Best Insurance Software

Best insurance software companies in India are Eclipse, insureEdge, BrokerEdge, insureCRM, BindHQ, CRMNEXT, SohamLife, and Artivatic. These Insurance agent software streamlines workflows, improve customer service, enhance data security, and provide insights and analytics.

Connect With Your Personal Advisor

List of 20 Best Insurance Software

Category Champions | 2023

End-to-End Insurance Software to Grow Your Agency

InsureEdge is a powerful insurance software that empowers insurers, carriers, agents, brokers, and customers with smart tools to cater to all their Insurance needs. It is an essential tool to manage all your end-to-end operations. Read InsureEdge Reviews

Starting Price: Available on Request

Recent Review

"Highly Handy Insurance Management Software" - Derek Thomas

| Pros | Cons |

|---|---|

|

- Quick and seamless implementation- Diverse features and modules- Secure user interface |

Nothing specific comes to my mind. InsureEdge is a productive platform. |

|

InsureEdge helped us automate various business processes. Setting up the system was also a breeze and the experience was rather seamless. |

I am yet to find anything I dislike about InsureEdge. |

Category Champions | 2023

Eclipse is an excellent software used by insurance companies. This all-inclusive tool has a real-time interface and offers useful features such as ledger accounting, accounts payable, accounts receivable, advanced reporting, carrier downloads, and much more. Read Eclipse Reviews

Starting Price: Available on Request

Recent Review

"Eclipse IDE one of the best IDE's for java developers" - Akash Jain

| Pros | Cons |

|---|---|

|

Its friendly user interface which makes every developer to use easily. |

I could not find any as such till now |

|

The eclipse marketplace has a lot of handy packages that you would like to integrate in your workplace.I personally like the Wakatime package which tracks the time you have spent on your project and they also sent a weekly report from where you can track your progress. |

The booting up time is a little bit more when you first opened it .It can be improved a little bit. |

Category Champions | 2023

BrokerEdge is a flexible and scalable insurance broker software that helps automate end-to-end processes for brokers in personal, commercial, and specialty lines of business. Read BrokerEdge Reviews

Starting Price: Available on Request

Recent Review

"Useful Software for Insurance Brokers" - Rick Harman

| Pros | Cons |

|---|---|

|

BrokerEdge is user-friendly and enables our brokers to provide more convenient service to customers. It also helps with lead capturing and drives productivity. |

At the moment, I have no complaints concerning BrokerEdge. |

|

It’s easy to setup and useThe reporting function is quite advancedHelps brokers meet our expectations |

I don’t think the software has any flaws. |

OnBase is a certify enterprise content management solution for each level of government helping each meet today’s difficulty of smaller budgets and workers during laying the reason for simplified, effective and mobile government information technology. Read OnBase Reviews

Starting Price: Available on Request

Recent Review

"It is very nice software which work excellent." - Vandu Patel

Contenders | 2023

CRMNEXT is the leading global cloud CRM solution provider. It has practice leadership across nine verticals assisting businesses from SMEs to Fortune 500 businesses in optimizing customer relationships. Read CRMNEXT Reviews

Starting Price: Starting Price: ₹1080 User/Month/Billed Annually

Recent Review

"Headline highly efficient software to provide best CRM solution" - Lisa Macedonia

| Pros | Cons |

|---|---|

|

The support team is always available and provides accurate solutions. |

The price is little high and it would be difficult for small company to afford it. |

Contenders | 2023

3i Infotech offers insurance organizations an array of powerful solution accelerators and software that enable efficient end-to-end management of insurance software and business processes. With cutting-edge automation capabilities and quick-to-deploy solution. Read Premia Reviews

Starting Price: Available on Request

Recent Review

"Great Product" - Rutul Patel

Contenders | 2023

Jenesis Agency Management is a robust insurance management system that adds functionality and elegance to your insurance website. This affordable software is ideal for digitally transforming your business. It also offers online support during business hours. Read Jenesis Insurance Reviews

Starting Price: Available on Request

Recent Review

"Jenesis is easy to use and helps improve my productivity at work" - Jamiu

| Pros | Cons |

|---|---|

|

Seamless integration between the web and mobile apps- Easy to setup and use- Cost effective for small scale business owner like me- It comes with very good document and quote management systems |

Free trial should be introduced to attract new users |

Core software solutions for some financial services industry - Property&Casualty, General Insurance, and Life&Pension Management software. Sapiens Reinsurance is a complete solution authorize insurers to manage the entire range of reinsurance contracts and enterprise for all lines of business. Read Sapiens Reviews

