenses, and monitoring chargeable expenses. Also, users can submit receipts and link them to particular spending. Read Zoho Books Reviews

Starting Price: Starting Price: $10.4 Organisation/Month Billed Annually

Recent Review

"Zoho Bookings Schedule Good Timming" - JADAV PRAVIN

| Pros | Cons |

|---|---|

|

Zoho Books has integrated many little changes that further develop adaptability and convenience, alongside many significant changes. The webpage presently offers custom reports, QR code support in solicitations, further developed auto-examine for advanced monetary records like receipts, and improved coordination with other related Zoho sites.Automation features like payment reminders, scheduling reports and setting triggers for certain workflows can save a business owner a lot of time from the monotonous bookkeeping work. |

You start by giving contact and relevant deals charge data. A few elements, similar to solicitations and costs, are remembered for the site as a matter of course, however you can pick which different modules you might want to initiate, for example, stock, buy requests, and time sheets. On the off chance that you're a tiny business, you might need to turn a portion of these off to limit any pointless elements. |

|

Easy to use |

Report |

QuickBooks Online is an accounting firm management software that helps small and medium-sized businesses to manage their finances and accounting processes. QuickBooks Online offers a variety of functionalities to assist businesses in managing their finances and is cloud-based, making it accessible from any location with an internet connection. Read QuickBooks Online Reviews

Starting Price: Starting Price: $69.44 Per Year

Recent Review

"Easy to access" - Manisha Garg

| Pros | Cons |

|---|---|

|

Its easy to use |

No cons |

|

Import feature, Export feature, auto suggestion appears while matching and their customization report feature. Their support system is awesome. |

It is not an easy software to learn, you need to have training before using it. Professional accounting base is necessary. Although they provide videos for training. |

Category Champions | 2023

Accounting success stories in numbers

LEAD Accounting Plus is a simple but comprehensive accounting software for small & medium businesses for billing, inventory management, taxation and financial reporting along with industry specific features like manufacturing. Read LEAD Accounting Plus Reviews

Starting Price: Starting Price: $208.33 License

Recent Review

"Worth the value we pay" - Nithu

| Pros | Cons |

|---|---|

|

It's features. |

Reports. |

|

Easy and intuitive UI. Simple process flow. Useful reports. Excellent support. |

Too many options. |

Category Champions | 2023

Software by EasyCloud Consultants Pvt Ltd.

A cloud-based practice management software that is significantly more better, faster, cheaper and effectively automates all routine and repetitive tasks, thereby, enabling practicing professionals to save a lot of time to concentrate on something that's new and innovative. Read EasyCloudBooks Reviews

Starting Price: Available on Request

Recent Review

"EasyCloudBooks: Good Workflow Management Software for Professionals" - Anil Kumar

| Pros | Cons |

|---|---|

|

The software has been designed with practicing CAs in mind. The developers have tried to handle issues faced by CAs such as CRM, deadlines, a delegation of work and reporting, micromanagement, and billing. The approach is down to earth |

Full video tutorials of setting up the software can help CAs to deploy the software in-house |

|

Very well explained and user friendly |

Right now I don't see any Cons |

Contenders | 2023

Take Control of your Operations, Work together with your Team and Clients, Eliminate the Stress out of Handling your Practice, Plan Tasks for the Entire Year,Manage Due Dates Effectively, Cost Monitoring at a Mouse Click, Prompt Handling of Invoices, and many more Read ERPCA Reviews

Starting Price: Available on Request

Recent Review

"One of the best software of CA Office Automation" - Priya Ahlawat

| Pros | Cons |

|---|---|

|

Arguably has the best Task Management System. Invoicing & Inward-Outward are exceptional as well. |

Sometimes software runs slower than expected speed |

|

Easy to use, Comprehensive task management, Billing, Inward -Outward Management |

Data loading speed has scope of optimization |

Until 31st Mar 2023

For accounting businesses aiming to boost productivity, streamline workflow, and expand their practice, accounting practice management software is an effective tool. These software solutions provide a variety of capabilities that can assist accounting firms in managing numerous client accounts, being organized, and working together as a team.

This manual offers advice on how to choose and buy the finest software for your firm's requirements, as well as an overview of the main features and components of accounting practice software.

What Is Accounting Practice Management Software?

