Best Online Accounting Software

Best online accounting software includes QuickBooks Online, Zoho Books, FreshBooks, Wave Accounting, and TallyPrime. Such online software securely manages an organization's financial data and allows access to records anywhere within a minute.

Connect With Your Personal Advisor

List of 20 Best Online Accounting Software

Category Champions | 2023

Online Accounting Software for Growing Businesses

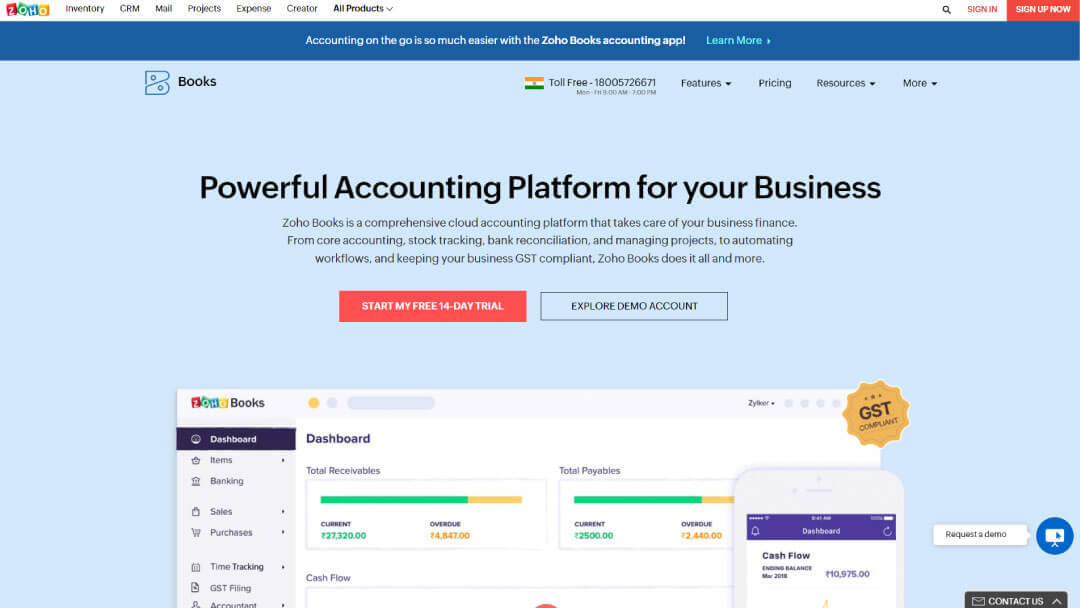

Zoho Books is an easy-to-use online account software for small businesses to manage their finances and stay on top of their cash flow. You can download a 14-day free trial of Zoho books. Read Zoho Books Reviews

Starting Price: Starting Price: $10.4 Organisation/Month Billed Annually

Recent Review

"Zoho Bookings Schedule Good Timming" - JADAV PRAVIN

#1 Cloud ERP for Fast-Growing Businesses

NetSuite, #1 cloud ERP, is an all-in-one cloud business management solution that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Learn more about Oracle NetSuite ERP

Starting Price: Available on Request

Melio is a free Accounts Payable software for small businesses. It allows companies to pay vendors using free bank transfers or credit/debit cards, while the vendors get paid via a bank transfer or check. Read Melio Reviews

Starting Price: Available on Request

Recent Review

"Excellent accounts payable solution that requires very little training" - Jasmin H

Category Champions | 2023

Cloud Accounting Software Making Billing Painless

This online bookkeeping software makes your accounting tasks easy, fast, and secure. So, start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Starting Price: Starting Price: $15.00 Per Month

Recent Review

"FreshBooks: The Simple and Intuitive Accounting Solution for Small Businesses" - Ayoub El Fahim

Oracle Netsuite is the first and last business system you will ever need. For more than 20 years, Oracle NetSuite has helped organizations grow, scale and adapt to change. NetSuite provides an integrated system that includes financials / ERP, inventory management, HR, professional services automation and omnichannel commerce, used by more than 26,000 customers in 215 countries and dependent territories. Read Oracle Netsuite EMEA Reviews

