The introduction of the dynamic Goods and Services Tax (GST) has brought about many vital changes in business organizations. Most businesses are using various kinds of invoicing software to remain compliant and adhere to the current mandatory regulations. It boosts efficiency, saves times and helps managers focus on more important strategic objectives rather than GST tax invoice preparation.

What is Meant by A GST Invoice?

An invoice or a bill simply means a list of various goods or services provided, along with the monetary amount due to the concerned party. It is absolutely essential that whenever any goods or services are rendered, a valid GST invoice needs to be created. For any type of goods or services that are included in the GST (Goods and Services Act) Act, this type of bill is termed as a GST tax invoice.

The Government has passed legislation regarding the GST tax invoice rules, and these were implemented in India on July 1st, 2017. It is necessary for any type of sellers to prepare a valid GST invoice, and send it to the buyer for necessary action. Failure to do so will make the business transaction invalid and invite punitive action legally. There are many free online invoice generators that can help small business houses manage their GST taxation in a streamlined manner. Technology-enabled tools to facilitate accurate calculations and reduce the workload of employees in preparing detailed GST tax invoices.

What is the GST Invoice Format?

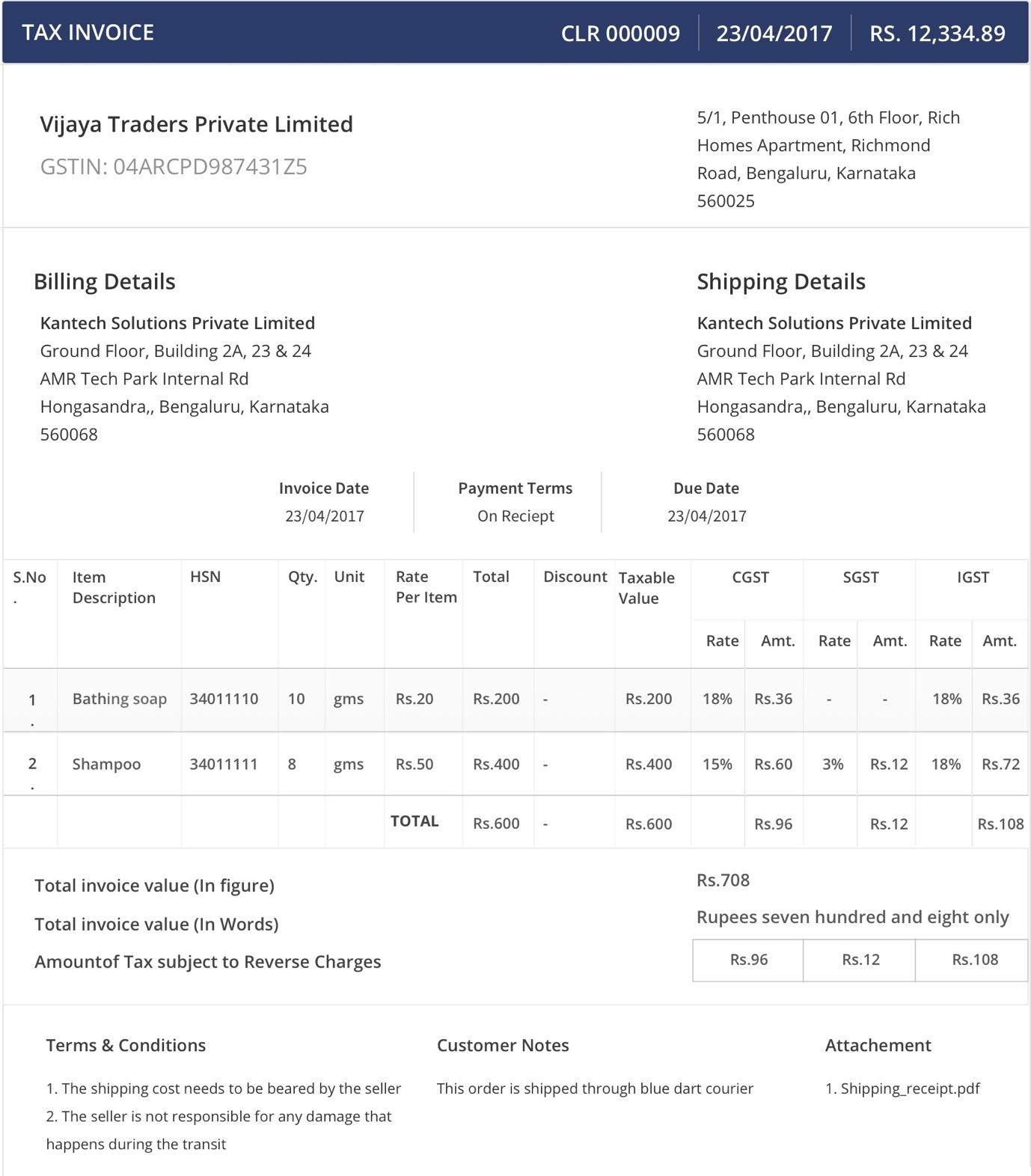

The GST Act, 2017 has issued a very clear format to be used in case of preparing tax invoices.

