Best GST Software

List of the best GST software solutions are Zoho, SAG Infotech, ClearTax, myBillBook, Tally, and Vyapar. GST accounting software for return filing enables an organization to manage taxes in one system and helps to securely return filing with calculated tax automatically per the applicable GST rates.

Connect With Your Personal Advisor

List of 20 Best GST Software

Category Champions | 2023

Online Accounting Software for Growing Businesses

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Starting Price: Starting Price: $10.4 Organisation/Month Billed Annually

Recent Review

"Zoho Bookings Schedule Good Timming" - JADAV PRAVIN

GST Software is an end-to-end GST Solution India compliance automation system for chartered accountants, tax consultants, and enterprises. Avalara has built this cloud-based software under domain expertise of veteran CAs, advocates, and company secretaries. Read Avalara GST Reviews

Starting Price: Available on Request

Recent Review

"Best GST software in market" - Jisha Sharma

| Pros | Cons |

|---|---|

|

Very useful and time saving |

I havent faced any issue till now |

Contenders | 2023

Full Invoicing solution designed for Indian SMBs

Sleek Bill is one of the fastest billing and invoicing software solutions which designed for Indian small businesses. It offers tax management, multiple invoice templates, stock and much more. It easily creates invoices, quotations, proformas and challans. Read Sleek Bill India Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

Nothing |

Customer Service |

|

UI and the ease of usability |

Need more templates for invoice. Need mobile application |

Category Champions | 2023

Giddh is the latest cloud accounting software that provides all the accounting solutions like Cash management, Inventory, Invoicing, Ratio analysis, P&L, Bank Reconciliation, Ledger, and has Tally plug in for a hassle free switch. Read Giddh Reviews

Starting Price: Starting Price: $13.89 Per Company/yearly

Recent Review

"Nice work" - Ansh Bhardwaj

| Pros | Cons |

|---|---|

|

The professionalism of the people |

Cost of service can be reduced |

|

Easy understanding |

Detailed export of financials.Journal entries should be possible. Stock out entries as scrap to be provided |

Category Champions | 2023

XaTTaX (GST filling and reconciliation solution)

XaTTaX (GST filing and reconciliation solution) is a simple and accurate complete GST software with great user interface for all type of enterprises in India. It offers a multi-layered security mechanism, which implies that whatever transactions you process are 100% secure. Read GST Software - XaTTaX Reviews

Starting Price: Starting Price: $138.89 One Time

Recent Review

"Best GST software" - Sruthi N

| Pros | Cons |

|---|---|

|

Very useful, easy to use and time saving |

I havent faced any issue till now |

CBO is a best, cost effective and flexible Pharma SFA for Indian pharmaceutical companies. Software is capable of importing and exporting existing data from all the other billing and inventory software and can also be integrated with in TALLY. Read CBO Reviews

Starting Price: Available on Request

Recent Review

"Reporting Feedback" - R K Verma

| Pros | Cons |

|---|---|

|

Banner in mobile app |

need some more speed |

|

Its Features |

Mobile Reporting |

High Performer | 2023

The Complete Business Management Software for SMEs

An integrated bussing accounting and management solution, BUSY is a one-stop solution for your financial and payroll needs. It offers multi-location inventory, multi-currency support, order processing capabilities, and helps you make informed decisions. Moreover, it is best suited for the FMCG, retail, manufacturing, trading, and distribution businesses. Read Busy Accounting Software Reviews

Starting Price: Starting Price: $100 Per Year

Recent Review

"User friendly " - Pawan Sharma

| Pros | Cons |

|---|---|

|

On line services required. |

Trade specific features needs improvement |

|

From the software itself we are in the position of priniting thre payment cheque . |

User Interface can be good |

High Performer | 2023

Billing, Accounts and Inventory Management

HDPOS is the best accounting software. It has ease of use and nice interface. It is a Windows based Billing, Inventory Management and Accounting Software and it easly Install on single computer or multiple Terminals. Used for finance management system. Read HDPOS Smart Accounts and Billing Reviews

Starting Price: Starting Price: $18.06 Per Month

Recent Review

"Good software for tuff and intelligent people" - MOHANKUMARSETTY

| Pros | Cons |

|---|---|

|

Billing with images coupons short codes somany reports |

Little bit if I have any doubt not clarifiying |

|

Easy to use and good interface |

They have to work on android app. |

Category Champions | 2023

All your accounting needs will be taken care by this ERP accounting software. Filling GST, releasing salaries of your employees, keeping a track of leave and bonus and various other finance-related tasks can be performed with no-error. You can go for a free ERP software demo for a thorough understanding of its modules. Read TallyPrime Reviews

Starting Price: Available on Request

Recent Review

"Very best softare in my view but some measure have to be taken in order make it perfect ." - Arpit mishra

| Pros | Cons |

|---|---|

|

It's simple to operate on Tally and it's effective on daily basis use. |

my experience of over two years, I didn't dislike anything. |

|

It helps you manage accounting & payroll. |

It is Not User-Friendly. |

Category Champions | 2023

Vyapar is the simplest GST ready Accounting, Invoicing and Inventory management software. It's made completely for a businessman, you don't have to waste time learning it. Just start managing your business digitally like before even with no Accounting knowledge. Read Vyapar Reviews

