Best Church Accounting Software

Best church accounting software exists Zoho Books, Aplos, ACS- Church Management Software, ZipBooks, and PowerChurch Plus. These church accounting software helps churches and other religious organizations handle, automate and organize their day-to-day financial operations.

Connect With Your Personal Advisor

List of 20 Best Church Accounting Software

Category Champions | 2023

Online Accounting Software for Growing Businesses

Zoho Books is an easy-to-use, small church accounting software for small businesses to manage their finances and stay on top of their cash flow. Simple, easy-to-use business accounting system to help you manage your accounts online. You can download a 14-day free trial of Zoho books. Read Zoho Books Reviews

Starting Price: Starting Price: $10.4 Organisation/Month Billed Annually

Recent Review

"Zoho Bookings Schedule Good Timming" - JADAV PRAVIN

Cloud Accounting Software Making Billing Painless

This church bookkeeping software makes your accounting tasks easy, fast, and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Starting Price: Starting Price: $15.00 Per Month

Recent Review

"FreshBooks: The Simple and Intuitive Accounting Solution for Small Businesses" - Ayoub El Fahim

Category Champions | 2023

TallyPrime is a leading church payroll software for GST, accounting, inventory, banking, and payroll. TallyPrime is affordable and is one of the most popular business management used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Starting Price: Available on Request

Recent Review

"Very best softare in my view but some measure have to be taken in order make it perfect ." - Arpit mishra

| Pros | Cons |

|---|---|

|

It's simple to operate on Tally and it's effective on daily basis use. |

my experience of over two years, I didn't dislike anything. |

|

It helps you manage accounting & payroll. |

It is Not User-Friendly. |

Category Champions | 2023

Vyapar is the simplest invoicing, inventory management, and accounting software for churches. It's made completely for a church; you don't have to waste time learning it. Instead, start managing everything digitally like before, even without Accounting knowledge. Read Vyapar Reviews

Starting Price: Starting Price: $39.99 Device/Year

Recent Review

"Review for Vyapar" - Junaid Ahmad

| Pros | Cons |

|---|---|

|

Some additional pros of using accounting software for small businesses include:It can automate repetitive tasks such as invoicing, payments, and reconciling bank statements.It can provide real-time visibility into financial performance, allowing you to make more informed business decisions.It can help you stay compliant with tax laws and regulations by generating the necessary reports and forms.It can also integrate with other software such as point-of-sale systems, making it easy to track inventory and manage customer information.It can save time and increase efficiency by streamlining financial processes and reducing the need for manual data entry. |

It has a learning curve and the initial learning process may take some time, but this may not be an issue for experienced accountants |

|

Experts say |

Skills Development |

Category Champions | 2023

Sage offers the complete best church accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy-to-use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50 cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Starting Price: Starting Price: $50.58 Per Month

Recent Review

"Excellent service" - Lynne Smit

| Pros | Cons |

|---|---|

|

It is easy to use. |

It should accommodate other languages like Afrikaans. |

|

User Interface and ease of usage |

Stable version of applications |

Emergents | 2023

ZipBooks is a church accounting software that automates many of the more tedious aspects of handling your finances. Cloud accounting tools like time tracking, online invoicing, project management, and auto-billing make it easy to keep better records. Read ZipBooks Accounting Reviews

Starting Price: Available on Request

Recent Review

"Invoices, sells your data, or sends you "partner" emails." - Charu Das

Contenders | 2023

ExpensePlus is a cloud-based online church accounting software. It comes packed full of exciting features enabling you to simplify and streamline the way you process expenses, manage budgets, create accounts, claim gift aid, and view reports. Read ExpensePlus Reviews

Starting Price: Available on Request

Recent Review

"5* Cloud Accounting package for Churches" - Lorraine Briffitt

| Pros | Cons |

|---|---|

|

Simple, quick to set up and easy to use. ExpensePlus has helped streamline all of our finance processes from submitting expenses to creating our monthly accounts- saving us both time and money. The customisable user access has meant that each member of the team has access to what they need to. It's brilliant! |

