Best Loan Management Software in 2023

Best names in the category of loan management software are SimpleNexus Mortgage Platform, Sofi, Loansifter, Floify, and Total Expert. All the loan management systems help in automating the entire process of loan management and process.

Connect With Your Personal Advisor

List of 20 Best Loan Management Software

Category Champions | 2023

Finflux is a SaaS-based banking platform that offers all banking needs at one place, needs like LOS, LMS, financial accounting, marketplace integration, app-based lending, credit scoring, reporting & analytics. Read FINFLUX Reviews

Starting Price: Starting Price: $694.44 Per Month

Recent Review

"Finflux and Baiju Finance" - Harshit Gajjar

| Pros | Cons |

|---|---|

|

The platform is extremely helpful for our NBFC but the best part is how fast they respond to custom queries and updations in the software, and go out of their way to help their customers, providing a great user experience. |

There are no downsides. Have been using the software for a year now and can confidently say, we are satisfied |

|

Easy to use and highly responsive |

UI can be improved a bit |

Contenders | 2023

Software by AllCloud Enterprise Solutions Private Limited

AutoCloud Enterprise provides a Complete loan management software for NBFCs and finance businesses to manage personnel, property, vehicle or business loans. This cloud based loan software seamlessly automates loan origination system to improve quality and efficiency for end users. Read AutoCloud Reviews

Starting Price: Available on Request

Recent Review

"Automated loan payment and default statement" - Mumpe Robert

| Pros | Cons |

|---|---|

|

Not known |

Not known |

|

Very simple to use |

no |

LoansNeo is a lending management software developed for Banks and NBFCs. It comes with custom workflows, visual analytics, and AI-based recommendation features and can simplify loan origination, journey management, scheduling, payment tracking, and other activities. Read LoansNeo Reviews

Starting Price: Available on Request

Recent Review

"best loan management Software solution" - christian james thompson thompson

| Pros | Cons |

|---|---|

|

Fast interactions through built-in automated and customizable approvals.Can be integrated with payment gateways and other marketing/sales apps.Predictive analytics and risk profiling for each customer. |

Cons of the software1. Underutilization can lead to high operational cost2. Dependence on the development team for updates3. Solution may not be best-fit for all lenders |

|

Customizable, easy to use |

Couldn’t find any |

Easy to use SaaS cloud-based Loan management software solution. Simple user interface and flexible for various business use cases. Various analytical reporting and customer notifications. Read Advance Loan Manager Reviews

Starting Price: Starting Price: $41.67 Full License

Recent Review

"Excellent Cloud Software to Manager Lender's Business " - Rahul Bhatia

| Pros | Cons |

|---|---|

|

Auto payment reminder on email and WhatsApp. Detail reports and dashboard overview of the overall business. |

Awaiting Mobile application for the same |

|

The system is very accurate, simple to use and has all the features required to manage a loan. I can get the data in excel files as well. |

The system makes you dependent on it. I was handling my finances manually before I tried the system, but now I can't work without Advance Loan Manager. |

Category Champions | 2023

LoanPro is a fully featured Loan Servicing Software designed to serve SMEs, Enterprises. LoanPro offers Application Management, Customer Database, Student Loans, Accounting Management, Compliance Management at one place. Read LoanPro Reviews

Starting Price: Available on Request

Recent Review

"Modern tech and easy to use" - Alexander Helm

| Pros | Cons |

|---|---|

|

Automated collections, simple interface, customizable and growth-friendly |

Haven't had any hiccups so far so I'll keep my fingers crossed. |

|

The borrower portal to pay and view the loan accounts. |

Ability to customize fields on the fly. |

ABLE Origination is an end-to-end loan origination system for large banking groups and MFIs. With a modular basis, ABLE Origination is highly scalable and meets all business demands. Read ABLE Origination Reviews

Starting Price: Available on Request

Recent Review

"It improved our productivity" - Vladimir

| Pros | Cons |

|---|---|

|

Really mature software for retail and SME loan origination and management. We could create and manage hundreds of loan products. User friendly interface design. |

