Best Payroll Accounting Software

Best Payroll accounting software platforms are greytHR, QuickBooks, Sage 50Cloud, Patriot Payroll, PayWheel, and BusinessCore. These systems have an intuitive interface, advanced features, and security issues.

Connect With Your Personal Advisor

List of 20 Best Payroll Accounting Software

Papaya Global is a smart and simple payroll accounting software for managing all types of employment. It offers global payroll management by simplifying payroll processes, integrating existing workflows, and maintaining accurate workforce records. The software is a central platform for managing all the employee-related information in a single view. Read Papaya Global Reviews

Starting Price: Starting Price: $20 Employee/Month

Recent Review

"review of papaya global" - Tehzeeb Raza

Cloud Accounting Software Making Billing Painless

FreshBooks is an easy-to-use payroll accounting software for business owners and accountants of any business size. The platform provides features like professional invoicing, time tracking, project management, automated payments, and other accounting features, such as furnishing tools and reports to monitor the business's health and profitability. Read FreshBooks Reviews

Starting Price: Starting Price: $15.00 Per Month

Recent Review

"FreshBooks: The Simple and Intuitive Accounting Solution for Small Businesses" - Ayoub El Fahim

Contenders | 2023

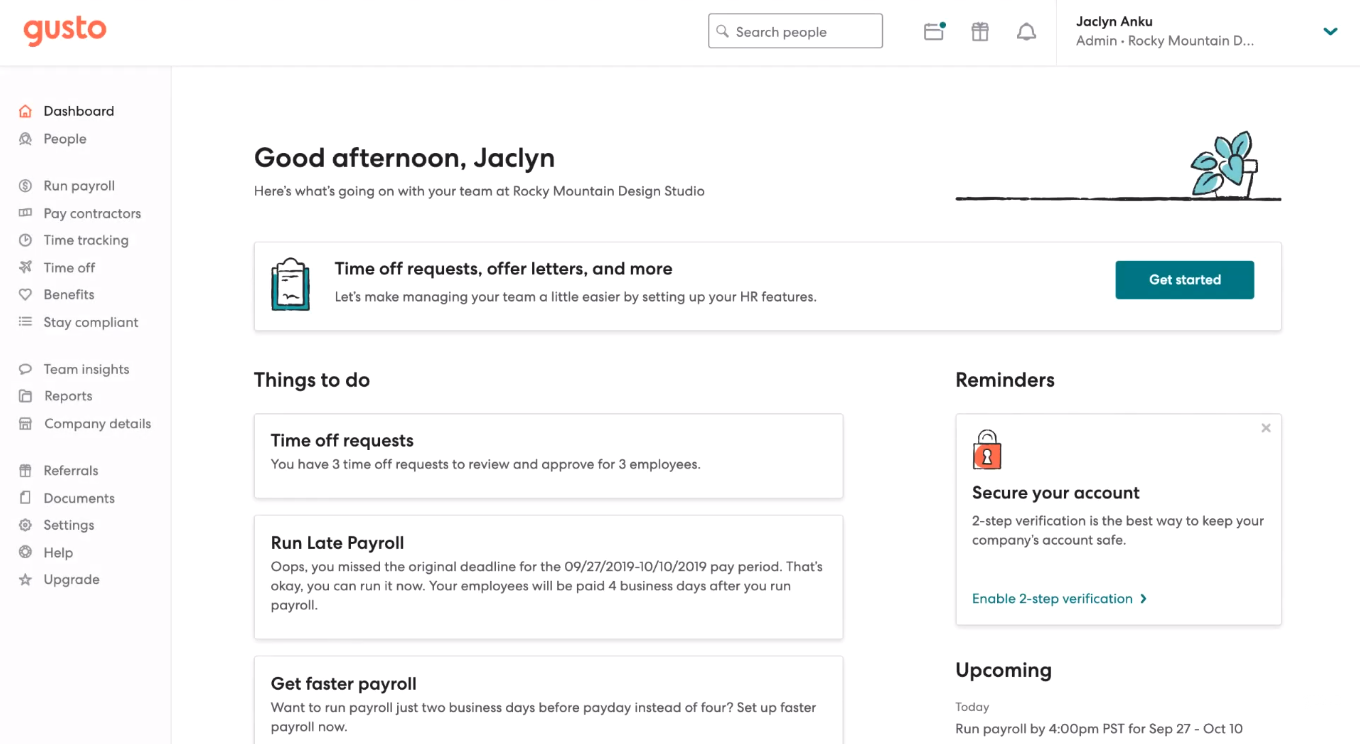

Gusto is an all-in-one payroll software for accountants to help build a successful business and an incredible workplace. It automates payroll, taxes, and HR tasks and helps manage all the employee data, including employee profiles, working hours, paychecks, tax filings, etc. The software also generates insights and reports to help make tough decisions clear. Read Gusto Reviews