None, and I love it that they keep adding new features! |

Contenders | 2023

Software by LOGOS Church Management and Accounting Software

Logos Fund Accounting is a fully featured Church Accounting Software designed to serve Enterprises, Agencies. Logos Fund Accounting provides end-to-end solutions designed for Windows. This online Church Accounting system offers General Ledger, Accounts Payable, Asset Management, Budgeting & Forecasting, and Activity Tracking in one place. Learn more about Logos Fund Accounting

Starting Price: Available on Request

Contenders | 2023

PowerChurch Plus is a fully featured online church accounting software designed to serve SMEs, Startups. PowerChurch Plus provides end-to-end solutions designed for Web App. This software offers General Ledger, Attendance Tracking, Child Check-in, Event Management, and Accounts Receivable in one place. Learn more about PowerChurch Plus

Starting Price: Available on Request

High Performer | 2023

Givelify is one of the best church software, which is also very cost-effective. No signup or monthly fees, customized branding and customized campaign for your nonprofit fundraising software. The online fundraising software amount donated so far, and the number of donors are updated in real-time. Learn more about Givelify

Starting Price: Available on Request

Emergents | 2023

ChurchPro is a full church membership and accounting solution in an all-in-one system; with our church financial software, you can track your donations, do payroll and manage your checkbook. ChurchPro - Church Management System works and tracks multiple checking and savings accounts, contributions and pledges, payroll, budget reports, end-of-year reports, and more! Learn more about ChurchPro

Starting Price: Available on Request

Contenders | 2023

Church CRM Solution supports successful stewardshi

The Church CRM software developed by Hykez Technologies is mainly used for churches of any size. This church accounting software helps its users manage and use integrated tools to support and engage congregation members. Learn more about Church CRM

Starting Price: Starting Price: $499 One Time

IconCMO is web-based church finance software; it manages families, Visitation Management, Outreach and Follow-Up, Online Picture Directory, Remember Special Events, Group Management, Track Group Attendance, Print Contribution Statements, Envelope Management, and more. Learn more about IconCMO

Starting Price: Starting Price: $35 Per Month

Until 31st Mar 2023

Many financial transactions take places in a church on a daily basis. And managing these entries becomes crucial to get accurate reports.

Many churches have started using online accounting software to create a streamlined accounting process. This guide provides comprehensive information on church accounting programs, what to consider when purchasing it, its key features, and a list of the 5 best church accounting software.

What is Church Accounting software?

The purpose of church accounting software is to assist churches and other religious groups in managing their financial activities, including budgets, expenses, and donations.

Typically, it has elements like automatic donation monitoring, internet giving, and financial reporting. Church bookkeeping software can also be integrated with other platforms, including accounting software and payroll software.

Benefits of Church Accounting Software

There are a host of reasons that churches need to implement the latest accounting systems and increase operational efficiency. Below are the main reasons why every church needs to implement an accounting system to create better processes.

-

Streamlines Budgeting

Church accounting software is important to streamline budgeting because it makes it simple for churches to monitor and manage financial transactions, which is required for creating and complying with a budget.

A budget can be created and modified using the software's comprehensive financial reports and statements, which can continuously analyze donations, expenditures, and other financial transactions.

Moreover, to ensure that the church's financial resources are being utilized effectively and efficiently, the tool can also enable churches to organize their salaries and other expenses. In general, church accounting software can help churches better understand their financial situation and make smarter decisions about allocating resources and funds in better ways.

-

Saves Time in Administrative Workload

Churches need Church Accounting software to handle financial transactions and records effectively. The software automates many accounting-related chores, such as bookkeeping, invoicing, and budgeting, which can save church administrators a lot of time.

By delivering accurate and current financial data that is simple to communicate with stakeholders, Church budgeting software can also assist churches with compliance and reporting obligations. As a result, churches may manage their finances more effectively and concentrate on their mission and community outreach with the aid of church bookkeeping software.

-

Financial reporting and compliance

The necessity for financial reporting and compliance is one of the primary reasons that churches want a Church Accounting system. Using the software, churches can create financial statements that adhere to generally accepted accounting principles (GAAP) and other reporting standards while maintaining accurate records of their financial activities.

This is significant for churches since they frequently have to disclose financial information to constituents, donors, and tax authorities.