We had to handle multi-currency. |

|

Many features out-of-the-box. Document management module. Convenient product catalog. No-code decision engine. The team is mature at integrations. |

Dashboard could be adjusted. |

Category Champions | 2023

HES Lending Software has a robust set of tools that help in all loan processing tasks. It has advanced features such as electronic signature, auto loans, document manager and audit trails. HES Lending Software is navigable, easy to use and customizable. Read HES FinTech Reviews

Starting Price: Available on Request

Recent Review

"Credit pipeline development for an online lending platform" - Aliya Akchurina

| Pros | Cons |

|---|---|

|

Responsible approach to fintech software development project Very helpful and professional team with excellent hard skills and soft skills HES FinTech is willing to solve business problems, not to upsell |

Nothing bad to say about this software provider |

|

Product is easy to use |

I don't find any difficulties |

Logic Research - Loan Management maintain records of loan details and loan payments is useful for Loan Provider Companies and Finance Companies have various features such as Create Loan Scheme – Loan number & Customer Details – Material Information – Value of loan amount – Loan Installment – Rate of interest % – Discount – Corresponding Reports. Read Logic Research - Loan Management Reviews

Starting Price: Available on Request

Recent Review

"A boon for small-scale business at a very reasonable rate" - Lina Sharma

| Pros | Cons |

|---|---|

|

Logic Search is a web-based app which takes care of all loan management responsibilities. It is simple and effective software to manage complicated loans. The feature of creating loan schemes is very helpful especially when you want to expedite the cust |

Logic Search is a web-based app which takes care of all loan management responsibilities. It is simple and effective software to manage complicated loans. The feature of creating loan schemes is very helpful especially when you want to expedite the cust |

Contenders | 2023

Keeping in view the assorted and varying demands of our privileged clients, we are readily engaged in presenting Loan Management Software. This service is rendered and imparted by a team of dexterous executives who closely interact with the clients and assure for their hassle-free working. Read NBFC Software - Loan Elantra Reviews

Starting Price: Starting Price: $763.89 One Time

Recent Review

"Best NBFC software" - Girdhar Goswami

| Pros | Cons |

|---|---|

|

Nice software for NBFC business |

No cons |

Contenders | 2023

CloudNBFC 2.0 helps the organizations in handling their loan management tasks related to the car, 2 wheeler, 4 wheeler and mortgage loans. The software is built to let the managers make smart loan-lending decisions and store the data in an organized way. It also has CRM, HR, payment and more features alongside. Read CloudNBFC 2.0 Reviews

Starting Price: Starting Price: $3472.22 One Time

Recent Review

"Easy to use software" - Vedshree Yadav

| Pros | Cons |

|---|---|

|

Easy to use. Great Customer support. |

No cons |

Category Champions | 2023

Margill Loan Manager is one of the best loan management software used by agencies, governments, lenders, and companies. It provides features like accounting management, loan processing, collections management, business loans, and amortization schedule. Read Margill Loan Manager Reviews

Starting Price: Available on Request

Emergents | 2023

Finsta is an integrated Loan Management System for Non - Banking Finance Companies, Nidhi Companies, and Producer Companies. Finsta has been designed with the State-of-the-art technologies to reduce the organization operational cost and analyze the work progress. Read FINSTA Reviews

Starting Price: Starting Price: $3472.22 Onetime

Recent Review

"Best NBFC Software in India" - Suraj Kumar

| Pros | Cons |

|---|---|

|

Highly professional team completely dedicated in giving the customer great satisfaction with their phenomenal work. |

Their NBFC Software Modules are completely user friendly and tested to manage our business |

LOANLEDGER is an online, real-time software that provides you with modules for firms dealing with loan management. This software is highly-customizable to suit all sizes of business. It has attributes like loan servicing management system, collection management, investor tracking service, transaction reports making, and much more. Learn more about LOANLEDGER