Starting Price: Available on Request

Recent Review

"Sapiens" - Aditya Sethi

| Pros | Cons |

|---|---|

|

efficient in terms of offering |

Costly |

Ozone Insuria is a fully featured Insurance Software designed to serve Enterprises, Startups. Ozone Insuria provides end-to-end solutions designed for Web App. This online Insurance system offers Insurance Rating, Contact Management, Quote Management, Document Management, Commission Management at one place. Read Ozone Insuria Reviews

Starting Price: Available on Request

Recent Review

"Fully comprehensive and very easy to use application" - Salahudeen

| Pros | Cons |

|---|---|

|

Easy to use Fully integrated Cost-effective Good technical support User-friendly interface |

So far am not find any cons. |

Emergents | 2023

Case Management System for Health Insurance Claim

Claimbook helps hospitals by accelerating overall discharge process of insurance patients, enhances Hospital revenue collection by increasing effective bed care days in hospitals for new admissions and preventing revenue leakages in payment collections from TPA/Insurance companies. One of the best Insurance software provider Read Attune ClaimBook Reviews

Starting Price: Available on Request

Recent Review

"Excellent Product!!!" - Sahil Kazi

| Pros | Cons |

|---|---|

|

Claims tracking and billing is the most helpful thing. |

the lab information system |

CSC present the insurance industry including innovative and differentiated systems to sell and support policyholders on each device though help enriched interactions between the insurer and their brokers and agents, policyholders, and all different customer-facing personnel covering ecosystem partners. Learn more about CSC

Starting Price: Available on Request

The World’s leader Insurers Transform Their Business with Pega These industry leaders are using Pega solutions to improve customer service and marketing increase sales pattern and streamline underwriting and claims. Learn more about Pega - Order Management

Starting Price: Available on Request

Fadata is an advance European provider of software resolution for General insurance INSIS fully supports only and unit-linked products, group life products, commercial and personal non-life lines of business, unit-linked products,health products. Learn more about INSIS Life

Starting Price: Available on Request

Guidewire InsuranceSuite signifies a proven solution so support optimized insurance process for insights obtain from an engaged global customer area and empowers worker, representative, and customers to respond and adjust to market development. Learn more about Guidewire InsuranceSuite

Starting Price: Available on Request

Emergents | 2023

Cost Effective Software Products and Services For

We provide differently and cost effective software products and services for P&C Insurance and financial business client. We provide Insurance software, project management and consultant service too. Learn more about Insurance Software

Starting Price: Starting Price: ₹72000 Onetime

High Performer | 2023

AI First Insurtech & Healthcare Platform

Artivatic is an Insurtech and Health-tech Platform that provides on-boarding, risk assessment, distribution, sales, underwriting, claims automation, fraud detection, consumer profiling and micro insurance. Learn more about Artivatic

Starting Price: Starting Price: ₹2.88 Per API Call

Emergents | 2023

Auto Insurance Claim Tracking and Management Softw

KAEM - AICTMS Auto Insurance Claim Tracking and Management Software: This Software tracks all stages of an Auto Insurance Claim including payment due with reminder emails after TAT. Customization is also possible. Learn more about KAEM-Auto Insurance Claim Tracking

Starting Price: Starting Price: ₹21240 One Time

High Performer | 2023

Medical Insurance companies, across the globe, face several challenges in processing claims, as the documents are transferred physically and then approved. We have created an Insurance ERP, which simplifies the process and significantly cuts down the operational costs. Learn more about Pwave Insurance

Starting Price: Available on Request

Amsoft is a fully featured Insurance Software designed to serve Agencies, SMEs. Amsoft provides end-to-end solutions designed for Web App. This online Insurance system offers Document Management, Contact Management, Policy Management, Quote Management, Claims Management at one place. Learn more about Amsoft Insurance

Starting Price: Available on Request

Velocity is a fully featured Insurance Software designed to serve Agencies, Enterprises. Velocity provides end-to-end solutions designed for Windows. This online Insurance system offers Cancellation Tracking, Renewal Management, Rating Engine, Policy Management, Contact Management at one place. Learn more about Velocity

Starting Price: Available on Request

Until 31st Mar 2023

What is insurance management system?