Additionally, church accounting software can assist congregations in adhering to rules and legislation pertaining to nonprofit organizations, such as the Federal Form 990. Church Accounting software can assist churches in ensuring that their financial information is correct and up-to-date by automating many financial reporting and compliance procedures, which can eventually help them serve their communities better.

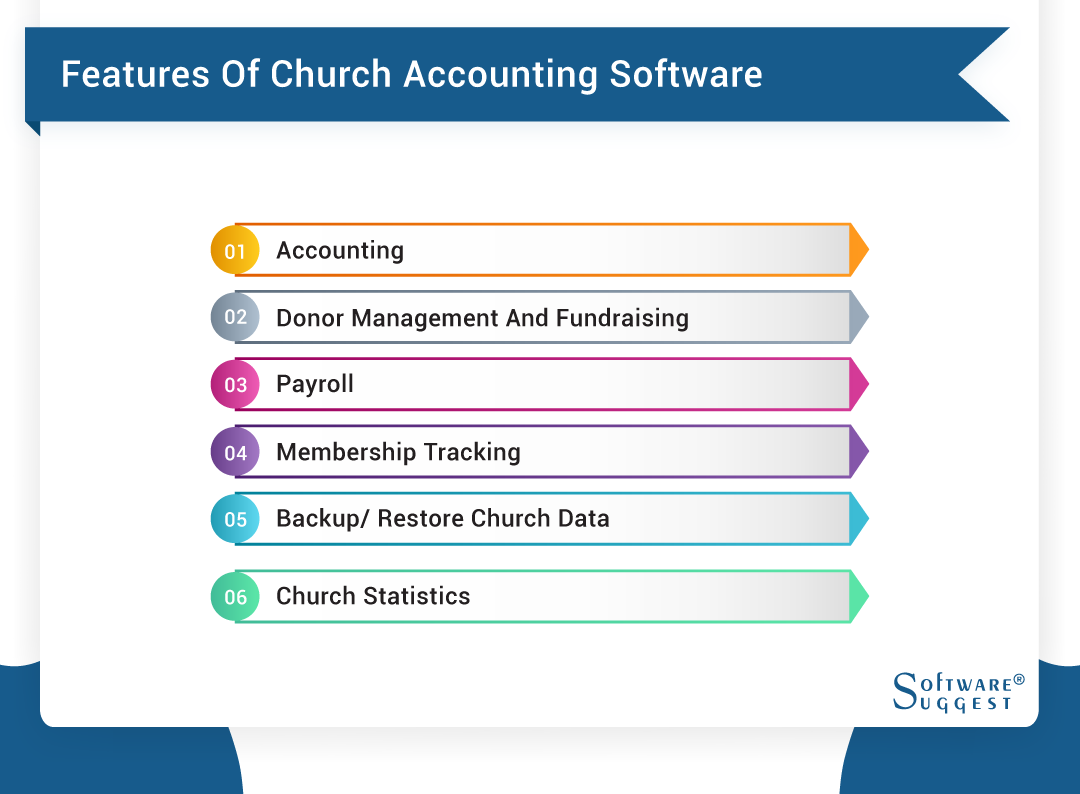

Essential Features of Church Accounting Software

Below are the key features of the best church accounting software.

-

Accounting

The software should cover the segment like a general ledger for keeping track of all financial transactions and accounts receivable to keep track of income, donations and pledges.

It should manage and track payments from members or other organizations and chart of accounts: to classify financial transactions into different categories such as income, expenses, assets, liabilities, and equity.

Financial Statements, such as Income statements, Balance sheets, and Cash flow statements, provide a summary of the financial performance and position of the Church.

-

Donor Management and Fundraising

In addition to the general accounting features, church financial software should also include features specific to donor management and fund accounting.

Fund accounting software should offer a donor database to store and organize information about donors, such as contact information, donation history, and giving preferences, and contribution tracking that can record donations and pledges to generate contribution statements for donors.

-

Payroll

Church financial software offers payroll processing to calculate and process employee paychecks, direct deposit payments and to automatically deduct taxes and other deductions.

Moreover, it also provides time and attendance tracking to track employee hours worked, absences, and vacation time, tax compliance: to ensure compliance with federal, state, and local tax laws.

Employee self-service portal allows employees to access their payroll information and make changes to their personal information; customizable payroll reports to allow for easy and efficient data collection from employees and for generating reports for compliance.