Starting Price: Starting Price: $40 Per Month

Recent Review

"Review for Gusto" - Junaid Ahmad

| Pros | Cons |

|---|---|

|

It was dependable, never experienced any problems with payment receipt, and funds were deposited directly into my checking account without any additional costs or expenses. |

It sounds like you had a negative experience with the software, specifically regarding its difficulty of use, lack of effective support, and issues with payment processing. It appears that the support staff were unable to resolve the issue, despite it being described as a major software bug. It also seems that a validation process was causing issues with payment processing. |

|

Ease of set up |

Customer service - live support from the tax compliance department |

Category Champions | 2023

GreytHR is a cost-effective payroll accounting system software to boost the productivity and engagement of employees. It makes the regular chores of HR easier by streamlining and automating HR and accounting processes. GreytHR can be easily accommodated into any business with its end-to-end setup assistance and comprehensive customer support. Read greytHR Reviews

Starting Price: Available on Request

Recent Review

"Good Handy Software for my company" - Amrutha Rao

| Pros | Cons |

|---|---|

|

Easy to use, user friendly and all time avaible, layouts are good, handy |

Mobile app cant be added, nothing more to say, it looks pretty cool, probably i ll think |

|

Leave workflow, attendance tracking, regularisation, analytics and the mobile app. |

Occassionally seeing some minor issues in mobile app - maybe due to our bandwidth also. The new UI is good and please do add more self service tasks in the app |

High Performer | 2023

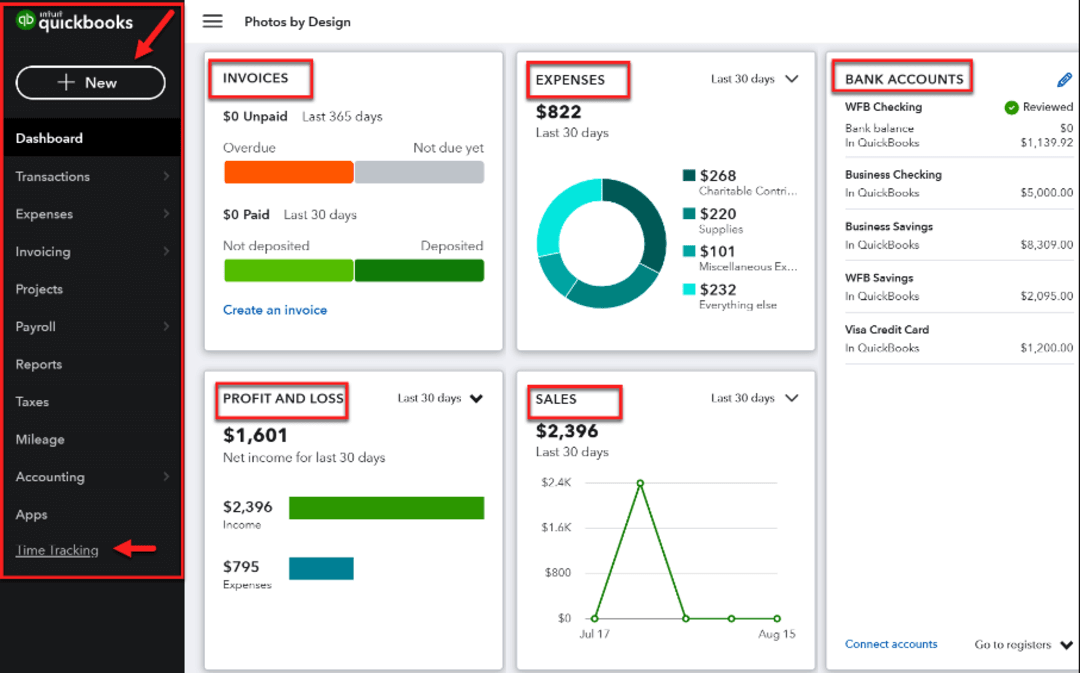

QuickBooks Online is a cloud-based payroll software for accountants to help them stay on top of the game. It helps run an accurate, automatic, and easy-to-use payroll. The software lets you manage everything from one place and handles all monotonous tasks so that you can focus more on the bigger picture. Read QuickBooks Online Reviews

Starting Price: Starting Price: $69.44 Per Year

Recent Review

"Easy to access" - Manisha Garg

| Pros | Cons |

|---|---|

|

Its easy to use |

No cons |

|

Import feature, Export feature, auto suggestion appears while matching and their customization report feature. Their support system is awesome. |

It is not an easy software to learn, you need to have training before using it. Professional accounting base is necessary. Although they provide videos for training. |

Emergents | 2023

Patriot is an easy and affordable payroll accounting software for running quick and seamless payroll. This value-for-money software is known for its free and easy onboarding, accounting software integration, HR integration, time and attendance tracking, accurate tax filing, and many other comprehensive accounting features and capabilities. Read Patriot Payroll Reviews

