Best Nonprofit Accounting Software

Best nonprofit accounting software are Freshbooks, Zoho Books, Aplos, QuickBooks, and Oracle NetSuite ERP. Use nonprofit accounting software to record all banking transactions and financial audit reports.

Connect With Your Personal Advisor

List of 20 Best Nonprofit Accounting Software

Category Champions | 2023

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Starting Price: Starting Price: $15.00 Per Month

Recent Review

"FreshBooks: The Simple and Intuitive Accounting Solution for Small Businesses" - Ayoub El Fahim

Category Champions | 2023

Online Accounting Software for Growing Businesses

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Starting Price: Starting Price: $10.4 Organisation/Month Billed Annually

Recent Review

"Zoho Bookings Schedule Good Timming" - JADAV PRAVIN

| Pros | Cons |

|---|---|

|

Zoho Books has integrated many little changes that further develop adaptability and convenience, alongside many significant changes. The webpage presently offers custom reports, QR code support in solicitations, further developed auto-examine for advanced monetary records like receipts, and improved coordination with other related Zoho sites.Automation features like payment reminders, scheduling reports and setting triggers for certain workflows can save a business owner a lot of time from the monotonous bookkeeping work. |

You start by giving contact and relevant deals charge data. A few elements, similar to solicitations and costs, are remembered for the site as a matter of course, however you can pick which different modules you might want to initiate, for example, stock, buy requests, and time sheets. On the off chance that you're a tiny business, you might need to turn a portion of these off to limit any pointless elements. |

|

Easy to use |

Report |

Category Champions | 2023

#1 Cloud ERP for Fast-Growing Businesses

NetSuite, #1 cloud ERP, is an all-in-one cloud business management solution that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Read Oracle NetSuite ERP Reviews

Starting Price: Available on Request

Recent Review

"Excellent " - HASMUKH PATEL

| Pros | Cons |

|---|---|

|

Easy of Operations, Functionality and last price |

Oracle Purchasing and Inventory Modules, also Hr Module |

|

Easy to use and quite faster. |

I haven't found any cons in this. |

High Performer | 2023

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Starting Price: Starting Price: $69.44 Per Year

Recent Review

"Easy to access" - Manisha Garg

| Pros | Cons |

|---|---|

|

Its easy to use |

No cons |

|

Import feature, Export feature, auto suggestion appears while matching and their customization report feature. Their support system is awesome. |

It is not an easy software to learn, you need to have training before using it. Professional accounting base is necessary. Although they provide videos for training. |

Category Champions | 2023

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Starting Price: Starting Price: $9 Per Month

Recent Review

"A complete solution for the financial management of your company" -

| Pros | Cons |

|---|---|

|

Among its positive aspects I can say that it is easy to use and that Xero has an intuitive and easy to navigate interface.It is also an online software, which means that it can be accessed from anywhere with an internet connection.It also integrates with a variety of complementary applications and services, allowing you to automate accounting tasks and improve efficiency.It also allows you to generate accurate and up-to-date financial reports in real time. |

can be more expensive than some other online accounting software.does not have full inventory accounting handling for businesses with a large volume of inventory. |

|

user friendly powerful |

none |

Contenders | 2023

HostBooks, an automated all-in-one accounting & compliance software provides you with a comprehensive platform for GST, TDS, eWay Bill Accounting, Tax & Payroll. Read HostBooks Accounting Reviews

Starting Price: Starting Price: $263.83 Per Year

Recent Review

"Good Software" - Irfan

| Pros | Cons |

|---|---|

|

Billing process is too easy. |

Yes, need to improve in general Ledger as per my opinion. |

|

Bad |

Bad |

High Performer | 2023

100% free accounting for your small business

Wave's accounting tool is 100% free, secure, and accountant-approved. Use Wave Accounting to connect your bank accounts, sync your expenses and balance your books to ensure you're ready for tax time Read Wave Accounting Reviews

Starting Price: Available on Request

Recent Review

"One of the best application to manage your accounts" - Vishit Chhatrapati

| Pros | Cons |

|---|---|

|

Detailing the features, flow of the application and seamless process |

for my usage, it's working perfectly fine. |

|

Advanced integration with high-end scalability. Invoicing payroll is seamless and prompt, accurate sales report generations. |

The app only comes with a support for IOS and Android. They should expand its usability. |

Category Champions | 2023

Sage Intacct is a cloud-based financial statement solution designed for small and mid-sized businesses. This robust and innovative software automates critical finance and accounting processes besides providing users with real-time financial insights. Read Sage Intacct Reviews

Starting Price: Available on Request

Recent Review

"A tool that seamlessly integrates with other software." - Charleen Ave Gallagher

| Pros | Cons |

|---|---|

|

Sage Intacct is the tool that has a robust system for managing financial and accounting data that helps improve and monitor expenses. I also like the customization of the reports, this is one of the qualities that helps to know exactly which are the parameters that we need to improve. |

It is a software that has the best tools to work in financial management and control. Sage Intacct has shown that the reports can provide detailed information on financial data for better control, it is also a very simple tool due to its very simple interface to run. |

|

Account control is adequate, where we have a record and save costs. Provides expense reports, the entire process with important details. Ease of implementation. Technical support that is helpful for new users. The information it offers about expenses is in real time, nothing better than that. We can have a detailed tracking of expenses. |