-

Membership Tracking

Church accounting software solution should have membership tracking, which includes membership management to oversee the enrollment process for new members and to keep track of the status of current members (active, inactive, etc.);

A membership database helps store and organize information about members, such as contact information, demographics, attendance, and giving history; attendance tracking to monitor member attendance at church events, services, and meetings.

Moreover, communication tools can send automated messages, such as newsletters, announcements, and reminders, to members. Generation of customizable membership reports of member activity, such as attendance and demographic information, to provide members with easy access to their information.

It also ensures that sensitive member data is protected from unauthorized access and can be customized to adapt the software to the specific needs of the church.

-

Backup/ Restore Church Data

For backup or restore purposes, the software should include data backup, automatically create backups of the church's finances, and backup in case of data loss, system failure, or other issues.

Multiple Backup options can help backup the data to multiple locations like the cloud, external hard drives, or other storage devices; scheduled backups at regular intervals, such as daily, weekly, or monthly, to ensure that the latest data is always backed up.

Versioning to keep multiple versions of the data so that you can restore data from a specific time in case of accidental data deletion or other issues, disaster recovery to have a plan in place to recover data and restore system functionality in case of natural disasters or other emergencies.

-

Church Statistics

The software should include features like attendance tracking to track attendance at church services, events, and meetings and to generate reports on attendance patterns over time.

Event tracking can help you track attendance and participation at church events and to generate reports on event engagement and effectiveness, customizable reports to allow for easy and efficient data collection from various aspects of the church and to generate reports on the statistics of the church, data visualization to present data in easy-to-understand charts and graphs, making it easier to identify trends and patterns.

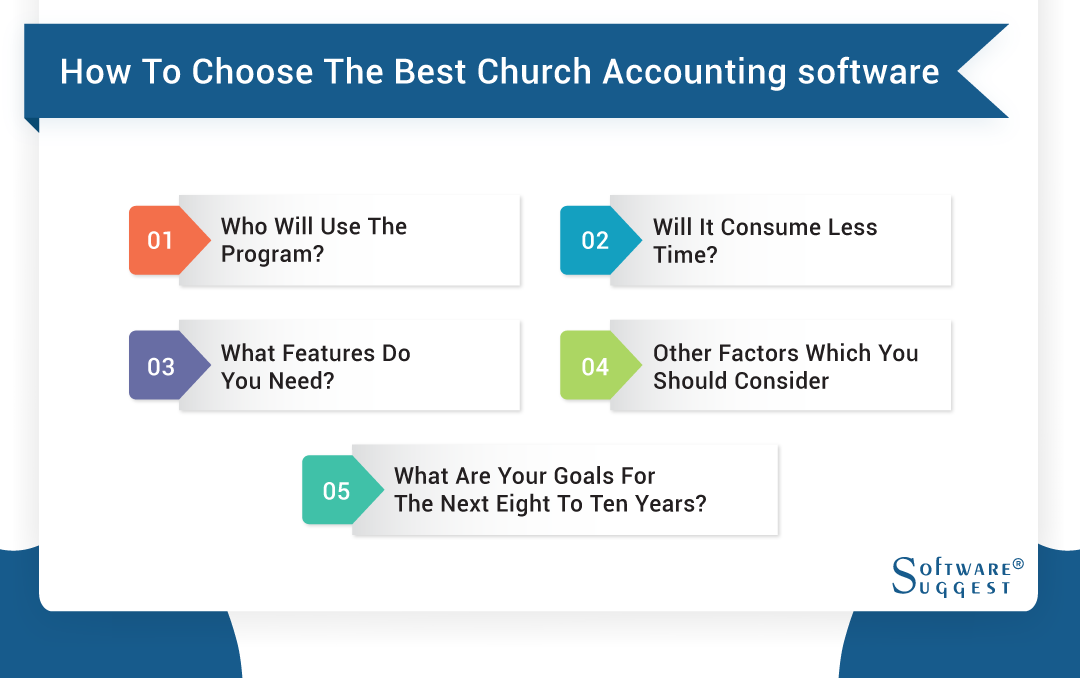

How To Choose the Best Church Accounting software?