Starting Price: Available on Request

finPOWER Connect is a comprehensive loan management software working from last 30 years with satisfied customers all over the world. It has got a user-friendly, intuitive interface which takes care of all the aspects of your business in the most efficient manner. It is easy to start with and has got a good customer support. Learn more about finPOWER Connect

Starting Price: Available on Request

Software by Xentric Technologies

RECKON Loan Management Software is a software for all types of loan providing companies to eliminate manual loan management and streamline the procedures. It helps to simplify the loan process for the lenders as well as the loan seekers thus enhancing the productivity of the loan providers. Learn more about RECKON Loan Management Software

Starting Price: Available on Request

Emergents | 2023

Award-winning AI-Based End-to-End Digital Lending Management SaaS Platform for SMEs and Enterprise Businesses including Banks, Credit Unions, Finance Companies, In-house Lenders, Non-profits, and Governments. Learn more about TurnKey Lender

Starting Price: Available on Request

MLM Software India offers web-based Loan Management Software and IT services to resolve lenders problem. Loan and lending is a profitable business in current economic environment. Lenders must need loan management software to track information such as due installments, payment collection, current balances, interest and penalty calculation etc. Learn more about MLM Software India

Starting Price: Available on Request

DownHome Loan Manager is loan management software designed especially for community lenders. This software is powerful, flexible, and easy to use. It has got modules to suit the needs of all sizes of business. The core system covers all the essentials, and add-on modules are available for specialized need. Learn more about DownHome Loan Manager

Starting Price: Available on Request

AXCESS™ is Our cloud-based and mobile-ready Loan Management Software offers ease of use and access for your customers and staff from anywhere in the world. AXCESS™ Software Suit manages a wide range of loan products including residential UCCC compliant, residential non-compliant, commercial, leasing and personal loans. Learn more about AXCESS

Starting Price: Available on Request

Software by Binary Stream Software Inc

Binary Streams' Loan Management system is an all-in-one loan management software which helps you find a solution to all the financial needs of your business. It is has got a number of satisfied customers including some of the big companies like Nikon, Panasonic, American Red Cross and many more. Learn more about Binary Stream - Loans Management

Starting Price: Available on Request

Until 31st Mar 2023

What is Loan Management Software?

Taking a loan is a major decision for customers – it could be for a new house, education, or personal reasons. Today, the modern customer wants to feel reassured that when they take a loan, it will be handled with the utmost efficiency and care by the organization. Investing in a loan management system is definitely the best way to improve the overall quality, turnaround time, and support for end customers who are taking a loan from your company.

Loan origination software is a set of revolutionary tools that enhance the agility, speed, and transparency of an organization’s holistic lending solutions for customers. It enables financial organizations and banks to completely automate critical loan management processes to achieve a high level of cost savings and provide a better experience to valued customers.

Today, the market is flooded with a host of loan management software suites that provide a comprehensive range of features that can increase the performance of loan management procedures in organizations. Loan management system software is the best way to make sure that your organization handles loans with a great deal of flexibility, and is the best platform for mortgage companies, commercial lending firms, banking institutions, and private and institutional lenders.