Starting Price: Available on Request

Recent Review

"Oracle NetSuite aids businesses to become more efficient and intelligent" - Mohammed Mustafha

| Pros | Cons |

|---|---|

|

user friendly powerful |

none |

|

Speed |

Backup |

Crunch Accounting is a fully featured Accounting Software designed to serve Enterprises, SMEs. Crunch Accounting provides end-to-end solutions designed for Windows. This online Accounting system offers Tax Management, Billing & Invoicing, Bank Reconciliation, Billing Portal, Customizable Invoices at one place. Read Crunch Accounting Reviews

Starting Price: Available on Request

Recent Review

"So good" - Nour Badawi

| Pros | Cons |

|---|---|

|

Ease of use |

Nothing, it is complete |

Category Champions | 2023

Making Modern Businesses GST friendly

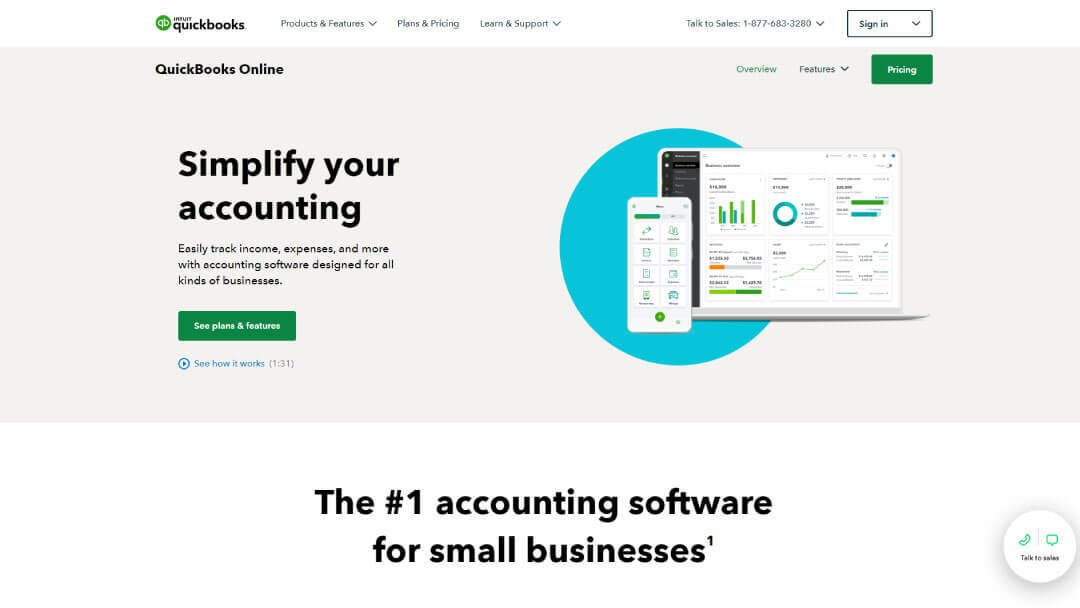

QuickBooks is the simple & best online accounting software for business owners to make informed decisions. You can run your business with QuickBooks anytime, anywhere. Read QuickBooks Online Reviews

Starting Price: Starting Price: $69.44 Per Year

Recent Review

"Easy to access" - Manisha Garg

| Pros | Cons |

|---|---|

|

Its easy to use |

No cons |

|

Import feature, Export feature, auto suggestion appears while matching and their customization report feature. Their support system is awesome. |

It is not an easy software to learn, you need to have training before using it. Professional accounting base is necessary. Although they provide videos for training. |

Category Champions | 2023

Xero Accounting is a cloud-based accounting system for small business owners and their accountants. It is beautifully designed and easy-to-use online software. Read Xero Accounting Reviews