Starting Price: Starting Price: $17 Per Month

Recent Review

"Best decision in a long time" - Ella

| Pros | Cons |

|---|---|

|

Definitely the ease of use is the most impressive thing about this software. It is very affordable, too. You can't go wrong |

There isn't any feature that I didn't have available to me. My needs for my business were met with this software. |

|

Easy and fast payroll |

There isn't a con that I have found |

OnPay is the best payroll software for accountants and HRs of all industries. It helps get more done in less time with its best-in-class integrations that allow integration with various accounting management platforms like Quickbooks and Xero. The software is a cost-efficient accounting solution for managing all the tedious accounting and HR work. Read OnPay Reviews

Starting Price: Starting Price: $40 User/Month

Recent Review

"Review for OnPay" - Junaid Ahmad

| Pros | Cons |

|---|---|

|

some of the benefits of using online payroll software include convenience, accuracy, and time savings. These types of programs can automate many of the tasks associated with payroll, such as calculating taxes and deductions, and can also provide reporting and compliance features. Additionally, some online payroll software can integrate with other business systems, such as accounting software, which can further streamline the payroll process. |

some areas where payment processing software may need improvement include ease of use, security, and customer support. Additionally, some users may want to see more features or integrations added to the software to better suit their specific needs. |

|

I like it when people call me back and help me with issues that arise |

I really haven’t found anything I dislike about OnPay. |

Rippling is a powerful software for automating payroll and accounting activities. Rippling offers automatic compliance to ensure that your business always complies with relevant forms, laws, and regulations and provides automatic tax filing to local authorities of your employees. The accounting payroll software can be easily integrated with over 400 other apps. Learn more about Rippling

Starting Price: Available on Request

Paychex is a one-stop solution for all your payroll accounting needs. It is the best payroll software for accountants as it is ideal for paying employees, managing human resources, and attracting and retaining employees by offering various benefits. Paychex streamlines the hiring and onboarding process and helps boost productivity with the latest tech automation. Learn more about Paychex Flex

Starting Price: Available on Request

Category Champions | 2023

Xero is an excellent accounting payroll software for small businesses, accountants, and bookkeepers. It syncs all the payroll details and helps with bill payments, expense reimbursement, tax calculations, bank connections, project management, file storage, data capturing, etc. Xero also provides accurate accounting and inventory reports to keep financial health in check. Read Xero Accounting Reviews

Starting Price: Starting Price: $9 Per Month

Recent Review

"A complete solution for the financial management of your company" -

| Pros | Cons |

|---|---|

|

Among its positive aspects I can say that it is easy to use and that Xero has an intuitive and easy to navigate interface.It is also an online software, which means that it can be accessed from anywhere with an internet connection.It also integrates with a variety of complementary applications and services, allowing you to automate accounting tasks and improve efficiency.It also allows you to generate accurate and up-to-date financial reports in real time. |

can be more expensive than some other online accounting software.does not have full inventory accounting handling for businesses with a large volume of inventory. |

|

user friendly powerful |

none |

Category Champions | 2023

Sage50 Cloud is a simple and automated payroll accounting system. It helps save time and money by reducing admin and paying employees accurately and easily. Sage 50Cloud streamlines and automates payroll processes and ensures they are confidently compliant. Its cloud functionality allows you to manage your payroll safely and securely from anywhere. Read Sage 50cloud Reviews

Starting Price: Starting Price: $50.58 Per Month

Recent Review

"Excellent service" - Lynne Smit

| Pros | Cons |

|---|---|

|

It is easy to use. |

It should accommodate other languages like Afrikaans. |

|

User Interface and ease of usage |

Stable version of applications |

Emergents | 2023

SurePayroll is a fully-featured payroll software for accounting firms to manage payroll and accounting tasks more efficiently. The software is fully customizable, easy to set up, and fast to earn. It simplifies payroll management by offering quick tax calculations and filing, automating regular payrolls, and allowing you to manage everything from one place. Learn more about SurePayroll

Starting Price: Available on Request

Paycom is a seamless end-to-end solution for payroll accounting management. It is the best payroll software for accountants to automate the core processes and develop and retain employees by paying them accurately on time and cutting days off the process. Paycom also offers insights to help businesses make informed decisions. Learn more about Paycom

Starting Price: Available on Request

Workday is a cloud-based payroll and accounting software for automating and streamlining payroll operations of the business of all industries. The accounting payroll software is a unified platform to keep HR, payroll, and time in sync, and it also provides real-time insights into payroll data, so you can act on what you see. Read Workday Reviews

