Whether you have studied accounting or not, you might have come across the terms ‘journal’ and ‘ledger’ quite often. Here, we will discuss a ledger, how it works, and the different types of ledgers.

A ledger meaning in accounting is defined as an account or record used to generate financial statements. Also known as a general ledger, a ledger in accounting provides a central database or repository that gathers all accounting data from sub-ledgers or modules. As a result, the ledger in accounting is considered the backbone of the corporate financial system.

The accounting information recorded in the ledgers is then used to create the income statement, cash flow statement, and balance sheet of a company. Examples of accounting ledgers include cash, accounts receivable, accounts payable, accrued income, outstanding expenses, and so on.

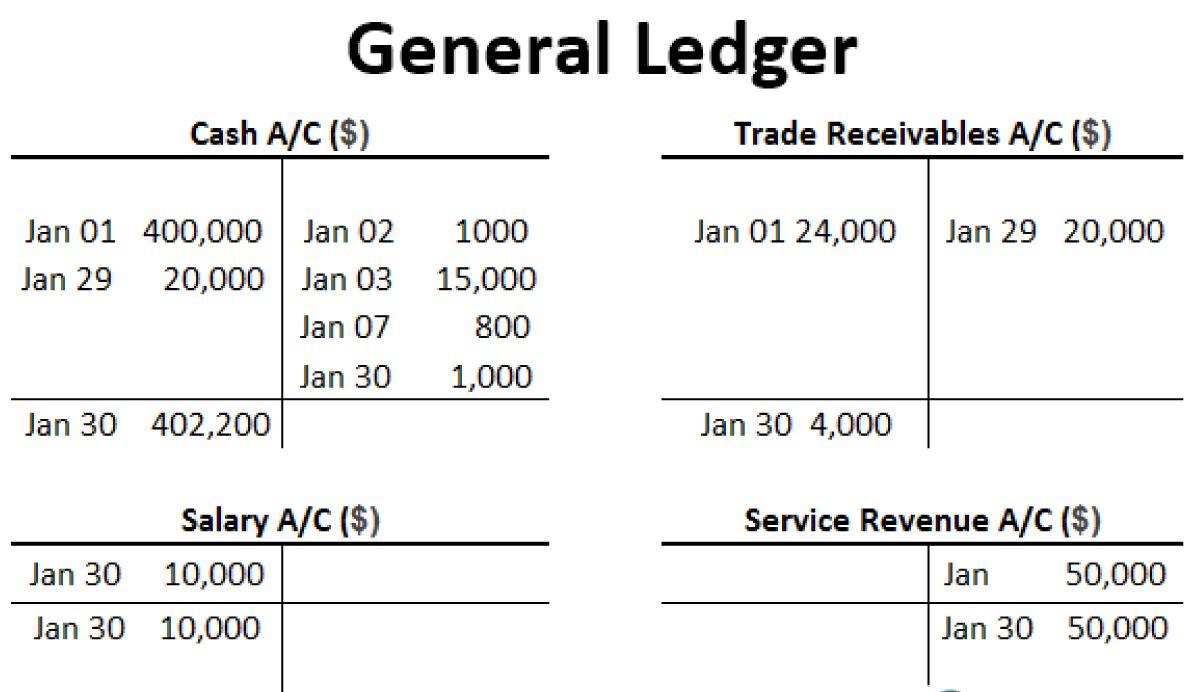

What Is a General Ledger Accounting?

Source: Wallstreetmojo

What is GL is a common question nowadays. General ledger accounting, or GL accounting, represents the record-keeping system for an organization’s financial transactions. A ledger in accounting provides a record of every debit and credit that occurs during the lifetime of a company. These transactions are usually classified by type into asset and expense accounts, liability accounts, owner’s equity, revenue, and others.

Certain general ledger accounts are summary records known as control accounts. To support each control account, the details are maintained outside of a subsidiary ledger. For example, accounts receivable might be a control account in a company’s general ledger, and a subsidiary ledger records each vendor’s transaction pertaining to that account.

To ensure that the transactions recorded in a general ledger are accurate and correct, a trial balance is maintained. A trial balance is a report that states every general ledger account and its balance. Its purpose is to make adjustments easier to check and errors easier to detect.

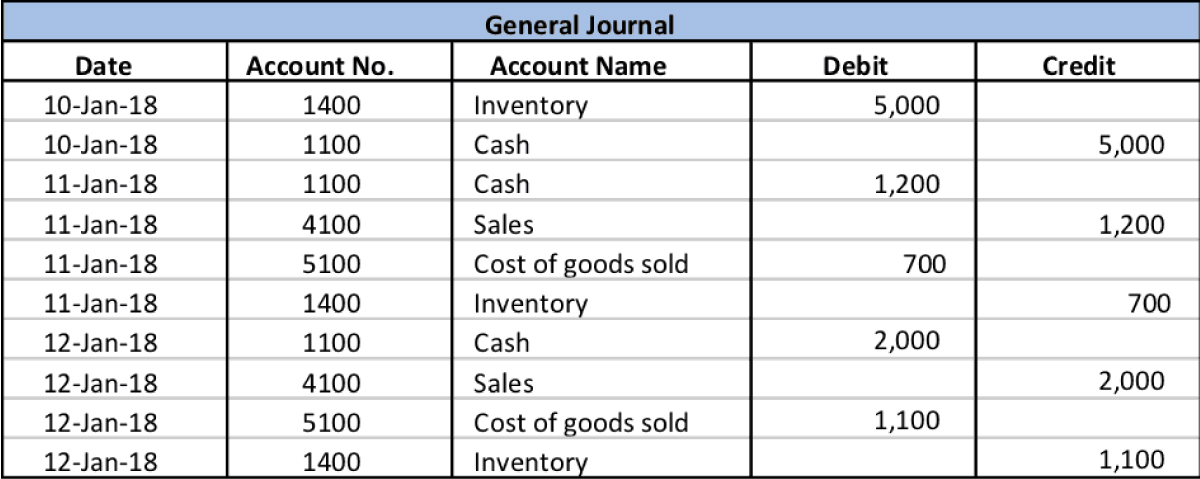

How Does a General Ledger Work?