Despite only taking a few months since its implementation, I can say that I have not found any flaws in this platform, everything is very innovative and with favorable results. |

Emergents | 2023

ZipBooks automates many of the more tedious aspects of handling your finances. Cloud accounting tools like time tracking, online invoicing, project management, and auto-billing make it easy to keep better records. Read ZipBooks Accounting Reviews

Starting Price: Available on Request

Recent Review

"Invoices, sells your data, or sends you "partner" emails." - Charu Das

Emergents | 2023

AccountEdge is the complete solution for small business of accounting. It tracks assets, liabilities, double entry, bank accounts, balance, income, and expenses. Also, generate an annual budget for the upcoming year. Read AccountEdge Pro Reviews

Starting Price: Available on Request

Recent Review

"Content with the software" - Geet Vohra

Contenders | 2023

FastFund Accounting is a fully featured Accounting Software designed to serve Enterprises, Startups. FastFund Accounting provides end-to-end solutions designed for Windows. This online Accounting system offers Donor Management, Budgeting & Forecasting, Bank Reconciliation, Activity Tracking, General Ledger at one place. Read FastFund Reviews

Starting Price: Starting Price: $42 Per Month

Recent Review

"Can't get through the website " - Mercy

| Pros | Cons |

|---|---|

|

Because it's helpful for my budget .... |

Because it gives a good salary for my days to days needs |

Emergents | 2023

Blackbaud is a low-cost alumni management platform that can be a part of any ecosystem easily. With a cloud-native contact management system, this alumni management software leverages the alumni association process and makes it easily accessible. Learn more about Blackbaud

Starting Price: Available on Request

Emergents | 2023

MIP Fund Accounting is a fully featured Accounting Software designed to serve Agencies, SMEs. MIP Fund Accounting provides end-to-end solutions designed for Web App. This online Accounting system offers Accounts Receivable, Accounts Receivable, General Ledger, Asset Management, Donation Tracking at one place. Learn more about MIP Fund Accounting

Starting Price: Available on Request

Emergents | 2023

Accounting Seed helps to get all accounting right for salesforce, saving a lot of time on back-office work. It helps in reporting, general ledge preparing, order and project management, and much more. Learn more about Accounting Seed

Starting Price: Starting Price: $55 Per Month

Emergents | 2023

FUND E-Z is a fully featured Accounting Software designed to serve Enterprises, Startups. FUND E-Z provides end-to-end solutions designed for Web App. This online Accounting system offers Fund Accounting, Accounts Payable, Donor Management, Fund Accounting, Accounts Payable at one place. Learn more about FUND E-Z

Starting Price: Available on Request

Acceptiva for Nonprofits is a fully featured Nonprofit Software designed to serve Enterprises, Startups. Acceptiva for Nonprofits provides end-to-end solutions designed for Web App. This online Nonprofit system offers Accounting, ACH Check Transactions, Event Management, Debit Card Support, Mobile Donations at one place. Learn more about Acceptiva for Nonprofits

Starting Price: Available on Request

Emergents | 2023

Financial Edge NXT is a fully featured Accounting Software designed to serve SMEs, Startups. Financial Edge NXT provides end-to-end solutions designed for Windows. This online Accounting system offers General Ledger, Accounts Receivable, Project Accounting, Grant Management, Bank Reconciliation at one place. Learn more about Financial Edge NXT

Starting Price: Available on Request

Emergents | 2023

NonProfitPlus is a fully featured Grant Management Software designed to serve SMEs, Startups. NonProfitPlus provides end-to-end solutions designed for Web App. This online Grant Management system offers Online Applications, Grant Management, Purchasing & Receiving, Accounts Payable, Budgeting & Forecasting at one place. Learn more about NonProfitPlus

Starting Price: Available on Request

Emergents | 2023

Abila is a one of the Best accounting software for fund accounting and association management. Simple and easy to use for users. It has a nice user interface. Trusted by lots of acquiring the talent. Learn more about Abila

Starting Price: Available on Request

Until 31st Mar 2023

What is Nonprofit Accounting Software?

Nonprofit accounting software provides a comprehensive solution for the financial management needs of nonprofit organizations. Equipped with features such as donation tracking, grant management, budgeting, and reporting, it addresses the specific requirements of nonprofit organizations.

The software assists NGOs in maintaining accurate financial records, adhering to rules, and increasing stakeholder transparency. Organizations can better deploy resources wisely and make educated decisions with real-time information on financial operations.

As a result, trust between NGOs and their contributors, supporters, and beneficiaries is increased, making it more straightforward for them to focus on their mission and accomplish their objectives.

Who Uses Nonprofit Accounting Software?

Below are the main entities that use nonprofit accounting software.

-

Charities

Nonprofit accounting software is used by charitable organizations, including NGOs, foundations, and other non-profit organizations, to handle their finances efficiently.

They are able to prepare financial accounts, comply with regulations, and track donations and expenses thanks to the program. These groups can increase their financial accountability and transparency, streamline their operations, and make reasoned decisions to further their cause by utilizing this technology.

-

Accounting staff

The accounting staff of charitable organizations primarily uses nonprofit accounting software. These experts are responsible for regulating compliance and supervising the organization's financial operations.