Starting Price: Available on Request

Recent Review

"Best of for small business and departments" - Abu Zar

| Pros | Cons |

|---|---|

|

One click searching system. |

I found everything good in my knowledge. |

|

Workday is easy to use and I did not require any help in setting up my profile |

I did not really find any significant problems in using the system, however would prefer better customer care. |

SBS is one of the most sought-out Payroll service provider globally loved by small, medium, and large businesses. We have helped various businesses across India and abroad in automating their payroll, staying compliant, and delighting their People. Read SBS HR Reviews

Starting Price: Starting Price: $97.21 Upto 100 Employees

Emergents | 2023

PenSoft Payroll is a brilliant payroll accounting system that can handle complex payroll requirements easily. It offers payroll services solutions such as payroll processing, tax calculations, employee management, and more to streamline processes and save time. Pensoft is fully flexible and can be customized as per the needs of the business. Read PenSoft Payroll Reviews

Starting Price: Available on Request

Recent Review

"A sophisticated software to reduce the admin and management work." - Om Suthar

| Pros | Cons |

|---|---|

|

with the help of customer support and experience you will totally love this software. It is highly efficient and very affordable. |

I found it little high on price. For a small business like mine wont be able to afford it. |

|

Very helpful software to manage the hr functions and payroll. Reduced a lot of hectic human efforts. |

using it for more than a year but didn’t find any negative factor about it |

Brightpay payroll software for accounting firms makes payroll management quick and easy. Its extensive features, like automated cloud backup, online employer dashboards, leave management, payroll submission and approval, and an employee self-service portal, reduce errors and saves time. Brightpay also integrates with other accounting applications to offer complete payroll solutions. Read Brightpay Reviews

Starting Price: Starting Price: $131.04 One Time

Recent Review

"A must-have tool for your business" - Binal Pandya

| Pros | Cons |

|---|---|

|

All the features of Brighpay have only one motto- “To ease down the overall operation”. Whether it is payroll management of employee management, it does it all for you at an affordable cost. |

So far, I am highly satisfied with its viability. |

|

I could maintain clean employee records with the help of Brightpay software. It is a supportive software which has increase the productivity of my small business |

A flawless software with zero negative factor . Couldn’t get anything as such |

Kashflow is a cloud-based payroll software for accountants to help easily manage their business accounts. Its easy-to-use functionality is ideal for small and large businesses, and its on-the-go access lets you view everything from anywhere. It offers features like automated payroll approval and payslip generation to help cut down workload. Read Kashflow Reviews

Starting Price: Starting Price: $9.24 Per Month

Recent Review

"Accounts review" - Linda Robinson

| Pros | Cons |

|---|---|

|

Easy to use, straightforward instructions |

You cannot always get all the reports that you want or need |

2GrowHR is a simple and secure payroll accounting software designed to help businesses of all sizes with their payroll processes. It aids in managing salary structure, bonuses, incentives, deductions, and investments of employees and offers tools for creating reports, generating forms, and managing employee data. Read 2Grow HR Reviews

Starting Price: Available on Request

Recent Review

"Overall performance" - Prasad KS

| Pros | Cons |

|---|---|

|

Seamless integration with third party software in pharma |

Little improvement is required on performance management system. |

Emergents | 2023

OneStop Accounting is a user-friendly and customizable accounting payroll software for the monthly computation of your employees' salary, generating pay slips, and analyzing salary reports. OneStop Accounting can be accessed from anywhere, making it ideal for remotely working businesses and is perfect for any business size. Read One Stop Accounting Reviews

Starting Price: Available on Request

Recent Review

"One Stop Accounting & Invoicing Software" - Ssndeep

| Pros | Cons |

|---|---|

|

One Stop Accounting Software is Cloud-based so can be accessed anywhere on any device. And it is quite affordable. |

Still working on some of the features. |

Until 31st Mar 2023

What is Payroll Accounting Software?

Software that automates the process of computing and handling employee payrolls, taxes, and other deductions is known as payroll accounting software.

By keeping track of employee hours, figuring payroll taxes, producing paychecks and direct deposit payments, giving reports, and ensuring compliance with legal requirements, it aids businesses in managing their payroll operations. Additionally, the software can automate the payment of taxes and other deductions.

A payroll system can be coupled with other HR platforms for performance management, benefits administration, and employee onboarding. Payroll software for bookkeepers enables businesses to have a comprehensive and unified HR system, improving the accuracy and efficiency of the HR and payroll processes.