Starting Price: Starting Price: $9 Per Month

Recent Review

"A complete solution for the financial management of your company" -

| Pros | Cons |

|---|---|

|

Among its positive aspects I can say that it is easy to use and that Xero has an intuitive and easy to navigate interface.It is also an online software, which means that it can be accessed from anywhere with an internet connection.It also integrates with a variety of complementary applications and services, allowing you to automate accounting tasks and improve efficiency.It also allows you to generate accurate and up-to-date financial reports in real time. |

can be more expensive than some other online accounting software.does not have full inventory accounting handling for businesses with a large volume of inventory. |

|

user friendly powerful |

none |

High Performer | 2023

100% free accounting for your small business

It is the best cloud-based accounting system for all businesses using mobile or desktop. Wave accounting tools are 100% free, secure, and accountant-approved. Easy to use, Simple, reliable, and fast. Read Wave Accounting Reviews

Starting Price: Available on Request

Recent Review

"One of the best application to manage your accounts" - Vishit Chhatrapati

| Pros | Cons |

|---|---|

|

Detailing the features, flow of the application and seamless process |

for my usage, it's working perfectly fine. |

|

Advanced integration with high-end scalability. Invoicing payroll is seamless and prompt, accurate sales report generations. |

The app only comes with a support for IOS and Android. They should expand its usability. |

Contenders | 2023

ProfitBooks is a simple and fastest business online accounting software for small businesses. It lets you create beautiful invoices, track expenses and manage inventory without any accounting background. Read ProfitBooks Reviews

Starting Price: Starting Price: $83.32 Per Year

Recent Review

"Good inventory keeping software" - Markus Schiefer

| Pros | Cons |

|---|---|

|

The software is really straight forward and users are quickly taught in. Dashboards are designed in a clear manner so that you can read the KPI's at first glance |

I have not found any issue with the software. There was once a problem with the report formatting, but the customer service was fast at helping me out. |

|

Innovative modules with the responsive operating system. Taxation management is error-free and time-bound. Web-based development and SAAS based payment system for easy accessibility. |

Lacks good customer support. Need to improve it’s after sale service as well. |

Emergents | 2023

ZipBooks is a very simple and easy-to-use cloud-based accounting software for small businesses. It enables you to streamline your financial operations and increase productivity. You can access all essential accounting, inventory, sales and purchase features. Read Zipbooks Reviews

Starting Price: Starting Price: $69.43 User/Year

Recent Review

"A useful mobile app which makes finance handling as easy as clapping. " - Alexandre Bastien

| Pros | Cons |

|---|---|

|

Better integration and ultra-responsive mobile app. Web-based development and easy installation, straightforward implementation and cost-effective business plan. |

Mobile app needs to be extra responsive. At times, it hangs and becomes too buggy to operate. |

|

Modern integration and well-built. The training provided alongside is also very useful. Cloud-based integration which allows you to have an access to the database around the clock. |

Only one business plan and lack the ability to get customized as per the need. Whatever is there, you can use that much only. |

Contenders | 2023

Billing, Accounts and Inventory Management

HDPOS is a cloud-based accounting system for businesses. It has ease of use and a nice interface. It is also a Windows-based billing and inventory management software that easily installs on a single computer or multiple terminals. Read HDPOS Smart Accounts and Billing Reviews

Starting Price: Starting Price: $18.06 Per Month

Recent Review

"Good software for tuff and intelligent people" - MOHANKUMARSETTY

| Pros | Cons |

|---|---|

|

Billing with images coupons short codes somany reports |

Little bit if I have any doubt not clarifiying |

|

Easy to use and good interface |

They have to work on android app. |

Emergents | 2023

All in one online accounting software for businesses. Myob AccountRight can manage inventory and multiple organization accounts - so you can make sure you handle your business the way you want. Get demo now. Learn more about MYOB

Starting Price: Starting Price: $35 Per Month

Category Champions | 2023

Advanced Accounting Software for your business

MARG is amazingly simple and fastest online Accounting Software for small businesses and it handle multiple customers by allowing to hold current invoice. It is economical and one of the most popular ERP software. It's an complete solution from Purchase planning to Balance Sheet. Read MARG ERP 9+ Accounting Reviews