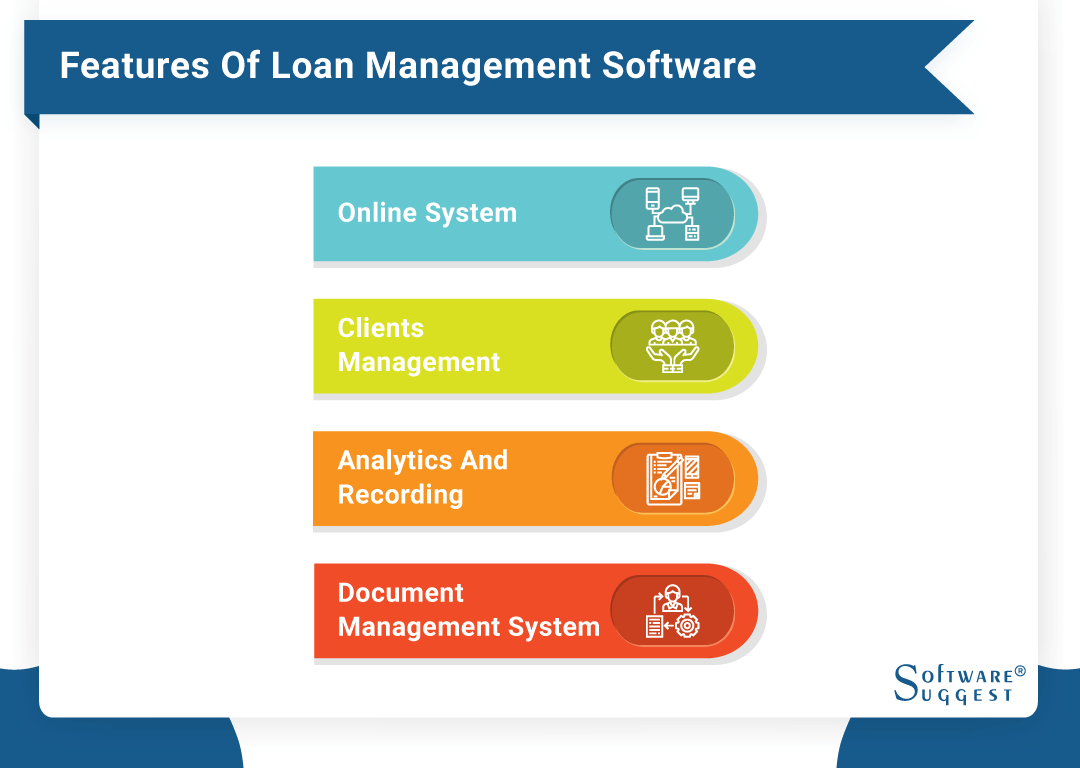

What are the Important Features of Loan Management System Software?

It is essential to make sure that your loan origination software has some features that will make it work smoothly and effectively. Here is a list of some features that your loan software should definitely possess:

1. Online Loan Management System

This is a highly helpful feature as your loan software system should have the ability to service a loan application online so that the borrower’s overall experience can be increased. Loan servicing software should make it possible for borrowers to make online payments so that they can remain self-sufficient and have the facility of convenience at their fingertips.

So make sure that your organization computerizes loan billing and payment, organizes collections management and financial accounting under a robust, streamlined, and secure online loan management system software.

2. Clients Management

One of the biggest challenges for organizations that give out loans is to keep a structured and up-to-date record of their client base. The loan origination system is a perfect solution because the novel client management feature makes sure that you can store, edit, and manage essential client-related data. It automatically enables your company to conduct complete client checks and manage due diligence in determining the creditworthiness of a potential client.

This is highly helpful as it allows your organization to assess the viability of a borrower so that your clients do not default on payments later. The latest loan management software suites also act as customer relationship tools, as they keep a complete record of customer interaction, record client notes, and help your forge lifelong relationships with your clients.

3. Analytics and Recording

It is important for a good online loan management system to give out useful reports so that critical business decisions can be taken with the right information at hand. Your loan origination system should be able to utilize current and real-time data to generate reports, tables, pie-charts, and other visual graphics so that the information can be viewed and analyzed by the management. An analytics dashboard is a useful tool as it is capable of displaying all essential loan-related information and can give a holistic overview to the team members at a quick glance!

4. Document Management System

Making sure that your loans are effectively managed is surely a complex task that involves a whole lot of documents and files. Well, the best part about getting loan management software for your organization is that you don’t have to worry about misplaced or lost documentation anymore. The document management feature is an innovative way of managing all the loan-related paperwork and keeping all your client files organized so that you have all the important data within reach any time of the day!

So make sure that that your loan origination software system contains all these amazing features as it will surely transform your bottom line results and help your company achieve great heights!