Starting Price: Starting Price: $39.99 Device/Year

Recent Review

"Review for Vyapar" - Junaid Ahmad

| Pros | Cons |

|---|---|

|

Some additional pros of using accounting software for small businesses include:It can automate repetitive tasks such as invoicing, payments, and reconciling bank statements.It can provide real-time visibility into financial performance, allowing you to make more informed business decisions.It can help you stay compliant with tax laws and regulations by generating the necessary reports and forms.It can also integrate with other software such as point-of-sale systems, making it easy to track inventory and manage customer information.It can save time and increase efficiency by streamlining financial processes and reducing the need for manual data entry. |

It has a learning curve and the initial learning process may take some time, but this may not be an issue for experienced accountants |

|

Experts say |

Skills Development |

myBillBook is a simple GST billing & accounting software designed to help you manage your business operations using mobile or desktop. No prior accounting knowledge is needed to use this software. You can create bills, maintain stock, track payables/receivables, etc. Read myBillBook Reviews

Starting Price: Starting Price: $42.6 Per Year

Recent Review

"Very simple and easy-to-use interface" - Shankar K

| Pros | Cons |

|---|---|

|

It has an amazing reporting section where I can have more than 25+ reports like GST JSON, Monthly, Expense, Monthly Income, Balance Sheet etc.., Other than accounting and billing, It has some very useful secondary features like WhatsApp marketing, payment reminders etc.., myBillBook has helped me save more than 8 hours/week. |

It would be great if they provide more flexibility in Inventory Management |

|

myBillBook is user-friendly, and the billing system is easy to set up and manage. |

NA. I like all the features of this software. no cons can be found in the software |

AlignBooks is an online business accounting software specially designed to cater to the needs of Small & Medium Business, Chartered Accountants & accounting professionals, and Business Executives who mostly remains on the move. Read AlignBooks Reviews

Starting Price: Starting Price: $34.72 Company/Year

Recent Review

"Very good support team. Good coordination. Easy onboarding " - Amey Doshi

| Pros | Cons |

|---|---|

|

Mobile app is very user friendly and easily accessible. Invoicing feature is good. |

Integration with other banks for reconciliation . Also EDC machine integration needed. |

|

Customer service and In that software one option is best Loyality point. |

In that software provide some usefull information adding. T........... |

Category Champions | 2023

Making Modern Businesses GST friendly

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Starting Price: Starting Price: $69.44 Per Year

Recent Review

"Easy to access" - Manisha Garg

| Pros | Cons |

|---|---|

|

Its easy to use |

No cons |

|

Import feature, Export feature, auto suggestion appears while matching and their customization report feature. Their support system is awesome. |

It is not an easy software to learn, you need to have training before using it. Professional accounting base is necessary. Although they provide videos for training. |

Category Champions | 2023

ClearTax is providing a complete solution and free trial of taxation with expert support and freelancer for the business to guide how to save money and time. Income tax return e-filing, GST, GST compliance software, etc modules are inbuilt. ClearTax is a leading invoicing and billing software that lets you create business invoices compliant with GST regulations. It even lets you file GST returns with a single click. ClearTax also identifies errors in documents before uploading them to the GSTN portal. Thus, reducing penalties while filing taxes. Read ClearTax Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

Clear tax delivers almost everything it promises. infact the price as well is very competitive and there are tons of features. |

Only thing which i found lacking is the integrity of the software when you need it the most. During the deadline times the software practically is difficult to use due to heavy usage from all clients. |

|

Most impressive is its usefulness and also customer care support. Fast updates which can compete with department site or notifications. Reports are wonderfull |

They should bring down renewal pricing. |

Swipe billing software and the app helps you to create sales/purchase invoices, quotations, manage inventory, save customers & vendors and be in control of your business. Create GST compliant invoices & share them with customers easily. Read Swipe - Billing Reviews

Starting Price: Available on Request

Recent Review

"Cool features" - Little Net

| Pros | Cons |

|---|---|

|

Create invoice less 10 than seconds |

Nothing |

|

Best UI. Good customer support. Available in mobile Application and web |

It is not there in IOS |

High Performer | 2023

Simple Billing software with complete inventory and accounts modules. It's fast, reliable and easy to maintain. Ideal for businesses that have a large number of invoices and deals in 100's of SKU's. Typically used by distributors, retailers and small manufacturers. Read Horizon ERP Reviews

Starting Price: Starting Price: $191.75 One Time

| Pros | Cons |

|---|---|

|

no impressive |

avoid fake selling |

|

No beneficial,worst software i have ever seen in my life. |

each and every part of horizon should improve. |

Category Champions | 2023

Just Billing Mobile is a unique billing app for micro, small and medium size business. It is an intuitive business solution, which does not require you to have any technical knowledge and simply automates your business. Read JustBilling Reviews

Starting Price: Starting Price: $250 FULL License/ One Device

Recent Review

"Good software, very user friendly." - Bismillakhan s

| Pros | Cons |

|---|---|

|

User friendly and good user interface. |

Nothing said to be negative. |

|

It's best billing software |

Nothing |

eZee FrontDesk is a state-of-art Hotel management system that enables hotels and hotel chains to run business operations more efficiently and effectively. Designed and developed with latest technology meeting international hospitality standards. Read eZee Frontdesk Reviews