Starting Price: Starting Price: $112.5 Full Licence/ Single-User

Recent Review

"Beat Application" - Shreeram Upadhyay

| Pros | Cons |

|---|---|

|

Best application for all departmental store and medical store very fast and good app |

Software is very smooth. And very easy to work |

|

Software is so good but ur representative are very unresponsible |

Nothing |

Category Champions | 2023

Sage offers a complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy to use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Starting Price: Starting Price: $50.58 Per Month

Recent Review

"Excellent service" - Lynne Smit

| Pros | Cons |

|---|---|

|

It is easy to use. |

It should accommodate other languages like Afrikaans. |

|

User Interface and ease of usage |

Stable version of applications |

Category Champions | 2023

TallyPrime is one of the leading business management solutions in the world, known for its accounting, stock control, reporting and payroll features. With TallyPrime, you don’t need to pay extra for additional features, which makes it affordable for small and medium businesses. It is used by 2 million businesses worldwide. Read TallyPrime Reviews

Starting Price: Available on Request

Recent Review

"Very best softare in my view but some measure have to be taken in order make it perfect ." - Arpit mishra

| Pros | Cons |

|---|---|

|

It's simple to operate on Tally and it's effective on daily basis use. |

my experience of over two years, I didn't dislike anything. |

|

It helps you manage accounting & payroll. |

It is Not User-Friendly. |

Category Champions | 2023

If you want to search for accounting software online, Vyapar is the simplest, Invoicing, Inventory management & GST-ready software. It's made completely for a businessman; you don't have to waste time learning it. So, start managing your business digitally like before, without accounting knowledge. Read Vyapar Reviews

Starting Price: Starting Price: $39.99 Device/Year

Recent Review

"Review for Vyapar" - Junaid Ahmad

| Pros | Cons |

|---|---|

|

Some additional pros of using accounting software for small businesses include:It can automate repetitive tasks such as invoicing, payments, and reconciling bank statements.It can provide real-time visibility into financial performance, allowing you to make more informed business decisions.It can help you stay compliant with tax laws and regulations by generating the necessary reports and forms.It can also integrate with other software such as point-of-sale systems, making it easy to track inventory and manage customer information.It can save time and increase efficiency by streamlining financial processes and reducing the need for manual data entry. |

It has a learning curve and the initial learning process may take some time, but this may not be an issue for experienced accountants |

|

Experts say |

Skills Development |

Category Champions | 2023

#1 Cloud ERP for Fast-Growing Businesses

NetSuite, the #1 cloud accounting software, is an all-in-one cloud business management solution that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Read Oracle NetSuite ERP Reviews

Starting Price: Available on Request

Recent Review

"Excellent " - HASMUKH PATEL

| Pros | Cons |

|---|---|

|

Easy of Operations, Functionality and last price |

Oracle Purchasing and Inventory Modules, also Hr Module |

|

Easy to use and quite faster. |

I haven't found any cons in this. |

Category Champions | 2023

The Complete Business Management Software for SMEs

Busy is the complete accounting software for small and medium businesses. It has been allowing SMEs across geographies, industry verticals and customer division and distribution and service by helping them manage their business efficiently. Read Busy Accounting Software Reviews

Starting Price: Starting Price: $100 Per Year

Recent Review

"User friendly " - Pawan Sharma

| Pros | Cons |

|---|---|

|

On line services required. |

Trade specific features needs improvement |

|

From the software itself we are in the position of priniting thre payment cheque . |

User Interface can be good |

myBillBook is a simple GST billing & online accounting software designed to help you manage your business operations using mobile or desktop. No prior accounting knowledge is needed to use this software. You can create bills, maintain stock, track payables/receivables, etc. Read myBillBook Reviews

Starting Price: Starting Price: $42.6 Per Year

Recent Review

"Very simple and easy-to-use interface" - Shankar K

| Pros | Cons |

|---|---|

|

It has an amazing reporting section where I can have more than 25+ reports like GST JSON, Monthly, Expense, Monthly Income, Balance Sheet etc.., Other than accounting and billing, It has some very useful secondary features like WhatsApp marketing, payment reminders etc.., myBillBook has helped me save more than 8 hours/week. |

It would be great if they provide more flexibility in Inventory Management |

|

myBillBook is user-friendly, and the billing system is easy to set up and manage. |

NA. I like all the features of this software. no cons can be found in the software |

Until 31st Mar 2023

What is Online Accounting Software?