In the fast-moving insurance industry, it is essential for insurance agents to stay relevant. As the insurance industry is becoming more complex with time, the role of robust insurance company software solutions is also becoming imperative. The Insurance management system is a must-have tool for insurance companies and insurance specialists. It not only helps you run your insurance agency smoothly and efficiently but also reduces operational expenses with help of operations software, besides boosting customer service and strengthening client relationships. At the same time, it eliminates the need for filling out forms or organizing policies and documents manually. In simple words, insurance management platforms are revolutionizing the way insurance agencies and insurers operate.

The best insurance broker software systems are highly customizable and can be tailored as per the requirements of your insurance management company. The software can also be integrated with your existing solutions for automating several routine tasks of your agency.

What are the Features of Insurance Management Software?

An innovative insurance software offers a lot of useful features and modules to help you streamline your workflow and stay ahead of the curve. Here are some of the useful features of insurance management software

- Data Storage: Insurance agency management systems offer powerful data storage facilities for storing huge volumes of data in a safe and secure manner. The software is capable of storing names, contact details, addresses of your clients, and other customer-related information along with contract and transaction-related data.

- Data Analysis: Insurance software solutions come with an inbuilt analytics tool that helps you analyze data patterns and make better business decision tools. The analytics tool also enables you to search, categorize, and organize data for generating reports.

- Built-in Templates: The insurance agency software system comes with multiple inbuilt templates for creating invoices, contracts, insurance applications, etc. This feature helps you generate essential documents when required.

- Notifications: Insurance software systems also generate text messages, alerts, and automated emails to keep your clients informed about scheduled visits, new policies, and claims, renewing service agreements, payment for services rendered, and much more. The notification feature offered by insurance software plays a key role in enhancing customer retention and satisfaction. Furthermore, since email / SMS alerts software facilitates the rapid exchange of critical information between team members, it also helps you manage crises more efficiently.

- Accurate Monitoring: To run an insurance agency impeccably, you need to monitor several day-to-day operations with precision. Insurance agency management systems help you control the finances, payments, transactions, debts, and activities of your team members. What’s more, insurance software also notifies you whenever it detects the slightest deviation.

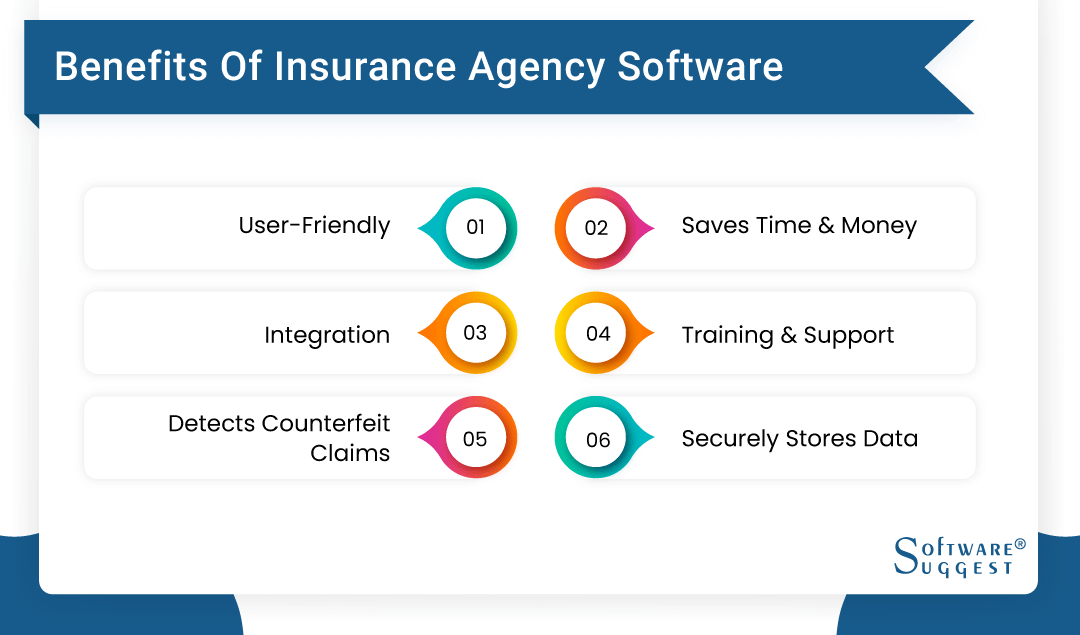

What are the Benefits of Insurance Agency Software?