Starting Price: Starting Price: $1150 One Time

Recent Review

"We owe a part of our success to Ezee" - Omdev Vala

GOFRUGAL is the only complete digital solution provider to retail, restaurant and distribution business. With over 14+ years, they have acquired 25,000+ customers across 60+countries. It has the largest product portfolio like - Desktop POS, Cloud POS, Mobile apps. Read GOFRUGAL POS Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

Customer service |

Double Rate change and automatic qty. Merge in sale bill |

|

Features and functions are good. |

Service in emergency |

Easy GST is an online accounting software to manage your accounting, inventory and to file your GST returns with ease. Sign up for a free trial. We at Easy believe that Accounting can be made very easy and powerful using the latest technology at a very affordable price. Read Easy GST - GST Ready Accounting Reviews

Starting Price: Starting Price: $11.11 Yearly

Recent Review

"Best Free Trial Accounting Software India" - Naresh PAtel

| Pros | Cons |

|---|---|

|

They provides affordable cost for all small business with enterprise businesses. Also free trail available. Many feature and many packages available. |

I think I did not found any cons. |

|

Easy to use and simple software Covers all features to run business and manage accounts I don't need accounting knowledge. Can easily share data with my accountant and CA without sharing actual file. |

NA |

Until 31st Mar 2023

Learn More About GST Software

GST software help organizations simplify the hassles of billing, filing returns, and generating GST invoices. Utilizing effective GST software can aid businesses in managing their finances, accounts, inventory, purchase, sales, payroll, taxation management, and other processes efficiently.

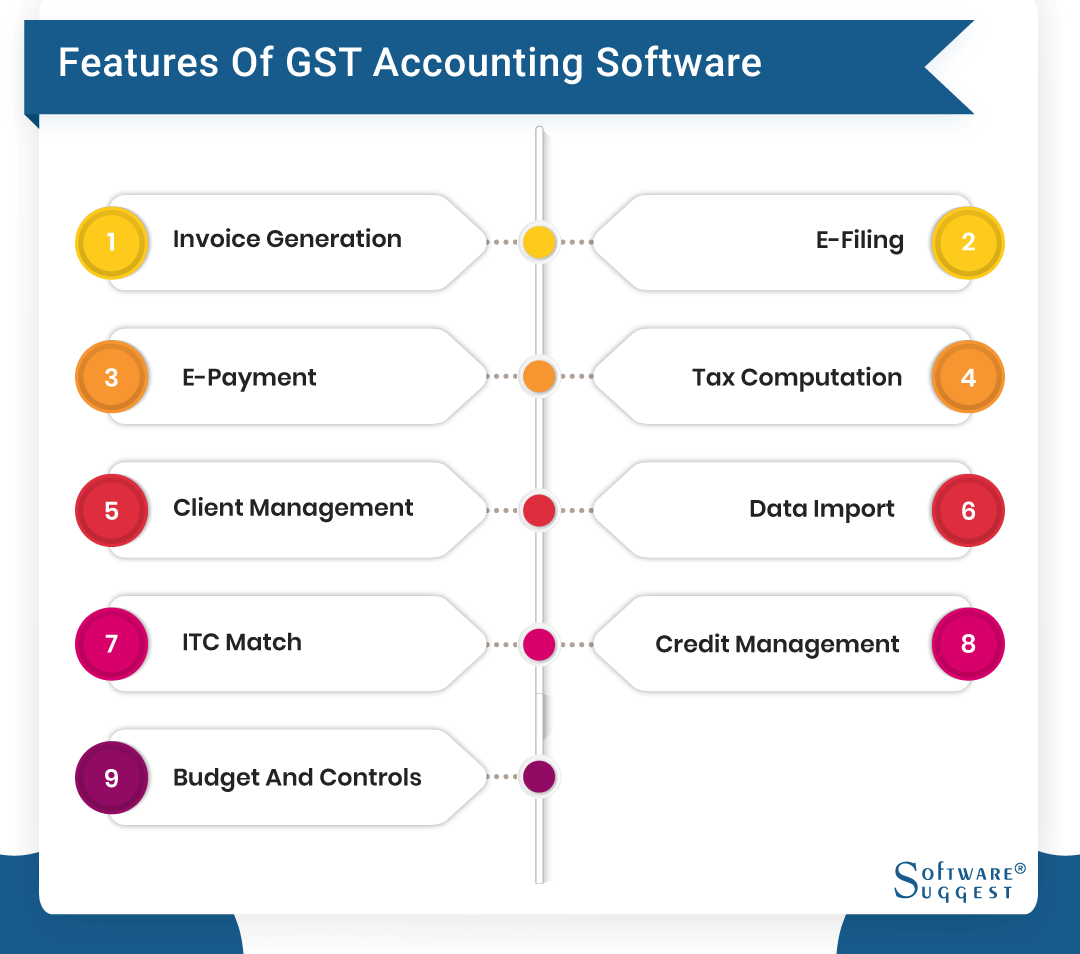

What are Important Features to Have in Your GST Software

Seeing the importance of the GST software in the GCC, many business organizations and traders have already adopted the implementation of the GST solution for a smooth tax-paying experience. In addition to the ease of paying the GST, business organizations also benefit from its essential features. Here are some of them:

1. Invoice Generation as per the GST Standards:

Business organizations can prepare a proper invoice for their taxation and other financial records that abide by the GST standards. It helps businesses' inadequate regulation of their income and expenses.