Online business accounting software, also known as cloud accounting software, helps finance department professionals to manage and take advantage of automated accounting data analysis. The user sends the data to the cloud, which gets processed and then sent back to the user for official use. Online accounting software reduces the hassles of installing and maintaining the software on every desktop.

Cloud accounting systems are subscription-based services where businesses only pay for the space. At the same time, enterprises receive automatic software updates without purchasing any additional software.

Thus, online accounting software significantly reduces the cost of installing and maintaining software across the organization. It also eliminates the time and effort of installation and maintenance. Thus, it provides more convenience and advantages to businesses.

Why Does Your Business Need Online Accounting Software?

In layman’s language, the main benefits of cloud accounting software make the entire financial transactions transparent by keeping a tab on them. The most common and essential features included managing and updating the general company ledger, payments received and paid payroll, and recording modules.

Often additional features are provided as per your need, like – fund bookkeeping for non-profit purposes, claiming for medical purposes, and calculating the extra commissions for sales-based businesses like real estate, brokers, and rate analysis for banks.

Similar to the most valuable personal finance software, it will provide plenty of user-friendly features to deal with all parts of your accounts.

Why is it most preferred? Extra hardware is not needed as it is directly hosted on the Internet. This online accounting software for small businesses requires an active server, has regular backup facilities, and reduces the expenditure cost that can be paid as a monthly or annual fee.

Online Accounting Software vs. Traditional Accounting Software

- Besides the onsite and off-site concepts, there are other noteworthy differences between online and traditional accounting software:

- Online accounting software is undoubtedly more flexible than traditional accounting. In a cloud environment, users can access accounting data from anywhere using any device through the Internet. However, this is not possible in traditional accounting software.

- Financial information is auto-updated in online accounting software. Also, there’s no need to upgrade license fees and maintenance costs. Businesses only renew their subscription contract if and only required.

- Cloud-based accounting software offers financial reporting in real-time. It reduces the chances of human errors, which are more likely to happen from manual data entry, thus providing accurate financial account balances. Contrary to this, real-time reporting is not available in traditional accounting software, which means more time, more effort, and a higher risk of errors.

- Unlike traditional accounting modules, cloud-based accounting software has more extraordinary ability and efficiency in dealing with multi-currency and multi-company transactions.

Crucial Factors That Drive Online Accounting Software

Small businesses can find several accounting software packages, and, at first glance, they all offer similar functionality. So, how do you pick the correct one for your company?

If you're looking for the easiest and best accounting tool for a small business, don't purchase the first package you see with a name you recognize immediately. Here are some of the most significant factors to consider:

-

Cost

Accounting software cost vary depending on several factors, such as functionality and the number of users, but are not usually excessive. It is essential to consider your current needs and what you will need in the future. Some online accounting systems are also priced according to the volume of trades.

-

General Functions

Recall the primary functions you will require at the start of your search. Will you be using it to process payroll, for instance, will you be holding raw materials, parts, or finished products in stock? Keeping basic accounting records is a part of any good accounting system, but they can differ in how they can be used in other ways.

-

Multi Currency Support

A multi currency feature lets you post transactions in foreign currency and your own. Having assets and liabilities in multiple currencies require currency revaluations, so ensure your online accounting solutions support numerous currencies.

-

Scalability

Your online accounting system must evolve with your company. As your business grows, you will likely have more transactions, which will also require a multi-user accounting system.