They may create financial statements, manage other financial activities, and efficiently track donations and expenses with the help of the software. The team may focus on other vital accounting tasks that advance the objectives of their organization by saving time and lowering the possibility of mistakes with the aid of nonprofit accounting software.

-

Chief Financial Officer (CFO)

The most important user of charity accounting software is a charitable organization's Chief Financial Officer (CFO). This software provides the CFO with useful data, resources, and information to use in making decisions about the organization's overall financial management and strategy.

The CFO can use the software to generate financial reports, track financial performance, and keep an eye on cash flow, among other important activities. Using nonprofit accounting software, the CFO can gain a complete understanding of the company's financial situation and make data-driven decisions to further the organization's objectives.

-

Nonprofit or voluntary organizations

Nonprofit accounting software is designed exclusively for nonprofit or volunteer organizations, including foundations, charities, NGOs, and other non-profit organizations. These groups can use the software to handle their funds efficiently, including recording donations and tracking expenses, creating financial statements, and adhering to legal regulations.

These organizations may improve their openness and accountability, streamline their financial procedures, and make goal-oriented decisions with the aid of nonprofit accounting software.

-

Private schools, colleges, and universities

Private colleges, universities, and schools can also use nonprofit accounting software. These organizations, which are frequently set up as nonprofits, are required to conduct responsible and open financial management.

The program gives them the resources they need to produce financial statements, track income and expenses, and adhere to legal regulations. These educational institutions may boost accountability, promote financial efficiency, and make well-informed decisions to further their educational missions with the aid of nonprofit accounting software.

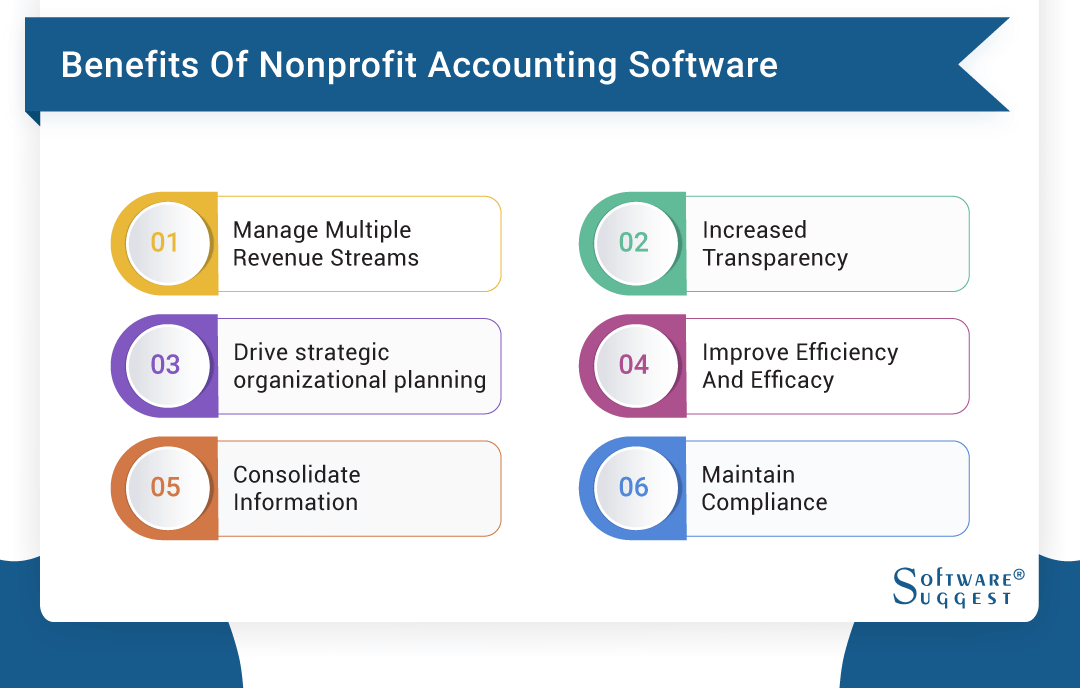

Benefits of Nonprofit Accounting Software

A nonprofit organization gets a lot of benefits from using accounting software like improved efficiency and accuracy, better accounting and financing, better reports, etc. Below are a few important benefits of using the software.

-

Manage multiple revenue streams

One of the key benefits of using nonprofit accounting software is the capacity to handle multiple sources of revenue. Nonprofits frequently receive funding from different sources, such as grants, donations, sponsorships, and membership fees.

With nonprofit accounting software, organizations can centralize the recording and tracking of all income sources, making it simpler to categorize, allocate and manage the funds. This results in more accurate financial records, informed decision-making, and the ability to monitor the performance of each revenue stream easily.

-

Increased transparency

One of the main advantages of nonprofit accounting software for non-profit organizations is increased openness.

Organizations can track and comprehend the effects of their financial activities more easily with the help of nonprofit accounting software since it provides a centralized, real-time view of their financial information. This information includes information on contributions, expenses, and other financial transactions, all of which may be quickly examined and reported using the software's reporting and analysis features.

-

Drive strategic organizational planning

Nonprofit accounting software provides real-time financial data and insights, allowing firms to allocate resources and make informed decisions based on the data.