2. E-Filing for the Returns and Return Reconciliation:

Now the business owners do not need to rush to the concerned official building to file their tax returns. With the help of the GST return filling software solution, it can all be achieved with a one-step e-filing of the returns and return reconciliation.

3. E-Payment Facility:

To top it all, the GST solution also offers the ease of paying tax returns through the e-payment facility. It is a hassle-free process to make the payment online securely.

4. Tax Computation and Validation:

All the computations are done on the computer system and, therefore, are entirely validated.

5. Client Management:

The top GST software also offers the ease of effective client management for business organizations.

6. Data Import:

The data relevant to the organization’s purposes can be easily imported with the help of specialized software.

7. ITC Match/Mismatch Report Generation:

If there is any trouble or mismatch in the ITC filing, then the GST accounting software creates the proper report.

8. Credit Management:

The GST solution can help minimize debt and improve the overall cash flow in the business by allocating varying credit limits to the different parties.

9. Budget and Controls:

Business organizations can efficiently utilize the funds and can control the overall expenditure.

How to Choose the Best GST Software?

With many GST solutions available in the market, one should select the software based on the needs and size of the business. There are several factors to be taken into consideration before purchasing a GST solution for your organization. They are:

1. Online and Offline Mode:

Based on the requirement of the business, the owner has to decide whether to opt for online or offline GST software. A GST filing software stores all your data safely and securely on the cloud and enables easy access. Online GST software gets automatic updates according to the changes and specifications made by the government. It provides information backup and security. Offline software does not have continuous updates and compromises security compared to an online one.

2. Security:

When buying top GST software, its security features must be thoroughly examined and ensure that the data is in safe hands. In offline versions, one should consider whether the software is equipped with proper features to prevent hacking and virus attacks.

3. Features:

This is one of the most critical steps to be considered when getting GST solutions for your business. Organizations need to check whether the income tax software fulfills their business requirements. It should enable easy user registration, simplify the understanding of the entire GST process and its handling to calculate your taxes accurately, and generate invoices in the format of your choice.

The GST system should be able to track various business processes, business expenditures, and returns, divide them into appropriate categories and manage accounts. It should enable users to manage business inventory, movement of both incoming and outgoing goods, track and manage suppliers/customers and should also be able to manage salary payments of employees. The software must also have provisions for transactions and calculations in different currencies.

4. Integration:

Integrating the product with the current enterprise resource planning and accounting systems should be smooth and easy. It should also be able to integrate data from multiple sources.

5. Scalability:

There are different types of GST software out there in the market, but you should not get carried away by all the fancy features offered that come with it. Before choosing one, you must know your business size, demands, and requirements well. The software might look like it fulfills all the business demands, but sometimes it does not. When your business starts to grow, there are chances that the software will find it difficult to manage the increasing data and fail in calculation and account management. Therefore, it is essential to do thorough research before deciding on software.

6. Complexity:

The GST system software should not be overly complex. It will make the process of filing returns and calculations a dreaded task. Asking for a demo of the software is always a good idea. Before buying one, check its user interface, usability, and ease of application understanding. User-Friendly software will help you save the extra money you might have to spend hiring a chartered accountant.

7. Software Customization:

Good software must be easily customizable and accommodate your business needs rather than adjusting as per the software. The GST solutions should be able to fit the needs of the business in case it grows. It should not take a lot of time for initiation and waste your time on its working.

8. Customer Support:

Since the GST and the whole taxation system are still new and in their implementation phase, not many people will be fully aware of some associated terms. So, the GST tool must have a strong customer support unit that will be able to support the smooth usage of the software.

9. A Complete Solution:

The software bought by you should be a complete package of accounting and taxation solutions, as using different software for different things causes many integration problems and confusion. It reduces the efficient running of a business and is cumbersome. A GST system software with a complete solution will improve money management and your business workflow drastically.

10. Cost:

Cost is one of the most important factors when buying software. It is a common notion that more expensive software operates better, which is entirely wrong. The software must be decided based on your business needs and size. A small business will not need expensive software. The price spent on the software should suit the company and be worth it.

Why is GST Software Importance for Your Business?

GST filing software is highly user-friendly and can be easily used by traders to utilize the tax-paying system's benefits. The different activities that the effective GST software can manage include:

1. Billing

2. Purchase transactions

3. Document printing

4. Discounts and schemes

5. Taxation reports or registers

6. Completely user-friendly invoicing

7. Utility management

8. MIS reports

9. Inventory management

10. Extensive financial accounting

The GST software in GCC would play a vital role in regulating the various forms of indirect tax flow throughout the country. With the help of efficient software, companies and businesses could act responsibly by paying timely and legit taxes to the government.

The prime factor in bringing the business class and the country's government closer. Moreover, business organizations can increase their profit margins by quickly analyzing the proper income and expenses along with tax filings. The tasks like accounting, financial management, tax filing, invoicing, inventory management, and so on can be easily carried out with valuable goods and services tax software.

What are the Essential Characteristics of a Good GST Software?