To expand your business in the future, you must review what upgrades you will require, so you can opt for the subscription at the right time. So, if your business is going to expand in the future, it might be best to check what upgrades you will need

-

Customer Service

A key factor in choosing any software for your business is customer support. When you first begin using a new cloud accounting software, you will require some training and support. If you usually update your accounts on the weekend, you won't be able to use weekday support. Check what kind of service & support are available and when customer service is available.

-

Reporting

In most accounting software, there is a report writer that you can use, but writing reports from scratch takes time. Ensure you inspect what standard reports are there in the system. When you get more familiar with the system, you will be able to easily create your own custom reports. An online accounting system that contains a complete suite of standard reports will save you time and money.

-

User Friendly

The majority of small business accounting packages are straightforward to use. However, there are those that require more technical skills and accounting knowledge. Before buying the best online accounting software, take a demo of the software and read consumer reviews. This cloud accounting software should make your life more comfortable.

What Online Accounting Software Should You Use? And How to Implement It?

While having a list of software is helpful, how do you pick which software is the best for your company? Here are a few things to remember when looking for affordable accounting software for small business owners:

-

Assess Your Needs

Does your business need a platform for inventory management, or are you more concerned with profit and loss statements, sales tax, and receipt tracking? Create a list of your needs and then start shortlisting software that falls into your desired category.

Before researching solutions, decide upon the number of needs your chosen software must meet. List your accounting needs and prioritize them from smallest to most necessary.

Being flexible is a plus. However, if you get distracted by accounting features that solve ten different requirements that you don't need, you often end up spending on the services you don't require.

-

Do Your Research

Even though the features can be appealing, you may end up paying for a lot of stuff you don't need if you are considering software that provides accounting services for global teams. Don't waste your money on worthless components. It would help if you instead thought only about the cloud-based accounting software that satisfies the majority of your prioritized necessities.

-

Shortlist Software

A buyer may require to construct a long list of cloud-based accounting software developed to assist firms in a particular industry before buying. For instance, there are platforms designed specifically for companies in retail, factories, cafeterias, etc.

Despite accounting software's ease of use, it still requires a certain level of financial reporting knowledge. In addition, double entry bookeeping software is often more user-friendly than enterprise software, but it offers fewer features.

-

Keep Your Budget in Mind

When evaluating accounting or bookkeeping software, determine how much you can afford to spend before starting the research phase. If you don't have the budget, don't waste too much time evaluating software that isn't within your budget.

There is plenty of paid and free accounting software for small businesses. However, make it a rule that you will walk away if a solution exceeds 30% of your budget.

-

Ask The Correct Questions

Here are some questions to ask when choosing software:

1. "Will my data be secure, or what security grade do you offer?"

2. "What type of customer support will be there? Are there specific business hours, or is it 24/7/365?"

3. "What other additional costs do I have to pay?"

These questions will help you choose the right provider and save you some bucks.

-

Hold Demonstrations

Companies should demo all products on their shortlist as a rule of thumb. Buyers should be encouraged to ask specific questions about the features they are most interested in during demos. For example, one might question how to operate reports, import financial data from other platforms, or walk one through the features.

Best Online Accounting Software for Small Business

Small business owners can use accounting software to track their expenses, prepare for tax season, and keep track of their finances. Small businesses often choose software over hiring an accountant or a large firm to handle their taxes and payroll, as it is more affordable.

We've gathered a list to make it more comfortable for you to choose the right cloud accounting software for your small business:

1. Zoho Books

Zoho Books can manage a company's finances across the entire association, an end-to-end accounting solution for all sizes of firms. Accounting payable and receivable, payroll, trade management, inventory control, and banking are some of the financial processes automated by the system.

Customers can also securely reserve their payment information for recurring transactions in Zoho Books' client portal, which manages customer and supplier interactions.

Features

- Customizable Invoice Templates

- Online Payments

- Transaction Approval

- Recurring Expenses

- Inventory Tracking

Pros

- It is effortless to roll out to the entire team.

- Streamlined expense reporting.

- Integrating invoicing with the CRM.

- The mobile app allows time-tracking and sends invoices immediately.

Cons

- The integration with other Zoho One modules is unmanageable.