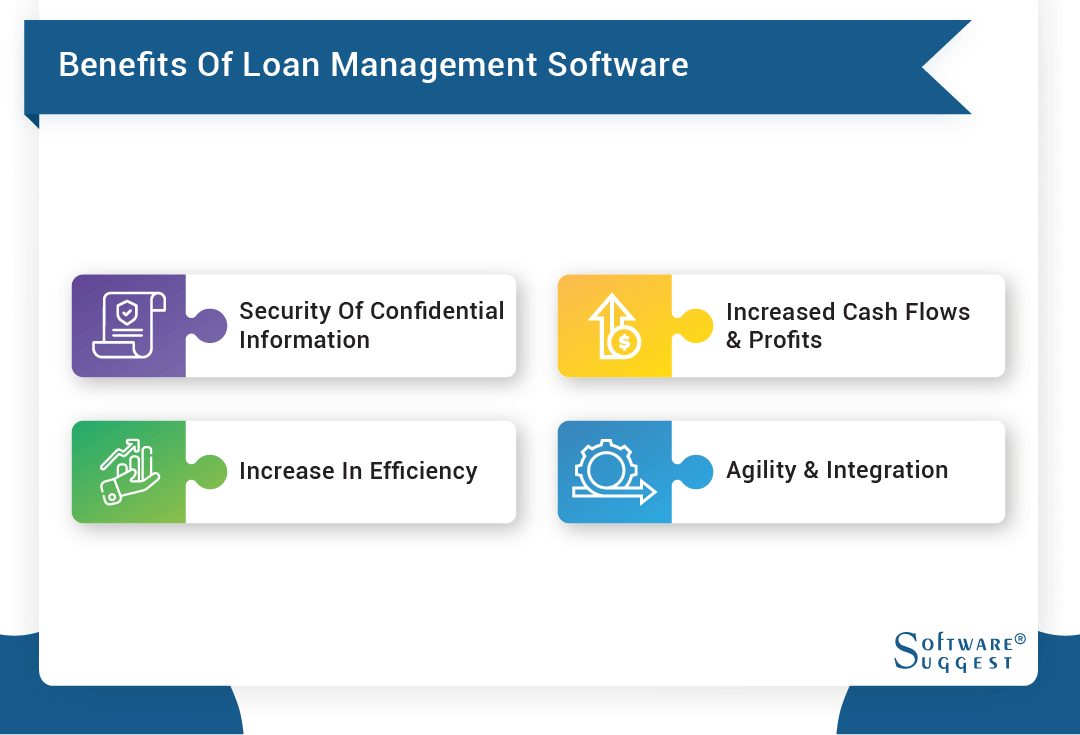

What are the Various Benefits of Loan Management System Software?

If you are still not convinced that your company needs a bank loan management system suite, then go through these great advantages that any organization can instantaneously gain through loan software:

1. Security of Confidential Information

Organizations need to be highly careful about client data and have to make sure that sensitive loan-related information is not misplaced or tampered with. Loan origination software has strong security through inbuilt firewalls and encryption, which makes sure that all your confidential loan documents and data remain safe and are not misused for personal gain by any third party.

2. Increase in Efficiency

Loan software plays an important role in boosting up the productivity levels of organizations, as it largely reduces the time and effort taken to process a loan. The turnaround takes place at a much higher rate and there are fewer chances of error, as most of the processes are highly automated. So, loan origination software is definitely the way to go if you want to escalate your organization’s output levels to unprecedented heights!

3. Increased Cash Flows and Profits

If you implement a loan management system, there will be a sudden and tremendous increase in your overall cash flows and profits. This is because of cutting off days or weeks from your loan collection cycle – thereby streamlining business operations with a faster turnaround, fewer staff members, and better administration. So don’t wait to invest in loan management software if you want to intensify your end results at a quick and rapid pace!