Accounting practice management software is developed especially for accounting firms and individual accountants. A variety of tools and functions, including client and contact management and appointment scheduling, are included in the software to assist in managing the day-to-day activities of an accounting office.

Software for managing accounting practices includes Sage Practice Solutions, QuickBooks ProAdvisor, and Xero Practice Manager, for instance. These programs' main objective is to automate tedious operations so that the accountant may concentrate on more crucial duties like offering clients professional services, evaluating financial data, and giving business recommendations.

Purpose of Accounting Practice Management Software

While accounting management software works for many different requirements, its main purpose is to help create streamlined accounting practices. Below are the main purposes of using accounting practice management software.

-

Client management: The software enables the management of tasks and projects as well as the storage and organization of customer information.

-

Time tracking: The software allows tracking the time spent on different tasks and projects, which can be used for billing and invoicing.

-

Billing and invoicing: It allows automated billing and invoicing and can also manage recurring payments and subscriptions.

-

Document management: The software can store and organize important documents, such as financial statements, tax returns, and contracts.

-

Workflow management: Software can help manage the workflow within the firm, including task assignments, deadlines, and progress tracking.

-

Compliance and reporting: Software can help with compliance and regulatory reporting requirements, such as tax returns and financial statements.

-

Performance insights: Software can provide real-time insights into the firm's performance, such as revenue, expenses, and profitability.

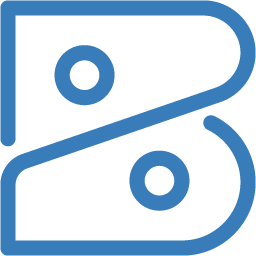

Key Benefits of Accounting Practice Management Software

Accounting practice management software can provide a number of benefits to accounting firms for their practice. Below are the main benefits of the right accounting software:

-

Enhances data security and maintains business compliance

Data encryption is a common feature of many accounting practice management software programs, and it can help safeguard sensitive data from unauthorized access.

Additionally, the software offers a variety of access controls to guarantee that only authorized individuals have access to sensitive data and that users can only carry out tasks for which they have been given permission.

Moreover, the software has backup and recovery options that can help prevent data loss in the event of a system malfunction or other problems. The platform can also assist organizations in managing regulatory reporting and compliance obligations, such as tax returns and financial statements, which can lower the risk of fines and penalties.

-

Eliminates manual processes and enhances efficiency

Software may greatly reduce the time and effort needed to manage a business's finances by automating time-consuming and repetitive accounting operations like data input and account reconciliation.

Automating these manual processes can improve the consistency and accuracy of financial data, which can result in more timely and accurate financial reporting and decision-making. The ability to collaborate and communicate more efficiently between team members can be enabled through software, increasing output.

-

Provides scalability

The software can give your organization scalability by automating a lot of the manual tasks needed in running an accounting firm. Along with tasks like billing, bookkeeping, and tax preparation, this may also involve managing clients and processes.

By automating these processes, the software can assist you in being more productive and efficient, allowing you to grow your business without having to hire more staff members.

Numerous accounting practice management software also includes features like time monitoring, document management, and reporting, which can help you further streamline your business procedures and increase efficiency.

-

Keeps a record of practice performance indicators

Practice Management Software for accounting firms can help keep track of practice performance indicators by providing various tools and features that can be used to measure and analyze key performance metrics.

Accounting practice management software can help track performance indicators such as client management, time tracking, financial reporting, project management and different KPIs.

Key Features of Accounting Practice Management Software

Before purchasing any software, you need to look at what features the platform provides. The key components or features of accounting practice management software typically include

-

Task automation

The use of accounting practice software enables the automation and streamlining of numerous accounting practice-related operations. The management of clients, billing, timekeeping, document management, and other tasks can all be automated.

For instance, it can be tedious to send invoices to clients if you own an accounting practice. You can use an accounting practice management system to automatically generate invoices in this case as opposed to manually making them.

-

Client management

Client management is a key feature of accounting practice management software. Using this function, users can keep and organize client information, such as contact details, financial information, and notes about the relationship.

Additionally, it may be used to manage projects and deadlines related to each client, organize meetings and appointments, keep tabs on communications, and log conversations. Tools for creating invoices, managing payments, and creating reports on customer activity and financial performance are also frequently included in the feature.

-

Workflow automation

Accounting practice management software's workflow management feature is created to help accounting practices streamline and automate workflow procedures.