1. Security:

As one might have to deal with vast amounts of money, the software must ensure secure transactions. Secure GST software would protect confidential information related to any business, avoiding any compromise that might threaten the business information. Therefore, the GST offers robustness in filing returns and ensuring overall data security for business organizations.

2. Multi-Platform Adaptability:

Functioned well on multiple platforms to keep up with the various compliance requirements. It is easily accessible from PCs, laptops, and even smartphones through the app. This tends to increase the ease and speed of return filing through the online medium.

3. Flexibility:

Several businesses use the ERP system and various accounting tools to manage tax filings. Therefore, your GST software should be flexible enough to integrate well with the existing system and offer a seamless experience to the users.

4. Cognizance:

Under the new GST regime, an average taxpayer registered in one state will have to file as many as 37 returns during a financial period. The software can evaluate the possible events that might be coming in the way of the traders. This will ensure that no deadline is missed in the process and that the business remains up and running.

5. Friendly User Interface and Reporting:

The software should offer a simple user interface and informative dashboard, including various MIS reports for quick decision-making and transparency in operations. The availability of real-time information might help business owners avoid over/understocking goods. This might save a lot of capital if it operates on a minimum user interface principle.

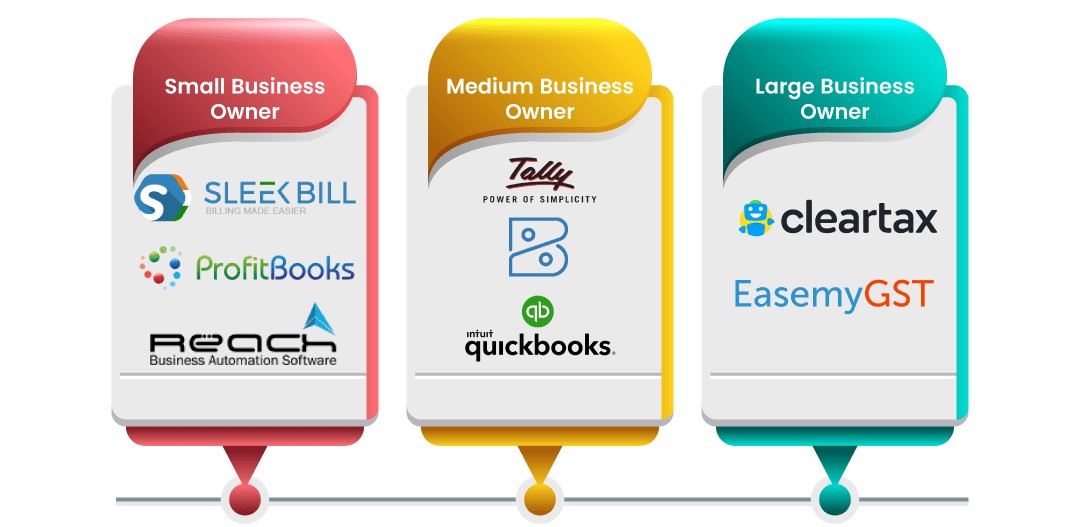

What are Different Types of GST Software for Different Buyers?

A) Small Business Owners:

Small business owners do not typically need significant GST filing software with extra features. They would require a GST solution that does its work to the point without beating around the bush.

1. Sleek Bill is a GST solution explicitly catering to the needs of small businesses. It has a fast mechanism and offers many features like stocks, tax management, and multiple invoice generation. The other parts are:

1. Online Integration with banks

2. Inventory management

3. Free software to design invoices

4. Handles payments and accounts

2. ProfitBooks is a GST software for small businesses that allows the creation of invoices, management expenses, and inventory without specialization and accounting background. Key features are:

1. Strong multi-layered security

2. Email and SMS notification

3. Management of customers and suppliers

4. Backing up of data

3. Reach Accountant is an advanced business automation software that stores all the information in the cloud. Not only does it help in billing and tax calculation, but it also provides good customer service. It has an excellent workflow, tracks employees, and gives real-time updates. It has an easy implementation process and can be operated from desktops, laptops, and mobiles, thus, making it easy for users to work from anywhere. Some of its key features are:

1. Automation of business

2. Bank synchronization

3. Creating invoices

4. Accounting

5. Email management

B) Medium Business Owners:

1. Zoho Books is one of the best GST software in the market. It is tailor-made for medium-sized businesses and provides simple and cost-effective accounting and GST solutions and features like:

1. Barcode integration

2. Multi-currency compatibility

3. Email integration

4. Billing, invoicing, and expense tracking

2. QuickBooks is another GST system with efficient navigation, automation, and high security, making it apt for medium-sized businesses. Some of its essential features are:

1. Accounting in the cloud

2. Desktop and mobile application

3. Report generation

4. Allows multiple users

5. Free customer support

3. TallyPrime GST accounting software is one such software that provides GST solutions for enterprises. Its simplicity, accuracy, and user-friendliness have made it one of the best in business. Its key features are:

1. Advance payment handling

2. Error-free GST returns computation

3. GSTR-1 and GSTR-3B form support

4. Outstanding reports for traders

C) Large Business Owners:

1. EasemyGST is a cloud-based GST billing software for enterprises. It has a full tax management feature that helps generate GST invoices and file GST returns. This GST filing software enables efficient accounting and tax management along with the below features:

1. Data security

2. CA to help GST compliance and tax filing

3. Multiple GSTIN management

2. Clear tax is the best software that automates billing and accounting. It caters to all types of small, medium, and large organizations. It also helps in the generation of an e-way bill. Some of its unique features are:

1. Easy ERP integration

2. Dedicated support and accounts manager

3. Automatic data import

4. Online and offline mode

5. No manual data entry

6. Imports from Tally and Busy

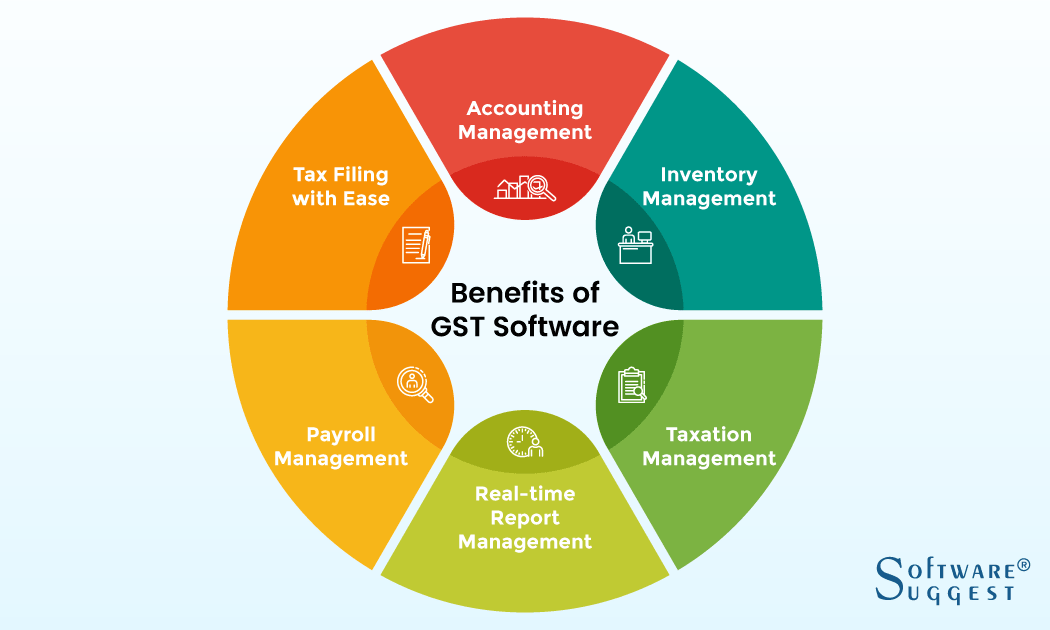

What are the Benefits of GST Software?

The GST software in the US has been a book for business owners and service providers who would not know how to handle the new taxation process without the billing software. Listed below are its advantages:

1. Efficient Tax Filing with Great Ease:

Accounting, finance management, different tax calculations, filing tax returns, and billing can be daunting tasks. Proper and accurate tax filing is imperative for a business to avoid any unnecessary problems in the future. A user-friendly GST software makes tax filing feel like a walk in the park and aids in the accurate and fast filing of taxes and returns.

2. Management of Accounting Activities:

It enables both cash and cashless accounting. It allows easy printing of professional invoices to be sent to the customer. It helps to keep track of receipts, expenses, and paid and unpaid invoices to generate estimates. It defines GST rates according to the products and helps with sales orders, debits, and credits. Some software also offers multi-currency support.

3. Management of Inventory:

The top GST solution allows the management of business inventory. It helps to keep track of the list, send invoices, and place orders for products depending on their requirements. It allows the entry of stock issues and wastage as well. Some software even has a barcode scanner that helps efficiently manage the inventory. It also helps generate various reports like sales inventory reports, service reports, items in inventory reports, and the movement of products reports.

4. Management of Taxation:

With all the tax rates being predefined, one just has to put down the products and select appropriate tax rates, and the software will help calculate all the taxes, such as CGST, SGST, and IGST. It is also designed to add any other extra rates and penalties, thus making tax management easier.

5. Management of Payroll Activities:

Payroll is a system that is very crucial to a business and to maintaining a good employer-employee relationship. A delay in salary payments and other financial settlements will make them question the company's financial condition. Therefore, payroll management is imperative. Paying the employees on time lowers the effective tax bill. The new GST system software has made the payroll process a little cumbersome. However, it is easier for business owners. The software helps generate automatic payrolls with all the taxes and other things added automatically and help create fast and accurate invoices.

6. Remote Management In Real-Time:

It is used in several industries like Retail, Restaurants, Automobile, Apparel, etc. So the GST compliance software must be customized to suit the needs and rates of the respective industry. The GST solution helps a distributor to categorize their sales into retail and distribution for sales & increase retail profit margins. For better management, invoices can be made in chronological order, and inventory books on order arrivals can be updated to avoid raising harmful stock bills. With real-time reports to track business operations, one can manage the entire workflow from any device anywhere using the GST software.

E-Way Bill in GST: All You Need To Know

A) What is Meant by the E-Way Bill?

Eway bill is the acronym for electronic waybills and is generated for the smooth movement of goods through the Eway bill portal. A GST-registered operator cannot transport goods whose value exceeds Rs 50,000 in any vehicle without possessing a valid Eway bill authorized through ewaybillgst.gov.in.