4. Agility and Integration

Web-based loan origination software has the capability to get integrated with your existing systems and can be customized to your exact organizational requirements. This makes your organization highly agile and responsive – lending a more consistent experience to your customers across multiple channels.

These benefits are the prime reason that organizations all over the globe are moving towards implementing loan management system software and benefiting from a gigantic growth in productivity and overall performance!

Types of Loan Management Software

Loan management software is a tool that is used to perform all the activities that are included in a loan or money lending process. These activities or steps include services like eKYC process, compatibility, Mobile application, versatility, GPS-based location mapping, collateral management, Multiple disbursals, and many more.

Loan management systems are mostly cloud-based and automated and are used to ensure that the loan process is smoothly executed, and the collection is appropriately facilitated. Different types of loan management software are available in the market, and all offer different benefits and features. Before understanding the ideal kind of software for your business, you need to understand the various types of them, and what features do they offer.

1. Cloud-Based / On-Premise System

Many small or medium-sized lenders don't have a dedicated IT department that can help them develop and manage a landing software with advanced IT functionalities. To overcome this problem, SaaS has gained popularity in the loan management software industry. These SaaS platforms are hosted from various remote locations and are equipped with a high level of cybersecurity and redundant backup systems. This type of LMS provides 24/7 uptime and a high level of security.

2. Comprehensive Loan Management System

In the field of technology, change is always constant. And to keep up with the rapidly changing technology, you need a lending software that adapts with any new changes or inventions in the lending software space. Comprehensive LMS offers the users an integrated integration along with flexibility and functionality. One thing to consider while selecting a comprehensive LMS is to find an LMS that provides a menu of individual modules. This way, you can choose the list of options and features you need for now and can retain the rest later on.

3. Automated Loan Management System

As the name suggests, automated LMS automates multiple tasks to carry out a smooth loan origination & servicing. If you don't want to pay a lot of attention to features and functions, but all that matters to you is revenues and profits, automated LMS can be a good option for you. Automated LMS offers a clean interface and allows you to integrate with multiple vendors. While choosing an automated LMS, make sure you look for advanced vendor integration as this feature can save you a significant amount of energy and time.

What Type Of Loan Management System Your Business Needs?

The type of loan management system your business needs depends upon the type and requirements of your business. If you are a small vendor in your initial stages, you might not need advanced vendor integration and comprehensive functionality. There are few free and open source loan management system options for those just starting out in business. On the other hand, if you are a large vendor, an LMS with limited functionality and features might not satisfy your business needs. Therefore, here are a few points to consider while selecting an ideal LMS for your business. There are a few free and open source loan management software options for those just starting out in business.

1. Broader Coverage

It is essential to choose an LMS that offers broader coverage. An ideal LMS provides complete assistance when it comes to tasks like mortgage documentation and asset financing. Additionally, it should be capable of delivering performance in activities like consumer loans or commercial leasing.

2. User-Friendly

One of the vital considerations, especially if you are a newbie vendor, is the ease of use. Not only does a complicated system makes it hard for the business to process its needs, but it also makes it challenging for the customers as well. Therefore, you should look for a system that simple to set up and configure as per your business requirements.

3. Speed & Agility

Speed, performance, and agility are essential for a loan management system, especially if you have a large business. The sanctioning of the loan should be fast and streamlined to make it easy for the users to request and receive the loan without any technical obstacles. This agility not only makes the work process more effective but also attracts more customers.

4. Customer Service and Technology Support

Another crucial factor to consider while selecting an LMS for your business is the quality of customer service and technical support. The software can have problems at multiple stages, and you should find a loan management system that has dedicated customer support for its users. Similarly, the LMS should provide adequate technical assistance to help you upgrade your systems with newer technologies.

5. Web And Mobile Compatibility

Unlike a decade ago when the desktop was the heart of technology, application-based services have gained decent popularity and for good reasons. In the lending industry, mobile applications can come in handy and can be used to fulfill a variety of functions. Therefore, you should choose an LMS that is supported by mobile and offers life software support.