As a result, organizations can accomplish their objectives and improve the results of their services and initiatives. The software can create detailed budgets, track spending, and identify areas for financial management improvement and more strategic resource allocation.

Additionally, the software offers historical spending research to assist businesses in making wise choices regarding their future income and expenses. Organizations can maximize their use of financial resources and more successfully carry out their goal by utilizing nonprofit accounting software to promote better strategic planning, ultimately having a bigger beneficial impact.

-

Improve efficiency and efficacy

The improvement of efficiency and effectiveness is a huge benefit of adopting nonprofit accounting software. The software automates a number of regular human financial tasks, lowering errors and freeing up time so businesses may focus on their primary objectives.

The program facilitates monitoring spending, tracking income, managing budgets, and making data-driven decisions, which improves organizational performance. Additionally, the program guarantees adherence to reporting and accounting standards, guaranteeing that the company follows the rules and laws.

Nonprofit accounting software enables organizations to accomplish their objectives more quickly and with greater impact, fully fulfilling their mission

-

Consolidate information

Consolidated information is a benefit of nonprofit accounting software. The software allows charitable groups to concentrate their financial information, including donations, expenses, and transactions. This makes it easier to monitor cash flow, track financial performance, and produce accurate financial statements.

The combined data can be utilized to allocate resources more effectively and make data-driven decisions about the organization's financial plan. Nonprofits can better understand their financial condition and utilize resources to further their missions by centralizing their financial information.

-

Maintain compliance

Numerous advantages of charity accounting software for maintaining compliance include automating financial tracking and reporting, improving the consistency and accuracy of financial reporting, and keeping track of funding sources and grant money.

Organizations may quickly comply with regulatory standards and save time and costs by utilizing built-in reporting and compliance capabilities like audit trails and automated tax forms. These advantages ensure that financial dealings and funding sources are handled in compliance with laws.

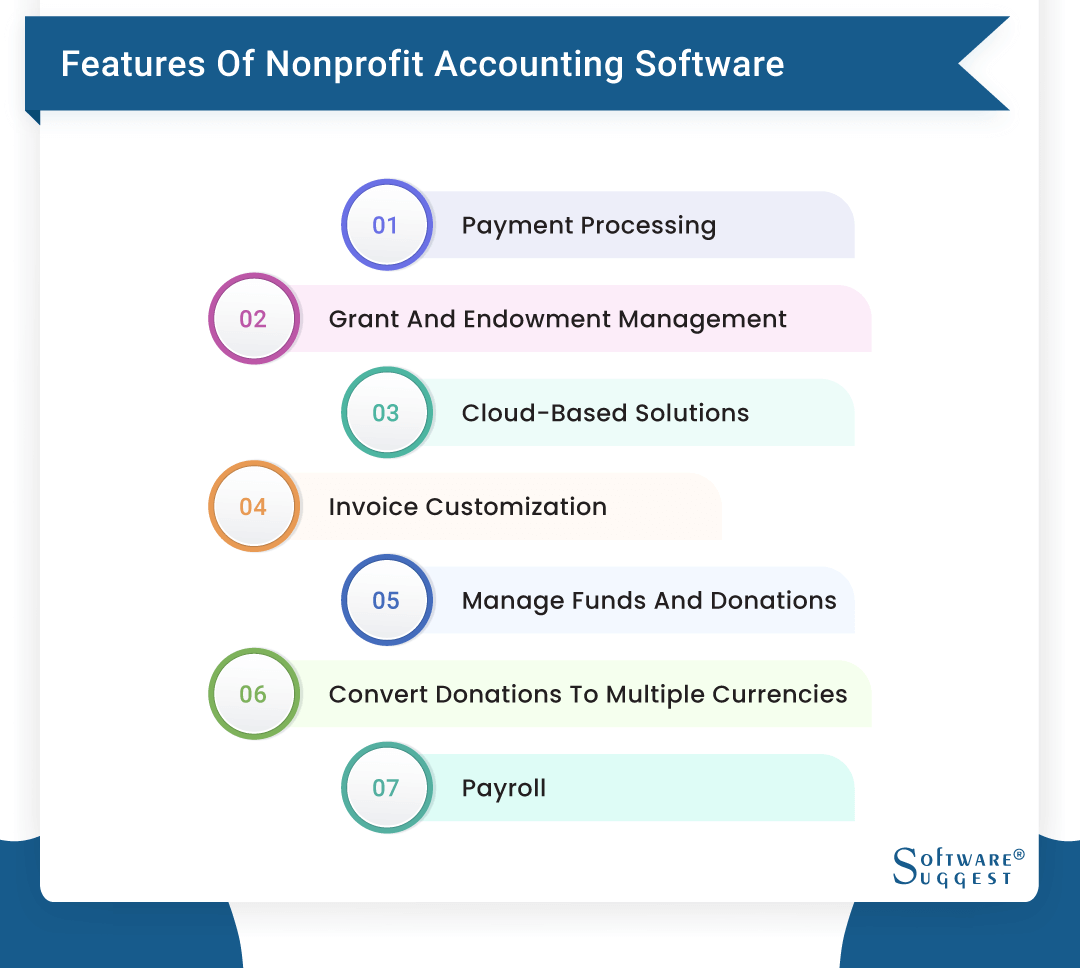

Important Features of Nonprofit Accounting Software

Selecting a not for profit accounting software requires thorough research. And it’s incomplete without selecting the right features. Below are some of the most important features you need to check.