Choosing the best Church Accounting software can be a complex process, as many different options are available, each with its unique features and capabilities. Here are a few key factors to consider when selecting Church Accounting software:

-

Who will use the program?

Identify the user roles within your church that will need access to the software, such as finance committee members, bookkeepers, or administrators. Look for software that can accommodate different levels of access and permissions for different users.

-

Will it consume less time?

Look for software that automates repetitive tasks like bookkeeping, invoicing, and budgeting. This can save your church significant amounts of time and help to reduce errors, and it can also help save you money as you don't need to hire so many employees to do the task, which can be done using a single platform.

-

What features do you need?

1. Donations and contributions management: Look for software that can track contributions, promises, and donations and produce donation receipts for tax purposes.

2. Budgeting and forecasting: Check if the software can help your church create and manage budgets, track expenses and revenues, and forecast future financial performance.

3. Financial reporting: Check the software's capacity to generate financial statements that adhere to GAAP and other reporting standards.

4. Inventory management: Check if the software can handle inventory monitoring, purchasing, and reporting if your church has inventory.

5. Collaboration: Software must be easy to collaborate with if used by multiple users, which can help them to share financial data and reports easily.

6. Integration: Check if the software can integrate with other systems and tools that your church already uses, such as online giving platforms or donor management software. This can save your church time and money by eliminating the need to enter data into multiple systems manually.

7. Cloud-based solution: Cloud-based Church accounting software can save you time and money by allowing you to access your financial data anywhere. They typically have lower upfront and maintenance costs than traditional on-premises software.

-

Other factors which you should consider

1. Compliance: Verify that the tool easily complies with all applicable laws, rules, and regulations about nonprofit organizations, including the Federal Form 990.

2. Customization: Check the software's ability to be adapted to match the unique requirements of your church.

3. Complexity: Make sure that the software is simple and not too complex to understand and operate and that the vendor provides sufficient training materials, such as user manuals or tutorials, to assist users in quickly becoming proficient.

4. Technical expertise: Consider the users' level of technical proficiency while opting for the product. While some software may be more user-friendly for non-technical users, others may demand a certain level of technical knowledge.

5. Accounts payable and receivable: Finding software that can manage invoicing, payments, and other accounts payable and receivable duties is important.

6. Accessibility: The software should be cloud-based to be easily accessible by employees outside the office on any device like a desktop or mobile with an internet connection.

7.Payroll: if your church has employees, find software that can handle payroll, taxes and benefits.

8. Pricing: Compare the pricing options and features of different software, and choose one that fits within your budget and offers the best value for your church.

-

What are your goals for the next eight to ten years?

One of the most important you need to answer is - will this investment benefit you in the future? Is it scalable and customizable? With time, you will witness growth in the church accounting system. So, the software you choose should be scalable as well.

Considerations While Purchasing Church Accounting Software

When considering the church, two factors are the most important; the size of the church and the budget you want to spend for the respective software.

-

How big is your church?

Small churches: A small church may not have a large budget and may not need all the features that a larger church would require. A basic accounting software for small churches with features such as general ledger, accounts payable, accounts receivable, and payroll may be sufficient.

Medium-sized churches: A medium-sized church may have more complex needs, such as donor management, membership tracking, and fundraising capabilities. They may also need more advanced reporting and analysis features to help them make better financial decisions.

Large churches: Large churches may require more advanced and sophisticated software to handle large amounts of data, such as donor management, membership tracking, fundraising, payroll and advanced reporting. They may also require multiple user access, customization options and integration with other software and systems.

In addition to the size of the church, other factors, such as the complexity of the financial operations, the number of staff, and the budget for the software, also need to be considered. It is important to evaluate the church's specific needs and choose software that can handle them effectively and efficiently.

-

How much do you want to spend?

The amount you want to spend on the software depends upon various aspects.

When purchasing church accounting software, budget is an important consideration. Different software options have different price points and features, so it is important to determine what you can afford. Here are some things to keep in mind:

1. Consider the long-term cost: While some software options may have a lower upfront cost, they may have higher ongoing costs, such as subscription fees, or require additional costs for features like support or upgrades.

2. Evaluate the features: Determine the essential features for your church's needs, and look for software that includes those features within your budget.

3. Compare the costs: Shop around, compare the costs of different software options, and consider the upfront and ongoing costs.