- Certain restrictions within modules make editing transactions difficult.

- Complexness in advanced custom reporting.

Pricing

- Free - $0

- Standard - $15 per month, billed annually.

- Professional. $40 per month, billed annually.

- Premium. $60 per month, billed annually.

2. QuickBooks Online

With Quickbooks Online, you can control all aspects of your business' finances on the internet. It can help you keep track of bookkeeping, payroll, invoice management, reconcile your bank account, track expenses, prepare financial reports, manage taxes, and more.

It does not require any installation or download on the user's end, and users can upload photos of bills for use as expense proofs or share them with concerned stakeholders. They can also download and reconcile credit card transactions.

Features

- Cloud Accounting

- Invoicing

- Online Banking

- Cash Flow Management

- Time Tracking

Pros

- It is effortless to send invoices

- QuickBooks online is fairly easy to use and user-friendly

- Easy to use reports for taxes at the end of the year

- Transparency is ensured by enabling accountants and auditors to access the data at any time

Cons

- QuickBooks online is slow to resolve tech issues

- Customer service needs improvement

- While the premise of bookkeeping cleanup is excellent, the implementation is terrible

Pricing

- Self-Employed - $15 per month

- Simple Start - $25 per month

- Plus - $75 per month

3. Vyapar

With Vyapar, you can easily handle all elements of your corporation's accounting and finances. The software possesses inventory tracking, invoicing, expense reminders, barcode scanning, and more. With Vyapar software, inventory is easily managed and tracked by color, size, expiry date, batch number, serial number, brand name, etc. E-way bills against sales are generated as required whenever required by Vyapar software.

Features

- Inventory Tracking

- Invoicing

- Reporting

- Payment Reminders

- Barcode Scanning

Pros

- Vyapar is user-friendly and can get modified as per your requirement.

- It is extremely affordable for small and medium businesses.

- Vyapar also helps with the easy filing of GST returns.

- No high level of training or accounting knowledge is required to use the app.

Cons

- This software is unable to back up on the cloud or anywhere.

- Customer service needs improvement.

- Vyapar is not available for iOS devices.

Pricing

-

Custom pricing

4. TallyPrime

The TallyPrime business management system is designed to automate on-premise accounting, inventory, compliance, payroll, and other business processes. As well as supporting tasks such as entry management, reminder letters, and bank reconciliation, the accounting module provides a dashboard to track business metrics. Sales track orders, record receivables/payables, and generates invoices and bills.

Features

- Invoicing & Accounting

- Inventory Management

- Insightful Business Reports

- GST/ Taxation

- Credit and Cash Flow Management

Pros

- TallyPrime is straightforward to use.

- It is a splendid application for planning in software development.

- Accounting and billing reconciliation.

- Easy to make journal entries, balance sheets, and income statements.

Cons

- This software has some limited functions.

- It doesn't allow the creation of custom reports.

- It is not cloud computing.

Pricing

-

Custom Pricing

5. FreshBooks

With its strong phone support and customizable invoicing features, FreshBooks is ideal for freelancers and independent contractors who need small business accounting software. Automate your invoicing, accept online payments, and get reimbursed 2x quicker with automatic invoicing. Boost your team's productivity with time tracking and collaboration tools, which keep track of every minute, every file, and every conversation.

Features

- In-App Estimates and Proposal

- Pre-populated Chart of Accounts

- Time Tracking

- App Integrations

- Recurring Payments and Auto-Bills

Pros

- FreshBooks is quite intuitive and user-friendly.

- It is excellent for building & sending invoices.

- Easy implementation & cloud support.

- The templates allow keeping branding professional

Cons

- The app crashes frequently.

- The software becomes slow when there is a large volume of data.

- The mobile app does not work nicely for some features.