-

Payment processing

Payment processing is a key aspect of nonprofit accounting software. It enables organizations to efficiently manage and track payments, including donations and membership fees, through online payment and credit card processing.

The software can also reconcile bank statements, saving time and reducing errors, and provide automated receipt generation and donor management to maintain accurate records. These payment processing features offer insights into the financial position and cash flow, allowing organizations to make informed decisions and plan for the future.

-

Grant and endowment management

A critical functionality of nonprofit accounting software is the efficient handling of grants and endowments. The software keeps track of grant and endowment funds, including their sources, applications, awards, and expenditures.

It also provides essential data to ensure that grants are reported in compliance. Accurate records of grant and endowment income and expenditures are kept to ensure that money is spent wisely. Automated grant reporting saves time and resources while assisting organizations in staying compliant, allowing them to prepare for the future.

Organizations may properly manage their funds and make sure it is being used effectively with the help of these grant and endowment management services

-

Cloud-based solutions

A feature to take into account while selecting nonprofit bookkeeping software is cloud-based technology. With the help of this functionality, businesses may access their financial data and information from any place with an internet connection, giving them more flexibility and convenience.

Along with lowering the chance of data loss and providing access to the most recent software features and security updates, automatic updates and backups are also offered. As the vendor hosts and maintains it, the cloud-based aspect of the software lowers IT expenses by relieving businesses of the need for internal infrastructure and support.

As a result, organizations of all sizes can choose cloud-based nonprofit accounting software since it is affordable and effective.

-

Invoice customization

A crucial component of nonprofit accounting software is invoice customization. With the help of this function, users can create personalized invoices that can be adjusted to meet the particular requirements of their business.

Options for customization can include including the nonprofit's logo, changing the layout, adding certain details like the terms of payment, and more. This can speed up the billing process and guarantee that invoices appropriately reflect the company's identity and payment rules.

-

Manage funds and donations

Having the capacity to manage money and donations is a crucial feature of nonprofit accounting software. Organizations can use this tool to keep track of the donations they receive and how they are being spent.

It offers features including keeping track of pledge commitments, classifying gifts, recording donor information, and producing tax receipts. Additionally, the program creates reports that enable wise resource allocation decisions and offer useful insights into the organization's financial situation.

With the help of this feature, nonprofits can have a centralized and well-organized picture of their finances, ensuring that the money they receive is being used wisely to further their purpose.

-

Convert donations to multiple currencies

The capability of nonprofit accounting software to manage donations in many currencies is essential. This function is perfect for organizations that operate internationally or accept donations from donors worldwide.

The program can swiftly and accurately translate these gifts into the desired currency of the organization, reducing the possibility of human error and saving time. No matter what currency the donations are made in, this aids NGOs in maintaining a constant understanding of their financial situation.

Nonprofits may effectively manage their funds with the help of this service, which also gives them access to reliable financial data.

-

Payroll

A key component of nonprofit accounting software is payroll administration. Organizations can use this tool to manage their payroll procedures, which include calculating salaries, taxes, deductions, pay stub production, and direct deposit administration.

The program could also keep track of employee perks, paid time off, and time and attendance. Payroll process automation assures tax law compliance, decreases manual error, and saves time. The program also offers valuable financial reports that the company can use to make defensible decisions about its budget and employment.

Overall, this function offers a complete payroll administration solution and aids organizations in effectively and efficiently managing their resources.

How To Choose the Best Nonprofit Accounting Software?

Here are a few things to take into account while selecting the finest bookkeeping software for nonprofits.

By taking into account these elements, you can select the best accounting software for your nonprofit organization, ensuring that it will fulfill your demands and assist you in achieving your goals. You can check out free accounting software for nonprofits and also compare it with paid tools for better understanding.

-

Think about the functions, such as budgeting, financial reporting, donor management, and compliance reporting, that are most crucial for your company.

-

The software must have a user-friendly interface and be simple to use.

-

Examine whether they can be integrated with the accounting software. Workflows can be streamlined, and efficiency increased through integration.

-

Think about whether the software can evolve together with your business to meet changing demands.

-

Consider whether the software can grow with your organization and accommodate increasing needs over time.

-

Evaluate the cost of the software, including any additional expenses such as setup fees, training, and maintenance. Consider the cost against the benefits you will receive.

-

Make sure that the software provider offers reliable customer support and resources, including training and technical support.

-

Ensure that the software includes robust security features to protect sensitive financial information.

-

Ask for references from other nonprofit organizations using the software and get their feedback on its features, ease of use, and customer support.

-

Consider the implementation process and training resources available. Make sure the software provider will provide adequate support to help you get started.

List of 5 Best Nonprofit Accounting Software

It is important to evaluate all the nonprofit accounting software platforms in the market before making an informed choice. If you want to find the top nonprofit accounting tool solution for your organization, here are our top picks based on user reviews.