You may develop and manage workflows using this tool for various tasks and processes, including client onboarding, tax preparation, and financial reporting. These workflows can involve automated operations like document production and data entry and can be tailored to the particular demands of the practice.

-

Communication portals

Clients can safely access and share information with their accounting practice using the communication portal feature of the software for accounting practices.

This feature often includes a secure web portal where users can log in to get other pertinent papers and information, check their financial information, and connect with their accountants. Additionally, it is frequently used to send in forms, make payments, and e-sign documents.

Additionally, the tool enables the practice to notify and remind clients. This enhances transparency between the practice and the client and lowers the likelihood of missed deadlines.

-

Project tracking

Accounting practices can manage and track their projects effectively with the help of the project tracking feature of their practice management software. Users can create tasks, assign them to others, establish due dates, and monitor the status of each project using this function. This aids in making sure that everything is finished on time and that nothing is overlooked.

Users may also be able to define goals, manage time and expenses related to each project, and allocate work to particular team members. This enables the practice to get a better understanding of the project's financial component and spot any potential problems.

How To Buy Accounting Practice Management Software?

When purchasing accounting practice management software, there are a few key aspects to consider to ensure that you choose the best software for your firm's needs.

-

Accounting practice management software comparison

It's crucial to weigh your alternatives when buying accounting practice management software and pick the version that best suits your business demands. The following actions can be used to compare software options:

1. List the features and capabilities that are crucial to your business, such as customer management, workflow management, and project tracking.

2. Look at the different software choices offered and contrast their features and costs. Examine online testimonials and seek advice from other accounting experts.

3. Software that is easy to use and navigate can save you a lot of time and frustration in the long run. Be sure to look at the software's interface and make sure it is intuitive and user-friendly.

-

Advanced functionality

Choosing advanced features when purchasing Accounting Practice Management Software can be important for several reasons:

1. Efficiency: You may automate and simplify a number of procedures, such as client onboarding and tax preparation, to boost your practice's production.

2. Scalability: As your business expands, your software requirements could also alter. More flexibility and scalability can be offered by advanced features to meet your changing needs.

3. Data Security: Modern features can add an extra layer of protection for customer data and financial information, like secure client portals.

4. Customization: More customization options may be available, enabling you to modify the software to match the particular requirements of your practice.

5. Increased profitability: Advanced features can help you better manage your practice and clients, leading to increased profitability and better client retention.

-

Compatibility

Compatibility is an important factor to consider when purchasing Accounting firm management software, as it can greatly impact the efficiency and effectiveness of the software for your practice. Here are a few reasons why compatibility is important:

1. Integration: The software can assist in streamlining and automating operations, boosting efficiency and productivity, if it is interoperable with other systems, such as your accounting program or CRM Sotware

2. Data transfer: The ability to transfer data, such as client information, financial information, and reports, between systems is facilitated by compatibility with other systems. This can save a tonne of time and effort and lower the possibility of mistakes.

3. Accessibility: If the software works with a variety of hardware and operating systems, it can give users more freedom in how and where they use it. This is particularly crucial if team members operate remotely or from various places.

4. Cost saving: If the software is not compatible with other systems, it may require additional costs to integrate or transfer data, which can be costly for the practice.

-

Assess requirements

The most crucial question you need to ask before purchasing an accounting practice management software is identifying whether you need it or not. So, compare the features, analyze your requirement, and then make the final decision.

This way, you can invest in software that will provide better ROI and improve your business processes.

5 Best Accounting Practice Management Software

There are many software options available, but here are the best practice management software for accountants that are popular:

1. Karbon

Karbon is a cloud-based accounting practice management system made to assist accounting companies in streamlining their operations and increasing productivity. Client management, process automation, and team collaboration tools are some of the capabilities offered by the software.

It has the capacity to create financial reports and client communications, as well as an integrated time tracking and billing system. Karbon interacts with well-known accounting programs, including Xero and QuickBooks, to give customers a streamlined workflow. The software is a popular option for small to medium-sized accounting firms since it is user-friendly and simple to use.

Features

- A centralized dashboard to manage workflow, client engagements, and communication

- Manage and assign tasks, set deadlines, and track progress

- Store, share and collaborate on documents with clients and team members.

- Secure file transfer protocols to improve client communication.