4. Look for free trials: Some software providers offer free trials, which can be a great way to test a product before making a purchase.

5. Consider the value for money: The most expensive option may not always be the best one for your church. Look for software that offers the best value for money.

6. Check for non-profit pricing: Some software vendors offer special pricing for non-profits, so check if any such options are available for churches.

5 Best Accounting Software for Churches

Below is the list of top five accounting software for churches. You can choose between paid and free church accounting software based on your requirements.

1. Aplos

Aplos accounting is a cloud-based accounting software for churches and nonprofits. It has functions including monitoring donations, managing expenses, and financial reporting. Additionally, it interfaces with other platforms for communication and fundraising that are frequently used by nonprofits. For non-profit organizations, Aplos Accounting strives to streamline the financial administration procedure.

Features of Aplos

- Manage the payment process and track vendor bills

- Handle the collection process and keep track of donations and other income

- Monitor the church's financial resources through a budget

- Produce financial statements, spending plans, and donor contribution statements

- Keep track of pledges and manage them

Pros

- Easy to navigate and understand

- Aplos can integrate with other software

- Accounting task can be automated using the software

- Aplos can be accessed from anywhere with an internet connection

Cons

- Limited customization personalizing specific features.

- Limited reporting to the users.

- Limited scalability, so not suitable for larger organizations

- Aplos is a paid software, so it may not be affordable for some

Pricing:

- The entry-level package starts at $39/month.

- The entry-level basic plan is $59 per month.

- Premium plan starts at $79 per month.

- All plans include a 30-day free trial.

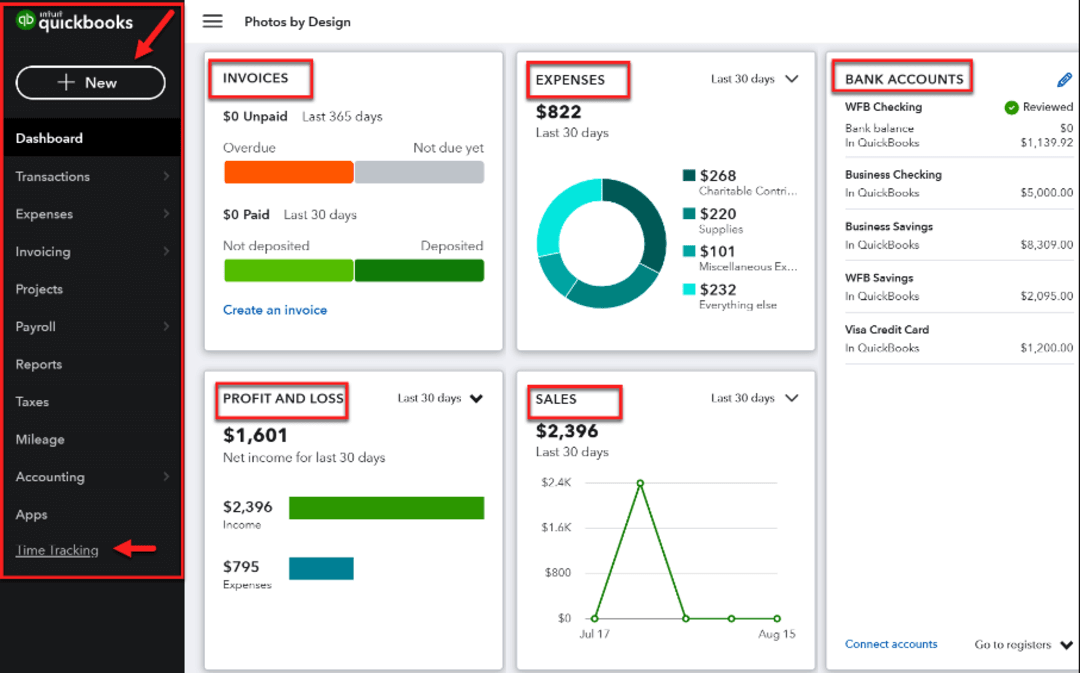

2. QuickBooks

QuickBooks is a popular accounting software for small churches. It offers a range of features, including invoicing, expense tracking, payroll management, and financial reporting. It can also integrate with other business tools, such as point-of-sale systems and time-tracking software. QuickBooks is available in various versions, including a self-employed version and an online version. It is designed to help churches manage their finances and stay organized.