Pricing

- Lite - $180 yearly

- Plus - $360 yearly

- Premium - $660 yearly

- Select - Custom pricing

Market Trends of Online Accounting Software

A fast pace of technological development is common in the world of accounting software, and online accounting software providers are always enhancing their solutions to remain pertinent to company owners and accountants. As we approach the year, here are the twelve accounting software trends for 2023 and beyond:

-

Customization As Per Your Requirements

Most of these solutions are agile and allow users to pay only for their services. So if your business needs core accounting and not tracking of sales management, then it would not be included. This benefit is that you don't pay extra charges, only pay for what is used.

-

Electronic Payment Gateways

They offer numerous advantages like online paying off bills and receiving payments. They save time and transport expenses for your customers. The benefit of online receipt generation is that the accounts are maintained transparently without the chances of getting lost or misplaced.

-

SAAS ( Software as a Service)

The SAAS offers many benefits, like the ERP system, CRM (Customer Resource Management), Sales and invoice management, outlet resource management, and financial software. They are highly functional and target large businesses that require all these features. They are multifarious and have diverse functions. This is their main benefit.

-

Remote Access to Financial Data

The user can access financial statements anytime and anywhere with web-based accounting software. He does not require installing the updates or downloading the updated version every time there is a system upgrade.

Because of its web-based platform, such software comes with flexibility as its unique feature. Some online business accounting software also comes with their respective mobile applications, enabling ease of remote access.

-

Real-Time Data Availability

The most common and significant advantage of computerized accounting software is that the data is accessible in real-time. There is no need to update the data manually every time. The reports are prepared considering the latest data information.

All this provides an up-to-date view of the current financial market too. This also makes it easier for enterprises to access real-time financial data as and when needed.

-

Automation

Automation of work always saves time and money in the long term. There is minimal manual interference. Technological advancements relieve the person from executing repetitive tasks. Also, it becomes easy to extract financial reports and complete data analysis speedily.

The accountant is no longer required to prepare ledger and vendor reports every time. For specific repetitive tasks, there are pre-designed formats that can generate results when needed.

-

Ease of Collaboration

A web-based accounting software tool makes it easier for any organization or businessperson to collaborate with his accountant. When given access to the accountant, he can generate reports & when needed without wasting his and your time.

You can also provide restricted access if needed. Also, you can easily integrate web accounting software with other cloud-based software tools for the organization's overall success.

-

Safety & Data Security

A cloud-based system ensures the safety and security of data. Cloud accounting software uses encrypted data to rewrite the information in code language and store it in the cloud. Cloud accounting software can also take your business to the next level. Web accounting software thus offers the following security measures to the user:

1. Secure premises

2. Staff security

3. Off-site automatic backup server

4. Regular security audit

5. High-level digital security software

-

Accuracy of Financial Operation

The computerized accounting software comes with security and automation features, which further ensure the accuracy of financial transactions. All the user needs to do is enter the information in a well-categorized manner.

With proper entry, the user can efficiently manage expenses and extract financial reports quickly and accurately. The user does not require to be well-brushed with accounts formulas to get accurate financial statements. Everything gets done automatically.

-

No Requirement for Installation

There is no need for any separate setup of hardware devices to use and install online accounting software. Everything gets hosted online. Unlike many other software tools that need individual licenses for each computer, computerized accounting software is readily available on a web browser or mobile app.

This also saves money spent on the IT team to do jobs like software upgrades or deal with other technical issues.

-

Ease of Technical Support

Ease of technical support is the prime benefit and reason that drives the need for cloud-based web accounting software. In case of technical issues, the user can contact support at all times of the day from any remote place.

The support is available in any technological format, like chat, telephone, email, and more. This saves them money and time, which people would have otherwise wasted in hiring an in-house IT representative to deal with software issues.

-

Paperless Working Environment

During the traditional days of financial management, people recorded accounting work on paper. But not anymore. With stacks of file and account statements compressed in the form of digital data, the finance department has become almost paperless.

There is no hassle and fear of paper documents getting misplaced, torn, or lost. Also, with a cloud-based accounting software program, the accountants are no longer required to enter the data manually on paper and then transfer it to the system. Everything gets done directly, thus resulting in a reduced risk of manual errors and loss of essential business data to a vast extent

.jpg)

.png)