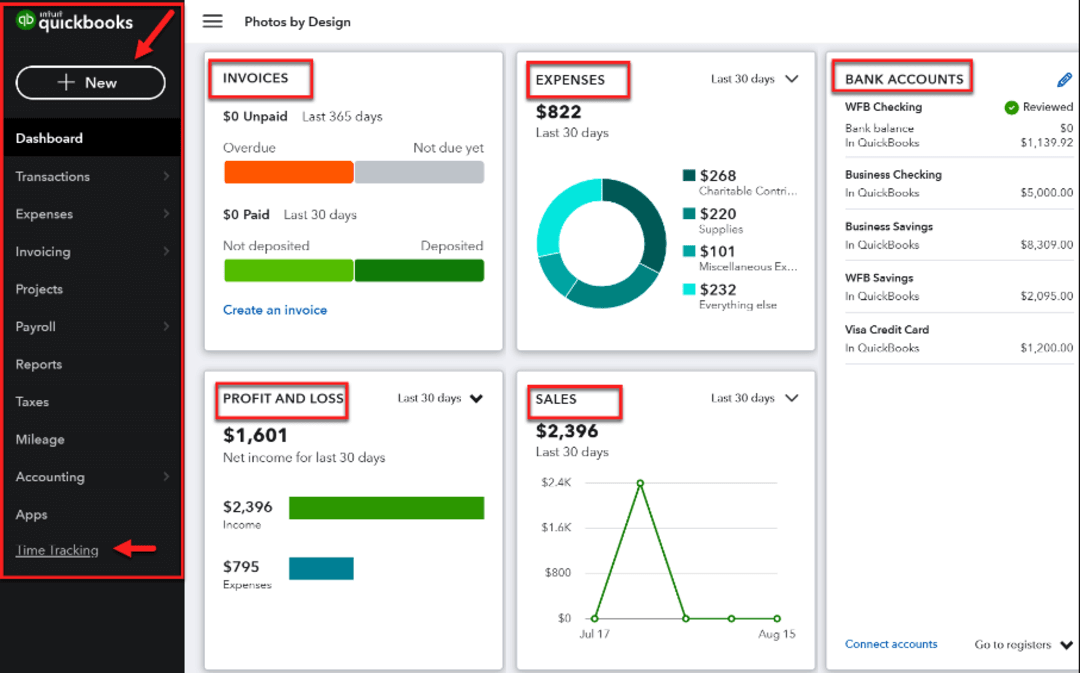

1. QuickBooks Online

QuickBooks Online Nonprofit is an accounting software specifically designed for nonprofit organizations to manage their finances efficiently. It offers features such as donor tracking, grant management, budgeting, expense tracking, and financial reporting.

The software integrates with various payment gateways and provides real-time financial data, allowing organizations to make informed decisions. It also helps to streamline accounting processes and save time.

QuickBooks Online Nonprofit offers customizable templates and reporting options to meet each organization's unique needs. Additionally, it ensures compliance with accounting standards for nonprofits and provides authorized users with secure access to financial information.

Features

- Donor tracking and grant management

- Budgeting and expense tracking

- Financial reporting and real-time data access

- Payment gateway integration

- Streamlined accounting processes

- Customizable templates and reporting options

Pros

- Easy navigation

- Efficient payment processing

- Secure access for authorized users

Cons

- Limited customization

- Limitations in handling complex financial structures

- Additional costs for add-ons

Pricing

- Simple Start: $25 per month

- Essential Plan: $40 per month

- Plus Plan: $70 per month

- Advanced Plan: $150 per month

2. NetSuite

NetSuite is a cloud-based accounting system made exclusively for nonprofit organizations. For managing finances, fundraising, grants, and donor management, it provides a number of capabilities.

Nonprofits can expedite their financial procedures and get real-time insights into their operations thanks to the software's integration with back-office activities. Organizations can simply track performance and make educated decisions with the help of sophisticated reporting and analytics tools.

Features

- General ledger

- Fund accounting

- Revenue management

- Donor management

- Budget and forecasting

Pros

- Easily scalable and customizable

- Has a user-friendly interface

- Provides real-time reporting

Cons

- It’s premium, hence on the expensive side

- Limited support

Pricing

- Offers custom pricing

3. Aplos

Aplos is a cloud-based accounting software designed specifically for the unique needs of nonprofit organizations. It offers a range of features to help nonprofits manage their finances, stay compliant with regulations, and make informed decisions.

Features

- Fund accounting

- Budgeting

- Online giving forms

- Event registrations

- Partner integrations

Pros

- Easy to use

- Helpful customer support

- Customizable functionalities

- Simple reconciliation process

Cons

- Check-in system may not work sometimes

- Transaction errors may persist

Pricing

- Aplos lite - $39.50 per month.

- Aplos Core - $69.50 per month.

- Aplos core and advanced accounting - custom quote.

4. Blackbaud

Blackbaud Nonprofit Accounting software is a specially developed financial management solution that contributes to creating streamlined processes.

It provides tools for tracking and reporting financial transactions, managing budgets, and analyzing financial data. The software features easy-to-use interfaces and reporting tools that allow users to quickly and accurately access financial information.

It also integrates with other Blackbaud products, including fund accounting software and donor management solutions, to provide a unified view of an organization's financial information. Overall, Blackbaud Nonprofit Accounting software helps organizations streamline their financial processes and make informed decisions to support their missions.

