Invoice, bill, and receipt, all of them seem the same, don’t they? But there are some subtle differences between the three of them that set their individual purposes poles apart. Let’s see the exact meaning of an invoice, bill, and receipt. And also, we will take you through the reasons why you should use invoicing software for your business.

1. What is an invoice?

An Invoice is a commercial document which you send to your customer to whom you have already provided your goods/services on credit, in the expectation of receiving payment from them for the same.

2. What is the bill?

A Bill is a commercial document which your vendor/supplier has sent to you in expectation of receiving payment from you, after having provided their goods/services to you on credit.

3. What is the receipt?

A Receipt is a commercial document of acknowledgment, that you provide to your customers at the point of sale of goods/services to them, in case they make immediate payment or when the payment is received for the invoices sent.

Invoice vs Bill: What is the difference between invoice and bill?

In summary, what the vendor sends to the customer an expectation of receiving payment from the customer is his invoice, but the same invoice is a bill for his customer.

For example, the commercial document that you send to your customers in expectation of receiving payment for the goods/services provided to them, the same document acts as an invoice for you and as a bill for your customer.

Invoice vs Receipt: What is the difference between invoice and receipt?

While invoice is the request for the payment; Receipt is a proof.

And when your customer will make payment to you, you will provide him a receipt, i.e. an acknowledgment that you have received the payment from him.

Vendor Sends An Invoice — Customer Receives It As A Bill — Makes Payment — Gets A Receipt

The purpose that documents such as invoices, bills, and receipts serve is that it is physical proof of a transaction, such as, in the case of an invoice, it acts as a proof of payment owed on the provision of goods and services provided on credit. And in case of a receipt, the customer can present it as a physical proof that the payment has been made.

Also, these commercial documents are very crucial for maintaining accounts in the process of bookkeeping and accounting.

Why Should You Use Invoicing Software For Your Business?

- Create invoices quickly, from anywhere

With automated invoice billing software, you create an invoice from any corner of the world; all you need is internet connectivity, and you are good to go. It helps you get rid of the physical constraint of being tied up to your desk, but you can also even share the invoices via email.

- Set up recurring invoices to send automatically

Sending the same invoices to a regular client can be a tedious task. What if you could automate the whole process to send out invoices automatically? Think of all the time that will save you.

- Reduce the risk of error

Manual entry of data is one of the most significant factors that your invoice reconciliation process may be struggling with daily. With invoice billing software, not only is the data automatically populated but it also accurately results in more time and effort saved.

- One centralized management system

No more relying on multiple sources to search for customer details, product information, order details, credit notes, etc. No more relying on manual effort to populate the same fields again and again. No more confusion between invoice vs. bill too! With just one system to house all information, you don’t need to look further!

- Keep an eye on your cash flow at a glance

More accuracy equals more time saved and money saved by merely streamlining the invoice reconciliation process. So, all the time spent on rectifying errors due to manual intervention can be instead spent on monitoring the cash flow for your business.

- Generate financial reports with a click

Invoice billing software comes equipped with an ability to generate reports and analytics. You can create custom reports with just a click, absolutely no programming skills needed.

- Work independently, from any device

Most invoice billing software tools are cloud-based, hence compatible with most devices. You can even work in offline mode, and the changes will automatically get synced when your device is connected to the internet.

3 Best Invoice Billing Software For Your Business

Software #1: Horizon ERP

As the name suggests, Horizon ERP is an Enterprise Resource Planning tool that provides invoice billing software features to industries like retail, FMCG, and other small-scale manufacturing verticals. It is loaded with a robust set of inventory management and accounting capabilities, with a single aim to streamline billing-related processes.

Key Features

- Expense Tracking

- Invoicing and Billing

- Stock accounting

- Item purchase details

- Inventory management

- Tax management

- Discount Management

- Purchase Orders

Upgrade for

Its pricing has a one-time payment of $150. However, it doesn’t have a free version, but you can check out all its features through a free trial available.

Software #2: FreshBooks

Touted as one of the best accounting software tools around, FreshBooks is one of the most-used apps. Not only is it a piece of cake to create professional-looking invoice templates in the shortest time possible, but you can lie back and rely on this software to do all the work; it’s that dependable! Automated reminders to clients and getting an advanced deposit of project fees are just other useful features that you’ll find interesting.

Streamlined workflows and work and cost forecast features have made this invoice billing software one of the industry favorites.

Key Features

- Easy discount management

- Multi-currency support

- Automatic tax calculation

- Custom invoice creation

- Pop-up notifications for every update

- Integration with accounting platforms

- Supports mobile devices

- Recurring payment automation

- Late Payment Fees

- Invoice Tracking

- Expense Tracking

- Cost forecasting

Upgrade for

Freshbooks has three pricing plans:

- Lite – $4.50/month for 5 billable clients

- Plus – $7.50/month for 50 billable clients

- Premium – $15.00/month for 500 billable clients

You can even ask for a custom quote if you want to manage more than 500 clients. Also, a free 30-day trial is available to test and get used to all its features.