Many technological platforms, such as GST and tax return software, help organizations generate valid E-way bills. Investing in advanced GST return software is a good choice for organizations as it enhances operational efficiency through the seamless generation of E-way accounts.

B) When and Who Can Generate an E-Way Bill?

GST invoice software can help any company generate an Eway bill automatically when there is a planned movement of goods in a conveyance, and the value of goods is higher than Rs. 50,000 either in each invoice or aggregate of all invoices:

1. About a supply

2. For reasons other than supply (e.g., return)

3. Due to inward supply from an unregistered person

The following parties are authorized to generate an E-way bill:

1. Register Person: E-way bill can be easily generated when a movement of goods exceeds Rs. 50,000 by a registered person. A registered party or transporter may choose to produce an Eway bill through the e-way bill software or GST system even if the value of the goods is below the limit of Rs. 50,000.

2. Unregistered Person: GST software is an excellent platform to help even unregistered parties generate a valid Eway bill. When a supply is made from an unregistered person to a registered person, the receiver must ensure that all the compliances are met. GST invoicing software can help managers overcome any hurdles.

3. Transporter: GST tax software can also be used by transporters carrying goods by rail, road, and air, as they must generate an authorized E-way bill.

GST compliance software is a revolutionary tool that automates and streamlines the entire process of generating Eway bills, hence investing in a sophisticated GST return software is highly recommended for organizations that deal with a frequent heavy volume of goods movement.

C) How Can GST Solutions Help in the Generation of Authorized E-Way Bills?

GST invoice software is an innovative and automatic solution that can help generate E-way bills in large quantities. The best aspect of GST return software is that it is a user-friendly tool that can greatly reduce organizations' legal compliance burden.

Getting software is a wise decision as it can help in generating E-way bills in the following ways:

1. GST tax software enables new system users to sign up with the E-way bill generation portal.

2. GST software can add multiple users to generate an E-way bill per organizational requirements.

3. GST invoice software helps documentation management and fills in the correct details to generate a valid E-way bill.

4. GST tax software assists in the printing and storing E-way bills for future reference.

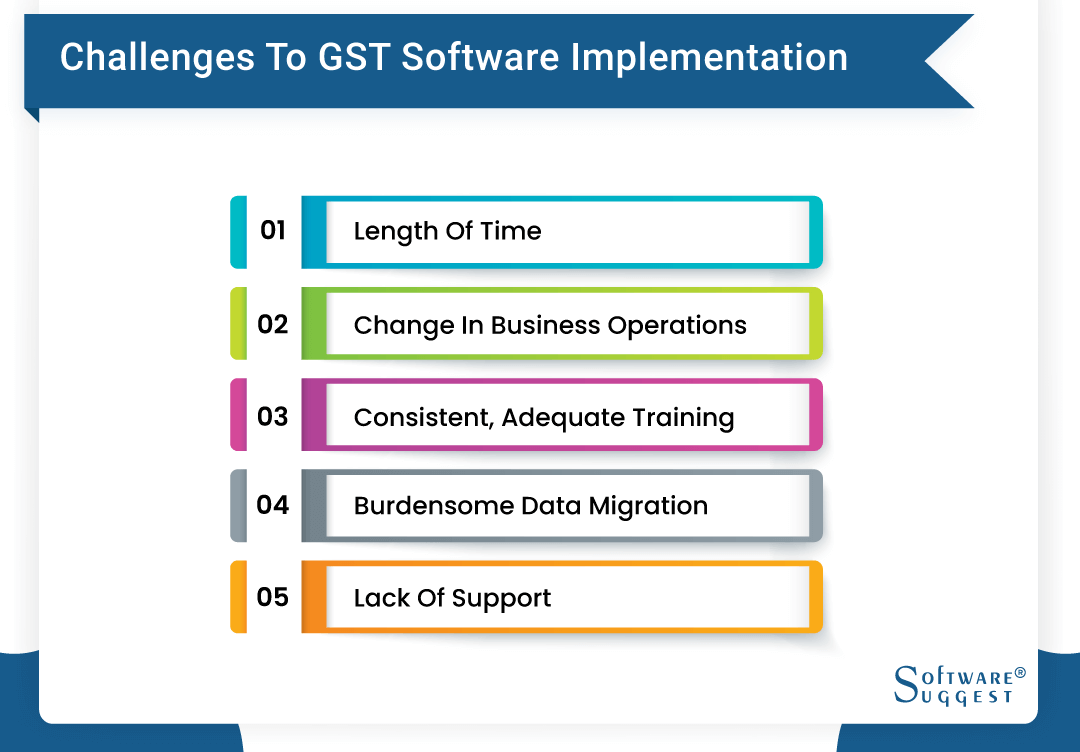

Challenges in the Implementation of the GST System

Like any enterprise, the software can be challenging to implement. Though you can easily overcome these challenges, they can make a big difference in your GST software implementation.

Let's delve into some common challenges you may face during GST solution implementation.

1. Length of Time

If you buy an on-premise GST solution, its implementation process will be lengthy and time-consuming. For some robust systems, the implementation process can even last for months. This will disturb your day-to-day workflow.