- Integrates with popular accounting solution

- Real-time reporting and analytics on practice performance

- Uses bank-grade security to protect client data

- Provides features such as two-factor authentication and data encryption

Pros

- Automated workflow features

- Task management feature

- Document management feature

- Integrations with other popular accounting software

- Offers real-time reporting and analytics

- Offer access through mobile

Cons

- Limitation in customization capacity

- Limited third-party integrations

- Higher pricing in comparison with other tools

Pricing

- The Basic plan cost $24 per user per month

- The Pro plan costs $39 per user per month

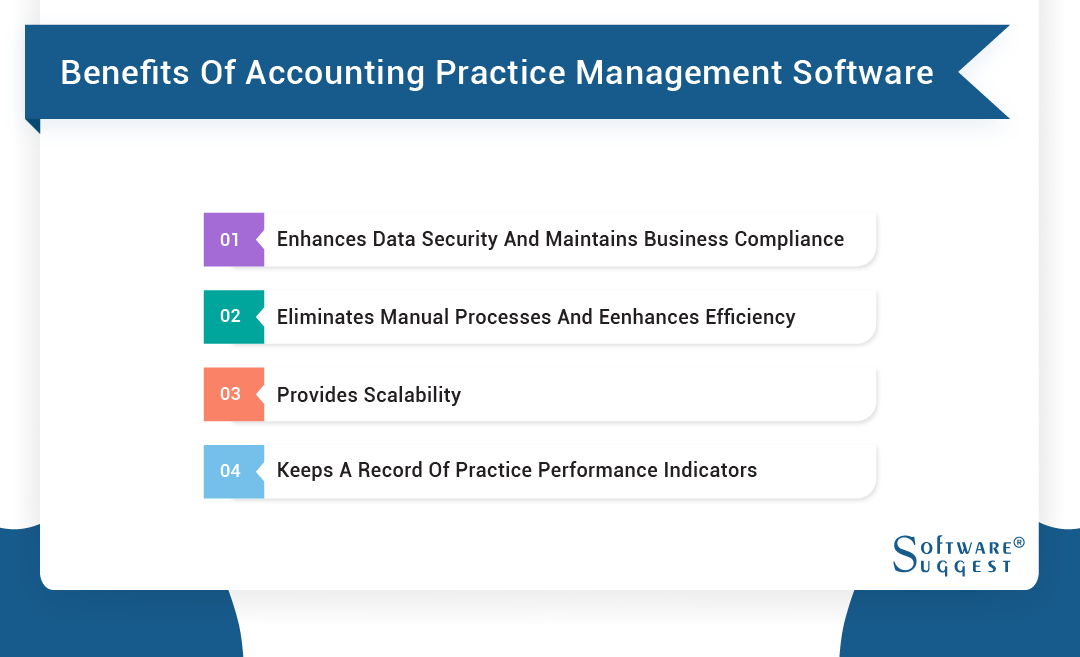

2. QuickBooks Online Accountant

Intuit developed QuickBooks Online Accountant, a cloud-based accounting tool is specifically built for accountants and bookkeepers to manage the accounts of their clients. It allows for real-time customer cooperation and grants them access to financial data.

Moreover, the platforms offer features for creating and sending invoices, keeping tabs on spending, generating financial reports, and managing payroll.

The software also includes a practice management center that, by centralizing client information, records, and communications, aids in maintaining the practice's organization. Additionally, it has a client site that enables users to engage in real-time with their accountants and see their financial data.

Features

- The software allows multiple users to access the same client's books

- Tools for managing client engagements, client dashboard

- Time tracking, and client data organization

- Bulk import of data, which can save time and improve accuracy

- Customizable reports, including financial statements and tax forms

- Bank-level security to protect client data and advanced permissions settings

- Integration with other software such as receipt scanning and payroll

- Accessible from any device with an internet connection

Pros

- Enable teams to simultaneously view the same client's books

- Possesses sophisticated permissions settings

- Give users access to ProAdvisor

Cons

- Limited customization options

- More expensive than other accounting software options

- Limited inventory tracking

- FewerLimited budgeting tools compared to other accounting system options

- Limited features for international users

Pricing

- Simple plan cost $15 per month

- Essential plan cost $25 per month

- Plus plan cost $40 per month

- Advanced plan cost $70 per month

3. Canopy

Canopy is a cloud-based accounting client management software to assist accounting professionals in streamlining their workflow, increasing productivity, and expanding their clientele. The program has facilities for team collaboration, client administration, workflow automation, time tracking, and billing integrated right in. Additionally, it offers a selection of financial reports and the option to alter them to meet the particular requirements of the accounting firm.