It is vital for organizations to be aware of the GST invoice format requirements issued by the Government. There are certain important fields that have to be mentioned and correctly filled. Some important aspects of the invoice format are mentioned below:

- All the details of both the concerned parties also have to be clearly mentioned in the GST tax invoice format.

- Each tax invoice needs to have a serial number as the first column. This serial number needs to be matched by the supplier and receiver to ensure the seamless and hassle-free flow of credit.

- There are many columns in the tax format that contain mandatory details such as item description, quantity, the rate per unit and discount that has been applied.

- After all the details are mention, the final invoice value needs to be stated both in words and figures.

- The shipping address along with the terms and conditions of shipping is also clearly stated in the invoice.

Here is a sample GST invoice for reference:

An inbuilt GST calculator serves as a handy tool to speed up the process of creating accurate and compliant invoices in the right format. The excel GST tax invoice format is available on a number of websites and can be modified or customized to meet the unique business requirements of an organization.

What Are the GST Invoice Tax Requirements?

It is mandatory for all GST registered businesses to provide valid invoices to their clients of the sale of goods or services. From July 1st, 2017 all GST bills created by suppliers need to mention the following fields:

- The complete name, address details and GSTIN of the concerned supplier

- Type of GST invoice – simple tax invoice, supplementary invoice or a revised invoice

- Invoice number and the date of transaction

- Billing and shipping address of the client

- Place of supply of goods or services

- HSN or SAC Code Number

- Total taxable value and discounts levied

- Quantity, units, description and other relevant details of the good/service

- GST applicable rates and total tax levied including the amount of CGST, SGST or IGST in separate columns

- Whether tax is payable on a reverse charge basis

- Digital signature of the supplier or any other authorized person

It is very important for GST bills to contain every one of these fields and not miss out any required information. If any of the above information is incorrectly filled, the entire transaction loses authenticity and is deemed invalid.

What are the GST Tax Invoice Rules?

There are certain compulsory rules that need to be followed while preparing GST invoices. Here are the legal mandates according to the GST Act, 2017:

1. Time Limit for Issuing GST Invoices

Under the current legislation, there are time frames within which the GST bills have to be issued. Here are the key GST invoice issuing time limits:

- In the case of goods supplied, the GST invoice has to be issued on or before the date of delivery or removal.

- In case of services provided, the GST tax invoice needs to be issued within 30 days of providing the service.

- If any services have been provided by banks or financial institutions, the valid GST invoice has to be issued within 45 days of providing the service.

2. Number of GST Invoice Copies to Be Issued

The number of GST invoice copies issued also depends on whether goods or services have been supplied.

- In case of the supply of goods, a GST invoice has to be issued in triplicate. This means that three copies of the GST bill have to be prepared. One is for the recipient (original one), one is for the transporter (second GST invoice copy) and the third one is stored in the supplier’s internal records (third copy).

- In case of services, GST Act rules clearly state that invoices have to be prepared in duplicate i.e two copies have to be made. The original copy is given to the recipient of the services whereas the second duplicate is kept for the supplier’s internal records.

3. Personalization of GST Invoices

It is possible for organizations to make their GST tax invoices distinct and recognizable. GST bills can be personalized by organizations in the following undermentioned ways:

- It is possible to add the issuing company logo for clear brand identification.

- Including the required authorized signatory field.

- Adding the name and address details of the issuing company in the official letterhead.

It is necessary for companies to follow these GST tax invoice requirements. By enforcing these rules, organizations can ensure that their GST bills are tax compliant and legally valid.

The enforcement of the GST Act has made it compulsory for registered dealers to follow the requisite GST tax format, rules, and regulations. It is very important to be aware of these rules so that suppliers adhere to them and do not default by providing any kind of wrong information. Following the proper GST tax invoice requirements keeps the entire business transaction smooth and streamlined, and makes sure that there are no legal hassles in the long run.

SoftwareSuggest empowers businesses to discover top business software and service partners. Our software experts list, review, compare and offer a free consultation to help businesses find the right software and service solutions as per their requirement. We have helped 500,000+ businesses get the right software and services globally. Get a free consultation today!