Overall, payroll accounting software saves businesses time and money by automating time-consuming, repetitive operations, lowering the possibility of errors, and assuring regulatory compliance. This enables businesses to concentrate on other crucial HR and business processe

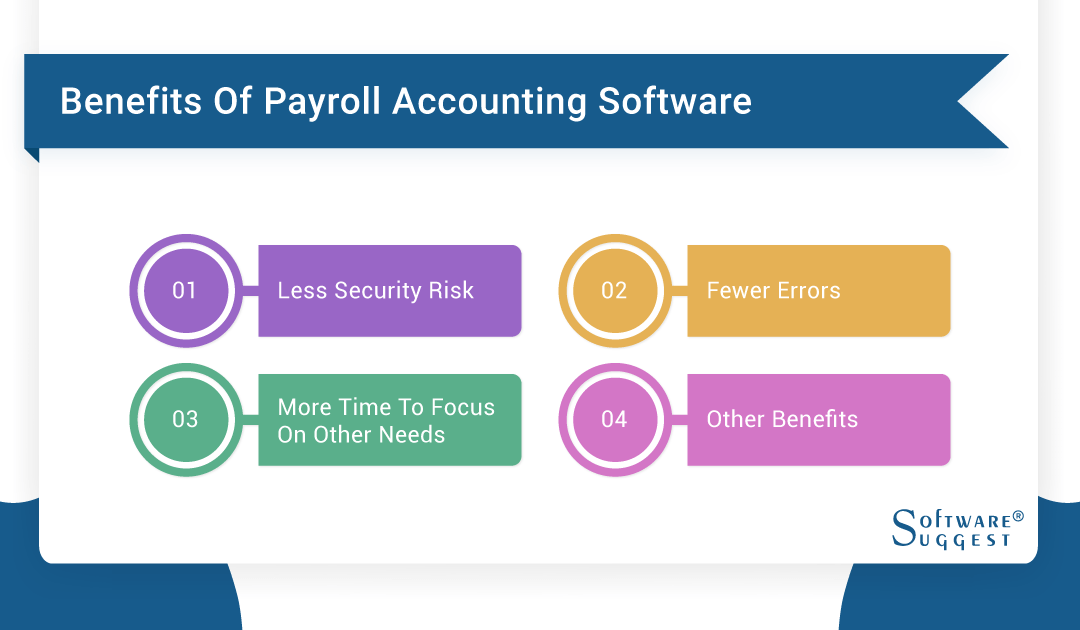

Benefits of Payroll Accounting Software

Payroll accounting software provides many benefits to a business that can help them improve accuracy and saves a lot of time and effort by automating manual tasks and reducing human efforts.

-

Less security risk

Payroll accounting software helps in reducing security risk by offering secure and encrypted storage of sensitive employee and financial information, reducing the risk of data breaches and unauthorized access.

The software can also automate many of the manual processes and tasks involved in payroll accounting, reducing the chance of errors and improving accuracy.

Moreover, many payroll accounting software comes with built-in security features, such as password protection and audit trails, to help ensure the safety and integrity of sensitive data.

-

Fewer errors

The ability of payroll accounting software to considerably lower the risk of errors in payroll processing is one of its advantages. The software automates many tedious calculations and procedures in payroll accounting, lowering the possibility of human error. The software can also be configured to enforce compliance with tax rules and regulations, lowering the likelihood of compliance mistakes.

Due to the software's ability to produce thorough reports and audits of payroll activities, using payroll accounting software can also make it simpler to spot and reduces the problems of payroll accounting software.

All things considered, using payroll accounting software can assist assure accurate and effective payroll processing while lowering the danger of errors and expensive blunders.

-

More time to focus on other needs

Businesses can use the extra time they have with payroll accounting software to focus on other crucial facets of their operations.

The program liberates significant time and resources that can be used to focus on other priorities like employee development, customer service, and business growth by automating the manual tasks involved in payroll processing.

Businesses can concentrate on their core strengths and objectives thanks to this greater efficiency, which will ultimately result in higher output.

-

Other benefits

Compliance enforcement: The risk of compliance errors can be decreased by programming the software to enforce compliance with tax rules and regulations.

Secure data storage: Sensitive financial and staff data are securely stored using the program, lowering the possibility of data breaches and unwanted access.

Detailed reporting: The software can offer thorough audits and reports of payroll transactions, making finding and fixing mistakes simpler.