The ability of Canopy to integrate with other well-liked accounting programs like QuickBooks and Xero is one of its primary advantages. This makes it simple for accounting firms to manage numerous customer accounts and function as a team. A variety of financial reports that can be customized to meet the unique requirements of the accounting firm are also provided by the software.

Features

- Multiple-currency assistance

- Making bills, keeping track of spending, and managing accounts payable and receivable

- Creating financial projections and budgets

- Assist companies in adhering to tax laws and regulations

- Can be integrated with other accounting software

- There is a mobile app for Canopy that is accessible from anywhere

Pros

- User-friendly interface and simple navigation.

- Can assist accounting firms in streamlining their workflow

- Include client management, document management, and time monitoring

- Canopy is accessible from any device with an internet connection.

- Increase data integrity by utilizing Canopy's variety of connectors with other software like QuickBooks and Xero

Cons

- Software's price can be too high for some people

- The software has a challenging learning curve, and mastering all of its features takes some time

- According to some users, customer service is not as responsive as they would want

Pricing

- The Basic plan priced at $29 per user per month

- The Professional plan is priced at $49 per user per month

- The Enterprise plan is priced on a quote basis

4. TaxDome

The cloud-based accounting practice management solution TaxDome was created especially for tax and accounting organizations. It provides several features to aid businesses in streamlining their operations, increasing productivity, and expanding their clientele.

Client management, process automation, team collaboration tools, and an integrated time tracking and billing system are a few of TaxDome's standout features. A variety of financial reports are also included, as well as the option to tailor reports to the particular requirements of the accounting practice.

With a variety of features to boost productivity, handle multiple client accounts, and optimize workflow, TaxDome is a complete accounting practice management system. Additionally, it provides a selection of built-in financial reports and the option to build them to meet the particular requirements of the accounting firm.

Features

- TaxDome provides a client management facility

- Document management

- Allows users to track time spent on client work and bill clients accordingly

- Includes a built-in messaging system

- Tax preparation tools to prepare and file tax returns for clients

- TaxDome integrates with software like QuickBooks and Xero

Pros

- Any device with an internet connection can access it

- Enables the creation of unique workflows and templates by users

- Provides a customizable price system

Cons

- Complex to use

- Provide limited integrations

- Provide limited support

Pricing

- The Basic plan cost $29 per user per month

- The Professional plan cost $49 per user per month

- The Enterprise plan is priced on a quote basis

5. Dext Prepare

The goal of the cloud-based accounting practice management tool Dext Prepare is to assist tax professionals in streamlining their operations and increasing productivity. Client management, process automation, team collaboration tools, and an integrated time tracking and billing system are just a few of the capabilities offered by the software. A variety of financial reports are also included, along with the option to tailor reports to the particular requirements of the accounting practice.

Dext Prepare's interface with well-known accounting programs like Xero, QuickBooks, and MYOB is one of its primary benefits; it enables accounting practices to handle multiple client accounts and collaborate as a team. The software also provides a variety of built-in financial reports, as well as the option to modify reports to meet the particular requirements of the accounting practice.

Features

- Automatically import data from a variety of sources

- Create budgets and forecasts

- Financial analysis tools, including ratio analysis and profitability analysis

- Allows users to share their financial data with other team members

Pros

- Provide automation that makes users' tasks easy

- Budgeting and forecasting to make informed financial decisions

- Financial analysis for improvement

- Making it easy for users to collaborate on financial planning and analysis

Cons

- Does not integrate with some of the tools as of its competitors.

- Provide limited support

- Limited functionality

Pricing

- The Basic plan is priced at $9 per month

- The Pro plan is priced at $29 per month

- The Custom plan is priced on a quote basis

Final Thoughts

In conclusion, accounting practice management software can be a useful tool for organizations that want to boost productivity, streamline processes, and expand their client base.

Client management, workflow automation, team collaboration tools, and an integrated time tracking and billing system are some of the major features to look for in such software.

Numerous of these programs also come with a selection of financial reports and the option to alter them to meet the particular requirements of the accounting practice. So, select the software that fits your requirement and contributes to your business!

.jpg)