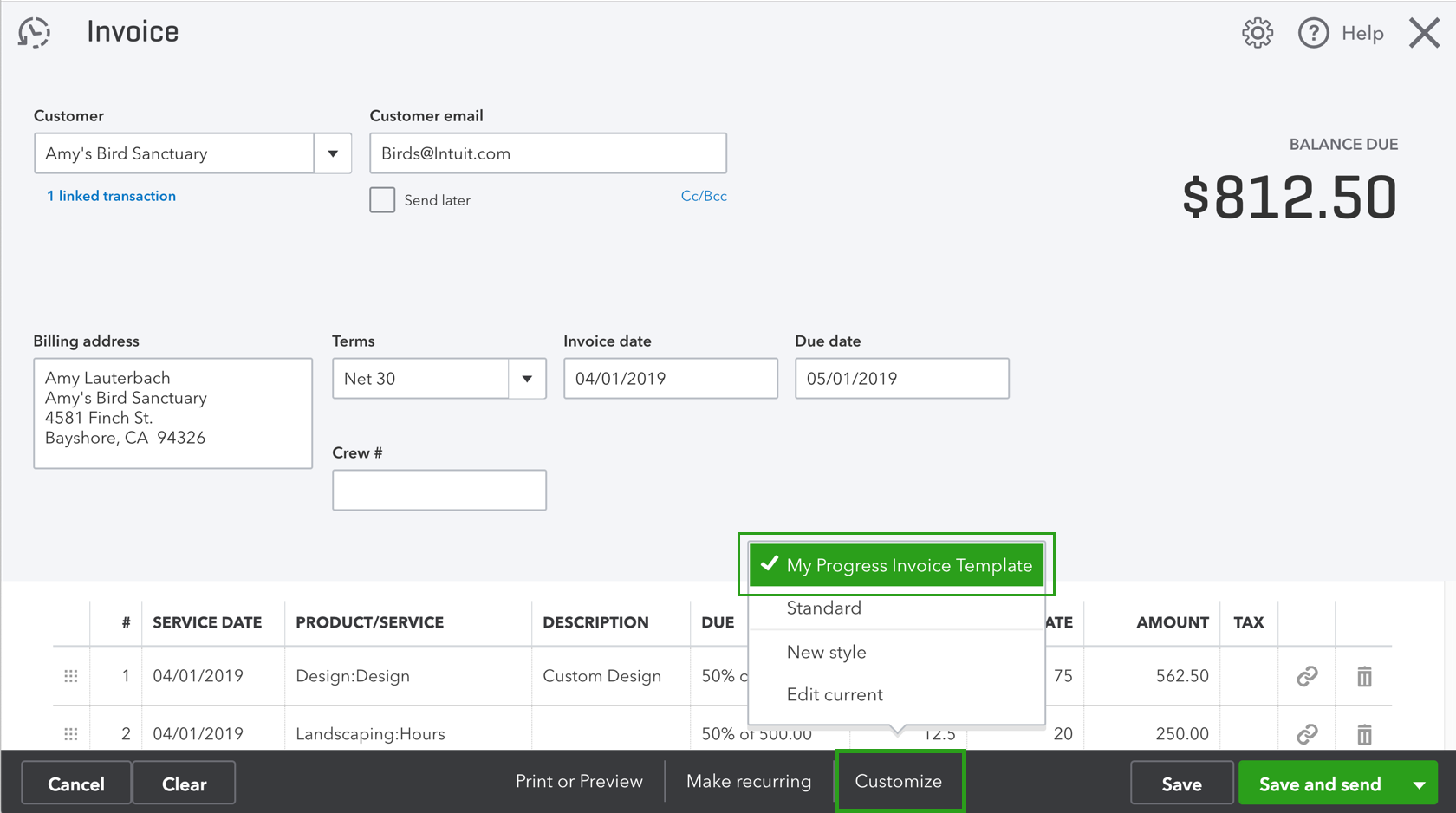

Software #3: Quickbooks

Specially tailored for GST invoicing in India, QuickBooks helps small business owners to not only create the best professional-looking custom invoices online but also manage the GST Bills with the most exceptional ease possible. The GST-ready templates come with built-in data and can be sent out automatically in case of recurring payments.

The Batch Action enables sending out batches of invoices together instead of manually sending out invoices one-by-one. You can Whatsapp, email, or print the invoices per your business need. With QuickBooks’s invoice billing software, it’s easy to monitor the cash flow and keep a tab on pending payments.

Key Features

- Custom invoice templates

- Payment terms

- Automatic application of client credits

- Print or email ability

- Automatic sending out invoices for recurring payments

- Automatic conversion from estimate to invoice

- Pop-up notifications

- GST Bill tracking

- Unlimited invoices per day

- Payment Reminder

- Dashboard and Reporting

- Unlimited Support

- Expense Tracking

- Integration with bank accounts

Upgrade for

Quickbooks has a meticulous pricing structure wherein you can use the software either online or on a desktop.

- If you want to access QuickBooks online strictly, then they charge $20/month.

- If you want to use it on your desktop, then the QuickBooks software charges $299.95/year with additional service upgrades.

Conclusion

Now that you have understood the difference between Invoice vs. Bill vs. Receipt, throw all your invoicing and accounting-related worries out of the window. Make informed decisions about using the right kind of invoice billing software for your business and help it reach greater heights.

An efficient invoicing software will not only give you the freedom to track your costs and expenses accurately but also help in overcoming the current obstacles due to manual intervention.

So, what are you waiting for? Browse through this super easy-to-use and robust invoice billing software tool and let us know your reviews in the comment section below.

SoftwareSuggest empowers businesses to discover top business software and service partners. Our software experts list, review, compare and offer a free consultation to help businesses find the right software and service solutions as per their requirement. We have helped 500,000+ businesses get the right software and services globally. Get a free consultation today!

Thank you for providing very important information in simple manner.