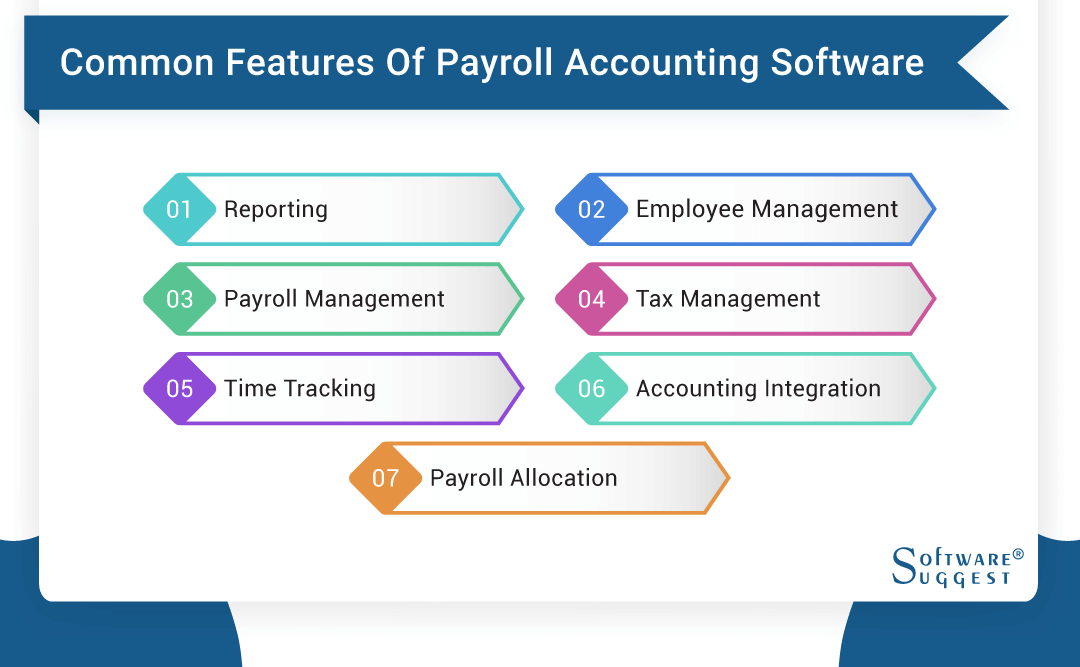

Common Features Of Payroll Accounting Software

Before selecting any payroll accounting software, you need to analyze which features you require for your business. Below are the main features of advanced payroll solutions for accountants.

-

Reporting

Software for payroll accounting generally includes reporting capabilities. Businesses may generate thorough reports on payroll activities, including payroll reports, employee earnings reports, tax reports, and other relevant data, because of the reporting features of accounting payroll software.

These reports can aid with compliance and tax reporting obligations as well as significant insights into payroll data, such as employee salaries and deductions. Additionally, the software frequently offers configurable reporting capabilities, enabling companies to design reports that precisely suit their requirements.

The reporting function can assist companies in locating patterns, inefficiencies, and mistakes, facilitating the use of data-driven decisions and the enhancement of payroll procedures.

-

Employee management

Another typical function of payroll accounting software is employee management. This component often consists of instruments for managing and monitoring employee data, including personal and salary data, time off requests, and benefit details.

Tools for managing and automating the payroll process, including the determination of payroll taxes, deductions, and benefits, may also be provided by the software. The capability for generating and maintaining employee schedules, monitoring attendance, and handling time off requests can all be included in the personnel management module.

The software can assist in streamlining and simplifying the payroll process by centralizing and automating many of the duties associated with employee management while offering insightful information about employee data.

-

Payroll management

Payroll accounting software enables businesses to run their payroll efficiently and accurately. It automates the calculation of employee salaries, taxes, and benefits based on predefined payroll rules and regulations.

The software also offers direct deposit as a payment option and automatically calculates and files taxes according to local, state, and federal laws. Additionally, the software supports payroll processing in multiple currencies and allows for the automatic deduction of court-ordered garnishments and other authorized deductions from employee paychecks.

The software also provides a comprehensive payroll history and the ability to generate and customize payroll reports based on specific business needs. The integration with time and attendance systems ensures that hours worked are accurately calculated for payroll purposes. Overall, accounting payroll software streamlines the payroll process, reducing errors and saving businesses time and resources.

-

Tax management

Using payroll accounting software greatly simplifies tax management, a critical component of payroll accounting. The payroll accounting software program ensures that businesses comply with tax laws by automatically calculating and filing taxes in accordance with local, state, and federal legislation.

Additionally, the software enables the handling of numerous tax documents, including W-2s and 1099s, and computes payroll taxes such as the federal income tax, Social Security tax, and Medicare tax automatically.

In order to ensure proper tax calculation, the program can also manage multiple payroll tax tables and give up-to-date tax information. Businesses may readily monitor their tax liabilities and make educated decisions if they have the ability to generate tax reports. In general, payroll accounting software makes tax management simpler and aids in keeping firms in compliance with tax laws.

-

Time tracking

Time tracking is a common feature found in Payroll Accounting Software. Employers can use this tool to track and record the duration of each employee's shift, including lunch breaks, overtime, and start and end hours. The total number of hours worked is then determined using this data, and each employee's paycheck is generated correctly.

Additionally, time monitoring can assist businesses in adhering to labor rules and regulations, such as those governing minimum wage and overtime pay. Employees can clock in and out using a time clock or a mobile app because many accounting payroll software solutions interact with time and attendance systems. This simplified method of timekeeping reduces errors and guarantees precise payroll computations.