Implementing a cloud-based GST system is the key to dodging this obstacle. Cloud-based solutions don't require manual installation; you can get them up and running almost instantly.

2. Change in Business Operations

Your staff is used to working without GST solution. Adopting a new system will suddenly be a challenge for your staff. Conducting business as usual, migrating to a new system, and learning to use it can be too much for your team.

3. Consistent, Adequate Training

You'll need to train your staff to use the GST software. Unless you have IT professionals on your team, your employees will have difficulty figuring out how to use the new tool. Therefore, you will need to conduct appropriate training sessions to ensure all the desired employees know how to use it.

4. Burdensome Data Migration

Arguably, data migration is the biggest hurdle for GST implementation. Let's say; you used a standard accounting system before implementing the new GST solution. Your existing tool would have years, maybe decades, of data that your staff will need to transfer manually to the new system.

5. Lack of support

Most GST software solutions lack ample support. In the case of on-premise software, you'll likely not receive free support beyond the implementation phase.

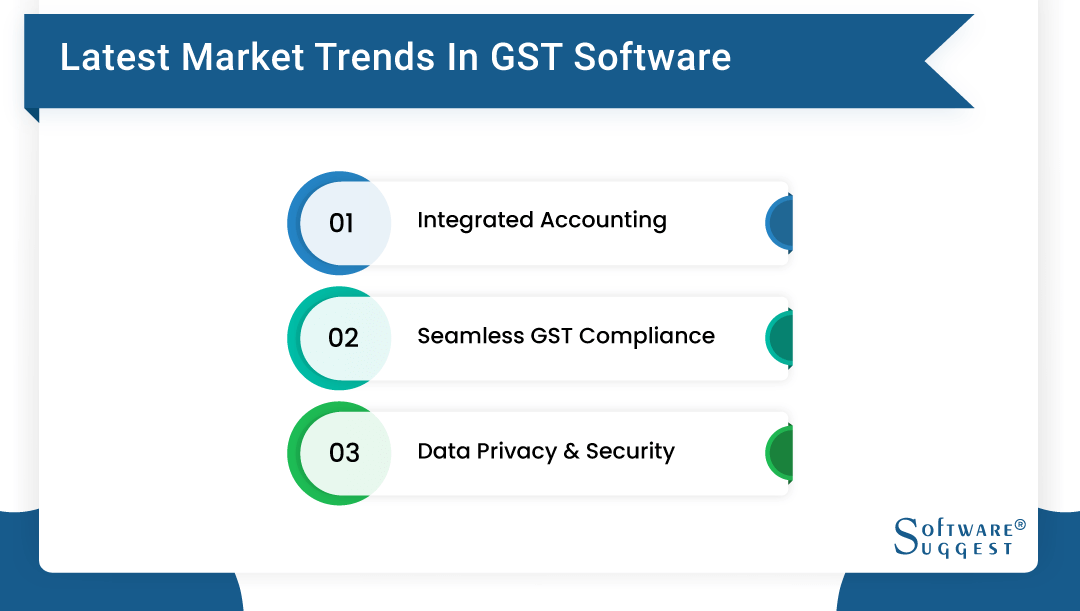

Latest Market Trends in GST Software

The introduction of GST software has changed the way accounting systems work. Here's a quick look into the latest market trends in GST software.

Integrated Accounting:

Businesses need periodic and accurate reporting. With modern-day GST software solutions, accountants and business owners generate financial reports quickly and precisely. This provides a transparent view of cash flow and profit/loss, which catalyzes intelligent decision-making.

Seamless GST Compliance:

During the day, accountants had to calculate and file GST returns manually. Not only was this process tedious, but it was also prone to human error. GST systems have automated GST filing and invoicing, helping businesses stay compliant.

Data Privacy and Security:

Cloud-based GST solutions are on the rise, and rightly so. They are cost-effective, easy to implement, and seamlessly scalable. However, data security was a major concern for users of online GST systems. This concern diminishes as GST software vendors implement enhanced data privacy and security features. Some advanced security capabilities include multi-factor authentication, encryption, and synchronization configuration.

Research Articles Related to GST Software

- GST Registration Cancellation Under GST act – Why and How?

- GSTR-7 Return Filing, Format, Eligibility, and Rules

- GST Exemption: Goods and Services Exemption List Under GST

- 7 Best GST Calculator Software To Look Forward

- E-Way Bill System: Guide For Transport Companies

- How GST Benefits Consumers and the Indian Economy?

- How to Pay GST Challan Payment Online?

- Top 16 GST Number Search & Verification Tools

- Free Accounting & Billing Software for India GSTN

- GST Composition Scheme - Rules, Rate, Limits, and Benefits

GST Software in following industries

- Accounting & CPA

- Advertising

- Agriculture

- Architecture

- Auto Dealership

- Banking

- Construction

- Consulting

- Distribution

- Education

- Engineering

- Food & Beverage

- Healthcare

- Hospitality

- Insurance

- Marketing Services

- Manufacturing

- Media & Newspaper

- Pharmaceuticals

- Property Management

- Real Estate

- Retail

- Transportation

- Telecommunications

- Textile

- Financial

- Hotel & Restaurant

- Sales

- Service

- Apparel

- Garment

- Fashion

.png)

.png)