Features

- Fundraising and advancement

- Accounting

- Financial aid management

- Peer-to-peer fundraising

- Donor and prospect research

Pros

- Great customer services

- Easy to set up

- Helpful resources

Cons

-

Complex interface

Pricing

- Custom pricing.

5. Accufund

Accufund is a comprehensive cloud-based accounting software for small nonprofits. It offers a range of nonprofit accounting features that helps manage financial operations more efficiently, such as reporting, general ledger, fund accounting, and grant management.

Features

- Financial management

- Onsite management

- Reporting

- Budget development

- Loan tracking

Pros

- Straight forward process

- Great customization

- Quick and efficient customer support

Cons

-

Reporting becomes complicated

Pricing

- Custom pricing

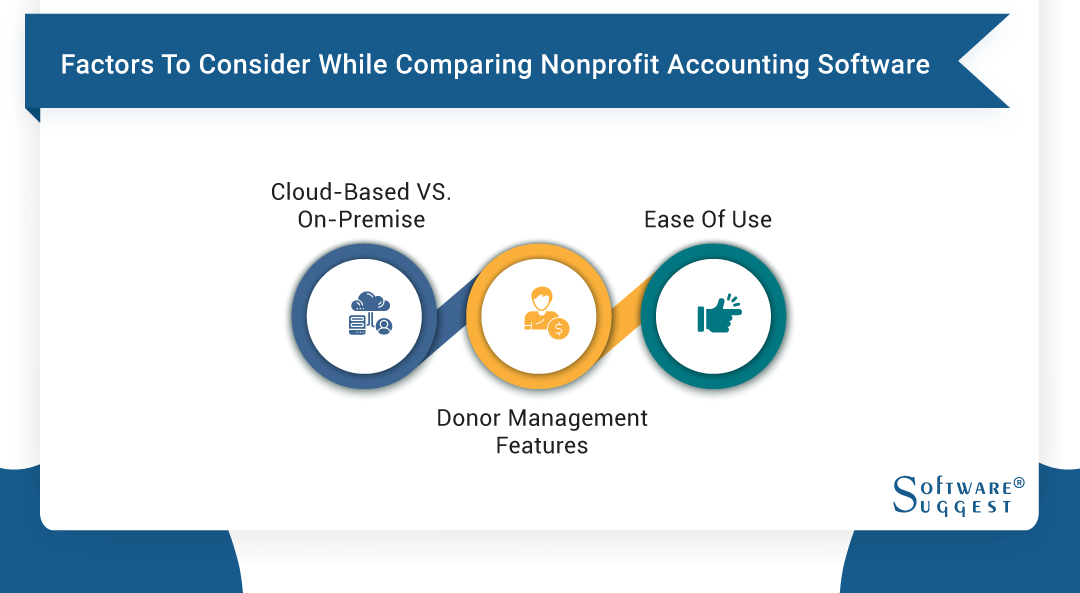

Factors To Consider While Comparing Nonprofit Accounting Software

While considering factors for comparing nonprofit accounting software, there are many things you need to consider other than pricing and features.

1. Cloud-based vs. On-premise

When comparing cloud-based vs. on-premise nonprofit accounting software, here are some factors to consider and by considering these factors, you can determine the best option for your organization, whether it is cloud-based or on-premise nonprofit accounting software.

-

Accessibility: On-premise software is only accessible from the organization's own servers, but cloud-based software can be accessed from any location with an internet connection.

-

Cost: On-premise software needs a substantial investment in hardware and infrastructure, whereas cloud-based software often has lower upfront costs and is paid for via subscription.

-

Maintenance: On-premise software must be managed and maintained by the company while cloud-based software is maintained by the supplier.

-

Security: Security considerations apply to both cloud-based and on-premise software, although cloud-based suppliers often have more money to devote to security and data protection.

-

Scalability: While on-premise software necessitates additional hardware investments to allow growth, cloud-based software may be scaled up or down to fit the demands of the organization.

-

Customization: Software installed on-site can frequently be customized more than software in the cloud, although customization may require additional technical resources and manpower.

-

Data control: On-premise software gives organizations full control over their data, while cloud-based software is subject to the provider's terms and conditions.

-

Integration: Cloud-based software is often designed to integrate with other cloud-based tools, while on-premise software may not have the same level of integration.

2. Donor management features

When comparing nonprofit accounting software with donor management features, here are some factors to consider:

-

Analyze how well the software manages donor data, including contact information, history of donations, and communication choices.

-

Check the software's capacity to monitor and administer donations, including reoccurring contributions and presents in kind.

-

Analyze the software's donation processing and receipting capabilities.

-

Look for tools like email communication and campaign management that let you interact with donors.

-

Consider the software's reporting features, such as its capacity to produce reports on donor activity, giving patterns, and campaign outcomes.

3. Ease of use

When comparing nonprofit accounting software, ease of use is a crucial factor to consider. Here are some specific aspects to look for.

-

Software with an intuitive interface is more likely to be accepted by the team, which can lessen the requirement for assistance and training.

-

Check for software that is simple to use, has a clear menu, and is structured efficiently.

-

Examine whether the software can be modified to match the unique needs of your firm while still being simple to use.

-

Consider the software's reporting capabilities, including the ease of generating financial reports and analyzing data.