-

Accounting integration

Accounting integration is another common feature found in Payroll Accounting Software. This function enables smooth integration with an organization's current accounting software, such as QuickBooks or Xero.

Companies can increase the accuracy of financial reporting, streamline their financial procedures, and lower the risk of data duplication and error by connecting their payroll and accounting software.

Accounting integration enables the general ledger to be automatically updated with payroll information, such as employee salaries and deductions, which eliminates the need for human entry and saves time.

Furthermore, many payroll accounting software programs can export payroll information straight into the company's accounting system, eliminating the need for manual data entry and enhancing the accuracy of financial reports. Organizations are now able to see all of their financial data in one place and make well-informed business decisions.

-

Payroll allocation

Payroll allocation is a useful feature found in many Payroll Accounting Software solutions. Organizations can use this tool to distribute payroll costs to particular projects, cost centers, or departments. This makes it easier for businesses to deploy resources wisely and track and understand the costs related to their payroll.

Payroll allocation enables businesses to better understand their labor expenditures and make budgetary and staffing decisions. By precisely tracking and reporting payroll expenses, this function can also assist organizations in adhering to rules and reporting specifications.

Numerous payroll accounting software alternatives include adaptable payroll allocation options, enabling businesses to divide costs in accordance with pre-established formulas, user-defined criteria, or personalized settings. With the aid of this tool, businesses can more precisely distribute their payroll expenses, enhancing their financial planning and administration procedures.

Considerations While Selecting Payroll Accounting Software

There are many aspects that organizations need to consider before investing in a payroll accounting system. Below are the factors you need to consider when selecting payroll accounting software.

-

Do you need full-service payroll?

One of the most important considerations while selecting payroll accounting software is whether full-service payroll is required. Full-service payroll means the software provider takes care of all aspects of payroll processing, including tax calculation and filing, direct deposit, and other payroll-related tasks.

This can be convenient for small businesses that do not have the resources to handle payroll in-house, but it may also come at a higher cost. On the other hand, if a business has the resources to handle some payroll tasks in-house, self-service payroll software may be a more cost-effective option.

-

Pay attention to the UI and workflow

Another important consideration while selecting payroll accounting software is the user interface (UI) and workflow. The software should have an intuitive and easy-to-use interface that allows you to quickly and efficiently process payroll. A well-designed UI and workflow can also help reduce errors and improve overall efficiency.

Additionally, it's important to ensure that the software integrates well with your existing accounting and HR systems, if you have any, for seamless data transfer and minimal manual effort. Before making a decision, take advantage of free trials or demos to test the software and see how it fits your business needs and processes.

-

Ask an expert

Seeking advice from an expert is also an important consideration when selecting payroll accounting software. An accountant, software consultant, or payroll expert is an example of this. They can help you find the ideal solution for your company's needs by offering insightful information about the features and capabilities of various software solutions.

They can also offer advice on crucial issues, including compliance, security, and data protection. You can make an informed choice and ensure that the software you select will satisfy your current and future payroll requirements by asking an expert for advice.

5 Best Payroll Accounting Software For Your Business

We have picked out the five best payroll software to simplify your decision process. You can compare the platforms based on their features, pros and cons, and pricing.

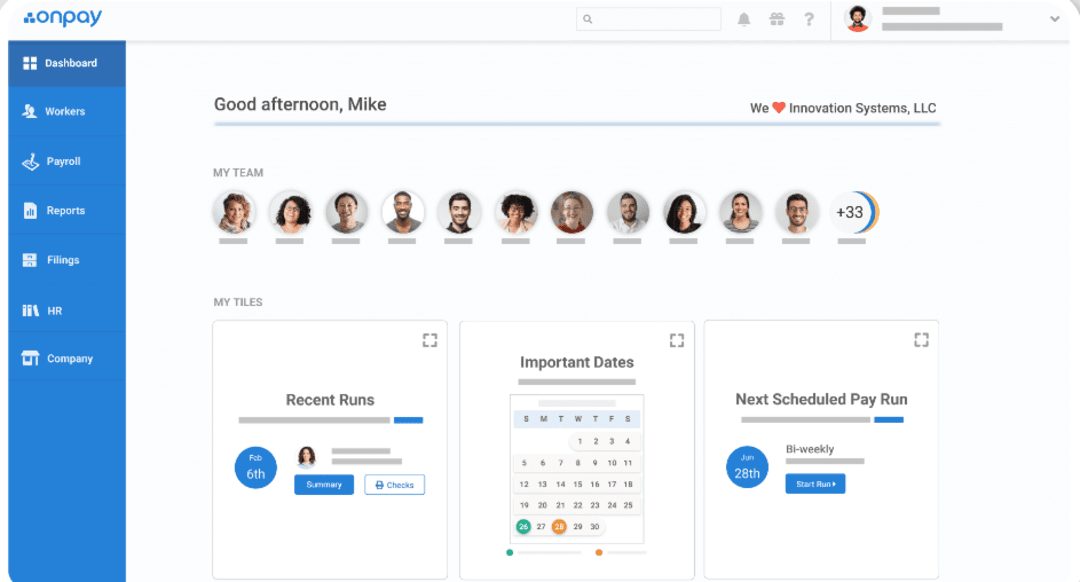

1. OnPay

OnPay is one of the best payroll programs for accountants. It provides a complete solution for payroll processing, including tax calculation and filing, direct deposit, and other payroll-related tasks. The software offers a user-friendly interface and intuitive workflow, making it easy to process payroll and manage employee information.