Features of QuickBooks

- Track income and expenses

- Track vendor spending and bills to control the payment process

- Handle the collection process and keep track of donations

- Track benefits, taxes, and employee compensation

- Monitor the church's financial resources through a budget

Pros

- QuickBooks is made to be simple to use and comprehend

- Provides integration with other platforms

- Creating invoices and comparing bank statements can be automated

- Various reporting options are provided by QuickBooks

Cons

- Not enough options available to fully customize the platform

- QuickBooks does not have enough features specific to their organization’s requirements

- Assistance offered by the tool is not entirely as per requirement

Pricing:

QuickBooks offers a range of pricing options for its accounting software, depending on the version and features you choose.

- Simple Start - $30 per month

- Essentials - $55 per month

- Plus - $85 per month

- Advanced - $200 per month

3. PowerChurch

Powerchurch is an accounting software designed specifically for churches and other religious organizations. It includes features such as donation tracking, check writing, and financial reporting. It also has a membership module that allows churches to track their congregants and their giving history.

Powerchurch is a windows-based software that can integrate with other church management software such as event scheduling and volunteer management. It aims to provide churches with an easy-to-use and comprehensive solution for their financial management needs.

Features of PowerChurch

- Monitor members' contributions, create statements, and keep track of promises and gifts

- Features like accounting, cheque-writing and budgeting, make it easy to manage the finances.

- Manage payroll for issuing cheques and computing taxes and deductions.

- Manage events, including scheduling and keeping track of attendance.

- Offers a wide variety of configurable and customizable reports.

- Church membership records can be managed.

- Can manage contact details, attendance data, and membership status.

- Update accounts without human intervention.

Pros

- Simple to use

- Easy to integrate with other software.

- Task like drafting invoices and comparing bank statements can be automated.

- Accessible from any location with an internet connection.

- Provide adjustable features according to the requirements of religious institutions.

Cons

- Not suitable for larger organizations with more complex accounting needs.

- Support provided is not as comprehensive as they need it to be.

Pricing:

- The basic entry-level plan is $29.99 per month.

- Premium plan is provided “On Request”

4. Wave

Wave is a cloud-based accounting software that provides church accounting software as well as a range of financial management tools for small businesses and organizations. It allows churches to manage their finances and track their financial transactions in one place.

Features of Wave

- Create and send invoices, track payments and manage account receivables

- Manage expenses, track income, reconcile bank and credit card transactions

- Scan and track receipts and automatically categorize them for expense tracking

- Generates financial reports such as balance sheets, income statements

- Set budgets and track their performance against them

- Provide payroll services to pay employees and contractors and track taxes

- Provide integration with other apps and services

- Wave uses bank-grade security to protect users' financial data

Pros

- Free, so easy to use

- Simple to use and comprehend

- It is a cloud-based software, so it’s easy to access

Cons

- Limited features in free version

- Complex for some users

- Limited support as it is free

Pricing:

The entry-level plan is Free

Premium plan for $20 per month.

5. Springly

With Springly, you may choose the level of accounting support you need without having to have any prior knowledge of your church's finances. You also have the option to enable more features as your church grows. Real-time data updates also make it impossible to ignore.

Features of Springly

- Provides automation for all the accounting entries and transactions.

- Have access to all the documents from any place.

- Track cashflows at your convenience.

- Transfer funds and monitor the activities.

- Modify your accounting entries as per requirement.

Pros

- Provides great user experience

- Has very quick response time

- The account processing is reliable and easy

Cons

-

The website could use some improvements

Pricing

The advanced capabilities of Springly are available for a free 14-day trial.

Freedom Plan: 0 per month

-

Up to 100 contacts for $25 each month.

-

250 contacts for $50 per month.

-

Up to 500 contacts for $80 per month

-

1,000 contacts for $110 each month

-

For 2,500 contacts, it costs $150 per month.

Conclusion

Choosing the right church accounting software is crucial as it will impact your entire accounting process. So, make the right decision by considering all the important factors mentioned.

Moreover, you can also check out the reviews of other church accounting software to gain better insight into the features and functionalities.

.png)