-

Evaluate the software's ability to be used on mobile devices, which can be convenient for staff working on the go.

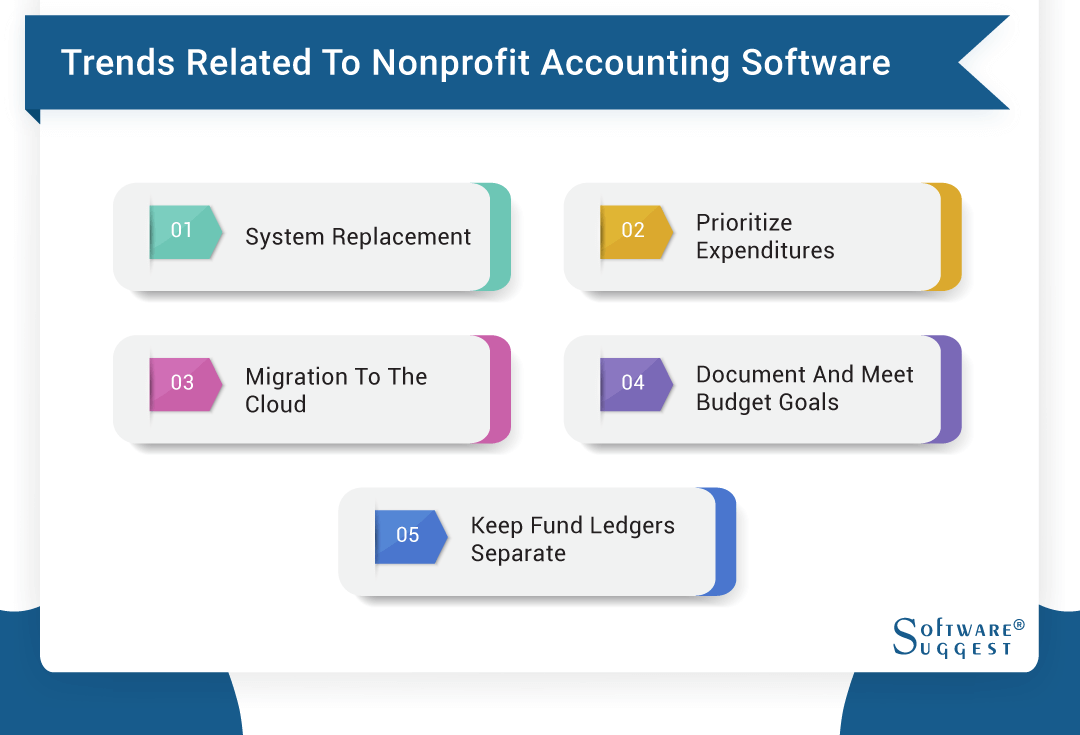

Trends Related to Nonprofit Accounting Software

It is important to remain aware of the latest trends related to nonprofit accounting software. While the trends keep changing based on the market, there are some trends that you need to implement.

-

System replacement

The trend in system replacement for nonprofit accounting software is toward solutions that are more modern, efficient, and secure. Nonprofits are seeking to replace their outdated systems with software that offers features with more user-friendliness, and better integrations with other software, such as donor management software to streamline processes and avoid manual data entry.

The software will be having cloud-based accessibility, which can be accessed from anywhere making it easier for the users. Nonprofits are looking for software that can automate manual processes, such as accounts payable and accounts receivable, to save time and reduce errors.

With increasing concerns over data security, nonprofits are looking for software that provides robust security features, such as encryption and multi-factor authentication, to protect sensitive financial information.

-

Prioritize expenditures

In recent years, there have been several trends related to nonprofit accounting software and the prioritization of expenditures. Some of these include scalability so that the software can be scaled with the organization's growth, more cost-effective software, and more customized software that can be tailored according to unique needs.

Nonprofits are seeking software that automates manual processes, such as accounts payable and accounts receivable, to save time and reduce errors.

-

Migration to the cloud

The trend toward the migration to cloud-based nonprofit accounting software has been growing in recent years. Some of the key drivers of this trend are improved security such as encryption, and multi-factor authentication to protect sensitive financial information.

-

Document and meet budget goals

Nonprofit organizations are highly using accounting software to document and meet their budget goals. The demand for more efficient financial management is what is driving this trend. Organizations can use nonprofit accounting software to analyze revenue and expenditures, build and manage budgets, generate reports, and make wise financial decisions.

Additionally, the software aids in maintaining adherence to accounting and reporting standards, making it simpler for firms to achieve their financial objectives. Another trend is the expanding use of cloud-based accounting software, which provides greater data protection, increased accessibility, and mobility.

-

Keep fund ledgers separate

One of the key trends related to nonprofit accounting software is the requirement to keep fund ledgers separate. This is because nonprofit organizations usually get funding from a variety of sources and are required to account separately for each source's expenditures.

Using nonprofit accounting software, which enables them to separately generate ledgers for each fund and maintain precise records of their revenues and payments, organizations can do this. Due to increased accountability and transparency, organizations are better able to provide donors and governmental entities with accurate financial data.

Conclusion

So, before purchasing a nonprofit accounting system, consider the features mentioned and make an informed decision. This tool has the potential to create a better and more streamlined process for growing organizations.

.jpg)