Source: Double Entry Bookkeeping

A general ledger is considered the foundation of the system used by accountants to create and store financial data. Entries recorded in the general ledger are further summarized and used for creating financial statements such as the balance sheet, income statement or the statement of profit and loss, and cash flow statement.

How does a general ledger in accounting work? Whenever a financial transaction takes place, it is posted to the individual sub-ledgers accounts, which are created by the company’s chart of accounts. These transactions are then closed out or posted to the general ledger. Later, the general ledger helps accountants generate a trial balance, which serves as a report of each sub-ledger account’s final balance.

The trial balance is then cross-checked for any errors and is adjusted by posting any additional or missing entries. The adjusted trial balance is used to generate financial statements.

Typically, the general ledger accounting system is used by businesses that follow the double-entry bookkeeping method instead of a single entry. Under the double-entry bookkeeping method, every financial transaction affects at least two sub-ledger accounts. Each entry has a debit and a credit transaction. These transactions, also known as ‘double-entry transactions,’ are recorded in two columns, with the debit entries on the left and the credit entries on the right. The entries are also called journal entries, and the total of the debit and credit entries must be equal.

The accounting equation that underlies the double-entry method is

The double-entry system of accounting works based on the above equation’s requirement that the balance on the left (i.e., debit side) must be equal to the balance on the right side (i.e., credit side) of the equation. Irrespective of the way the equation is presented, the balancing rule in general ledger entry always applies.

Let us now look at why general ledger accounting is important for your business.

What Is the Purpose Of a General Ledger?

Source: Accountinguide

In accounting, a general ledger is used for recording all the financial transactions that take place in a company. The transactions are then classified into assets, liabilities, shareholder’s equity, revenue, and expenses. After every sub-ledger is closed, a trial balance is generated.

The trial balance then checks whether the transactions are accurate or not, and adjusted accordingly. Later, the data summarized in the trial balance is used for creating financial statements such as the income statement, balance sheet, and cash flow statement.

Why is a general ledger important? Not only does it act as the foundation for accounting transactions in a business, but helps track financial performance for a given time period. Since the transaction details contained in a general ledger are compiled and summarized at different levels to generate various financial statements and reports, it allows accountants, company management, investors, and other stakeholders to assess the financial Sound of an organization.

Whenever there is a rise in expenses or a decline in sales, the financial statements cannot help you identify the problem. This is due to the fact that financial statements such as balance sheets and income statements provide a summary of how a business has performed over a particular period of time.

If you want to dig into the details of each financial transaction to find the issue, it is best to refer to the ledger in accounting. While this involves reviewing thousands of journal entries and can be time-consuming, it is crucial to maintain error-free and transparent financial statements and reports.

Some General Ledger Accounts Examples

To understand what a general ledger account looks like, here are some examples.

Balance Sheet General Ledger

Source: Business Case Analysis

Let us assume that a company pays outstanding rent worth $1000. To record this transaction, the accountant debits the outstanding rent account, reducing the liability by $1000, and credits the asset account, that is, the cash account, by $1000. Since the posted debit and credit amounts are equal and only affect one side of the accounting equation (Assets-Liabilities), it remains in balance.

Here is another general ledger example to help you understand a balance sheet general ledger better. Assume that you have received a payment of $500 from a client. The company will then increase the cash account by debiting the asset by $500 and crediting the accounts receivable, another asset account, by $500. Again the debit and credit amounts are equal, and the transaction affects only one side of the accounting equation. Hence, the equation remains in balance.

Income Statement General Ledger

Source: Accountingcoach

In an income statement general ledger, when a company receives payment upon the sale of a product or service, the cash received is recorded in the net sales account, along with other sales and sales returns. To compute the gross profit, the cost of sales is deducted from the net sales. Later, operating expenses such as manufacturing costs, rent, and general and administrative expenses are subtracted to calculate the operating profit.

Once you have calculated the operating profit, you need to subtract depreciation and amortization, interest payment, and tax. This will give you the net profit or net income for the period.

Wrapping Up

A general ledger in accounting builds the foundation for the accounting process in an organization. Using a general ledger, you can record all financial transactions taking place in a particular financial period, summarize them accurately, and use them to generate financial reports. Further, a general ledger helps you assess and track financial performance by verifying each transaction that took place in a given time period.

Frequently Asked Questions

Broadly, there are three types of ledgers in accounting. They include assets, liabilities, and shareholders or owner’s equity. There are other types of ledgers as well, such as revenues, expenses, and other income.

To create a ledger in accounting, you should first divide each account into two columns. The left side will consist of all debits, while the right side will contain all the credits. All your assets, expenses, and losses will be on the left side or in the debit column of the ledger. On the other hand, your liabilities, shareholder equity, revenue, and gains will be on the right side or in the credit column of your ledger.

A cash book is a type of ledger that records cash transactions. However, it serves both as a journal and a ledger since it stores all cash-related transactions and does not simply summarize them. On the other hand, a cash account is a separate account within a general ledger.

Nikita is a SaaS copywriter and content marketing expert with almost five years of experience. She creates engaging and high-quality content for businesses that want to see their Google search rankings surge. When she is not writing, she is busy following the search industry news to stay updated on all SEO tactics.