Currently, there is a huge demand for insurance management platforms because of the immense benefits they offer. Insurance software takes care of the needs of your insurance agency and helps you perform tasks faster, without the least error. Here are a few advantages of using insurance software in India that will help you understand why this software is gaining grounds in the insurance industry:

- User-friendly: Insurance software in India is easy to use. It offers a simple interface that helps you manage multiple aspects of your business in one centralized place. Insurance management applications also come with a simple dashboard to provide you with better insights and help you make data-driven decisions, effortlessly.

- Saves Time and Money: An advanced insurance software system is easy to use and helps save considerable time to help insurance agencies function smoothly. It automates the claim process and enables your team members to work competently. Since the software automates your manual tasks, it also helps reduce the extra hours of operation, which in turn, minimizes the operational costs to a great extent.

- Integration: Software used by insurance companies can be easily integrated with your existing systems to enhance operational efficiency. It not only helps you eliminate duplicate data entries but also reduces IT expenses, besides enhancing the flow of information between systems.

- Training and Support: Once you install an Insurance management system, the vendors assign a dedicated tech support team to help you tackle technical issues. They also offer you training via webinars, documentation, live online, and in-person sessions.

- Detects Counterfeit Claims: The software used by insurance companies is capable of detecting fraudulent claims. It also helps in accelerating the process of investigation. Soon after detecting deviations, it sends multi-level notifications to alert you about any impending danger.

- Securely Stores Data: Insurance policy management software stores your financial and customer-related data safely and securely. Insurance software solutions adhere to strong encryption policies to save your data from malicious attacks. Moreover, only authorized individuals are allowed to access sensitive data by using their unique ID and password.

These are only a few benefits of using an insurance management system; however, the list is too long. We hope the factors highlighted above have helped you comprehend why insurance agencies need software like this.

Latest Insurance Software Trends in 2023

If you do not want your insurance agency to fall behind, pick a high-performance insurance tool right away and gear up to reap the benefits of ultimate efficiency.

- Artificial Intelligence (AI) is the Future: In the coming times, businesses will be integrated with AI that enables insurance agencies to create unparalleled experiences to offer personalized experiences and cater to the prompt demands of Millennial consumers. With AI-powered insurance platforms, insurers will be able to access data and generate reports more precisely in a shorter time. AI-powered insurance tools will also improve the claims processing cycle, and also transform underwriting processes.

- IoT will Transform the Insurance Industry: The Millennial customer is keen on sharing additional personal data only if it helps them save money on their insurance policies. The Internet of Things, popularly known as the IoT, will automate the process of data sharing. The day is not far when insurance agents would be able to derive useful data from IoT-enabled devices to reduce risks and settle insurance rates. One can use IoT software for the same

- Machine Learning (ML) will Help Detect Frauds: The insurance industry is currently facing the problem of fraudulent insurance claims. To combat this issue, insurance companies are relying heavily on ML. Machine Learning software helps insurers to detect fraud patterns by identifying deviations. It also notifies insurance agencies about every potential fraud so that the insurers can take immediate action.

- Chatbots and Drones will Steal the Show: The role of chatbots and drones in the insurance industry is currently a hot topic. Chatbots powered by AI and machine learning will help insurance agencies interact with their customers effortlessly, thereby saving a lot of time. Moreover, chatbots can also walk your customers through the claims process and policy application, besides simplifying back-end operations, and customer service. Similarly, drones are also emerging as a game-changer for the insurance industry. Insurers have already started utilizing unmanned drones for accumulating data, evaluating damages, detecting insurance frauds, and estimating risks before policy issuance. Moreover, drones facilitate faster, safer, and easier inspection of steep and damaged rooftops, farmer’s crops, and flood or earthquake-affected areas through powerful cameras that capture high-resolution images.

- Telematics is Making its Way into the Insurance Sector: Last but not least, telematics will also provide numerous benefits to automotive insurers as well as the insured. Telematics leverages GPS software-enabled black boxes for accumulating useful customer data that cannot be manipulated. The black box analyses different aspects of customers’ driving and disseminates the data to the insurer. Insurance agencies across the globe are leveraging telematics to comprehend risks, understand customer behavior in a better manner, and multiply the frequency of interaction with customers.

These are the latest insurance software trends that are disrupting the insurance industry. With technological advancements, conventional insurance companies are now gearing up to embrace robust technology-based business models to accumulate critical data and take their business to the next level.

If you do not want to lag behind in the competitive insurance market, you should also consider investing in feature-packed insurance broker software to achieve new heights of success. However, before making the final decision, make sure you purchase the software from a reputed vendor to avoid post-purchase regret.