Features

- Payroll Processing

- Time Tracking

- Tools to manage employee benefits

- Employee self-service portal

- Compliant with federal and state payroll regulations

- Integrates with popular software

- User-friendly interface

Pros

- User-friendly interface

- Comprehensive payroll management

- Affordable pricing

- Integration with other systems

Cons

- Limited features

- Limited support options

- Occasional system outages

Pricing

- Small Business Plan: $36 per month plus $4 per employee per month

- Growing Business Plan: $72 per month plus $4 per employee per month

- Enterprise Plan: Customize pricing

2. QuickBooks Payroll

QuickBooks Payroll is a comprehensive and user-friendly payroll software for accountants that can help streamline their payroll processes and improve efficiency. Intuit, the maker of QuickBooks accounting software, offers the solution. It is designed to help small businesses simplify and streamline their payroll processes.

Features

- Payroll processing

- Tax compliance

- Integration with QuickBooks

- Employee self-service

Pros

- Affordable pricing

- Easy integration

- Tax compliance

Cons

- Limited support options

- Occasional software bugs

- Dependence on QuickBooks

Pricing

- Core Plan: $45 per month plus $4 per employee per month

- Premium Plan:$75 per month plus $8 per employee per month

- Elite Plan: $125 per month plus $10 per employee per month

3. Gusto

Gusto is a cloud-based payroll software for accountants and small business owners. Gusto provides a comprehensive range of payroll services, including payroll processing, tax compliance, and employee benefits management.

Features

- Payroll processing

- Benefits management

- HR management

- Tax filing

- Time tracking

- Access to mobile app

- 24/7 customer support

Pros

- Simple and intuitive interface

- Automated processes

- Compliance assistance

- Integration with other apps

Cons

- Limited customization

- Expensive than some other payroll solutions

- Limited international coverage

- Limited HR features

- Technical issues

Pricing

- Basic Plan: $45 per month plus $6 per employee per month

- Complete Plan: $39 per month plus $12 per employee per month

- Concierge Plan: Customized pricing

4. RUN Powered by ADP

RUN Powered by ADP is a cloud-based payroll and HR platform designed specifically for small businesses. The platform is part of ADP, a leading human capital management solutions provider. It is also highly automated, reducing the time and effort required to manage payroll and HR tasks.

Features

- Payroll Processing

- HR Management

- Automated tax filing

- Employee self-service

- Access to mobile app

- Provides 24/7 support via phone, email, and live chat

Pros

- User-friendly and intuitive interface

- Automated Processes

- Compliance assistance

- Employee self-service

- Access to mobile app

Cons

- Limited customization

- Expensive than some other payroll

- Limited international coverage

- Limited HR features

- Technical issues

Pricing

- Basic Plan: $45 per month plus $4 per employee per month

- Enhanced Plan: $70 per month plus $8 per employee per month

- Full Service Plan: Customized Pricing

5. SurePayroll

SurePayroll is a cloud-based online payroll software for accountants and small businesses. It provides an easy-to-use platform for businesses to manage their payroll processes, including tax calculations, direct deposit, and compliance with HR regulations.

Features

- Payroll Processing

- Automates tax filing and payment

- Employee self-service

- HR management tools

- Access mobile app

- Customer support

Pros

- User-friendly interface

- Automated processes

- Compliance assistance

- Employee self-service

Cons

- Limited customization available

- Expensive than some other payroll solutions

- Technical issues

- Limited HR features

Pricing

- Basic Plan:$39.99 per month plus $4 per employee per month

- Full-Service Plan: $109.99 per month plus $4 per employee per month

Cost of Payroll Accounting Software

Cost is an important consideration that organizations need to keep in mind before investing in payroll accounting software.

The payroll software cost varies depending on the features, size of the company, and the number of employees. Some payroll software providers offer free or low-cost solutions for small businesses, while more comprehensive solutions for larger businesses can be more expensive.

Conclusion

So, basically, payroll accounting solutions are software systems designed to help businesses manage their employees' payroll and related expenses. These solutions automate many of the time-consuming and repetitive tasks associated with payroll, such as calculating paychecks, withholding taxes, and filing payroll tax returns

.png)