Best Taxation Software in India for CA and Business Professionals

Best-used taxation software includes Taxadda, Taxmanns One Solution, TurboTax, and Cleartax. It is used by companies, firms, and individuals. These tools are helpful in calculating financial transactions and filing tax returns for various categories.

Connect With Your Personal Advisor

List of 20 Best Taxation Software

Category Champions | 2023

Online Accounting Software for Growing Businesses

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Starting Price: Starting Price: $10.4 Organisation/Month Billed Annually

Recent Review

"Zoho Bookings Schedule Good Timming" - JADAV PRAVIN

Bitcoin and cryptocurrency tax calculator that makes generating tax reports super easy. Simply connect your accounts & wallets via API or CSV files and let Koinly calculate your capital gains. Supports Form 8949, K4, Schedule C & many others. Learn more about Koinly

Starting Price: Available on Request

Category Champions | 2023

TallyPrime is India’s leading business management software for GST, accounting, inventory, banking, and payroll. TallyPrime is affordable and is one of the most popular business management software, used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Starting Price: Available on Request

Recent Review

"Very best softare in my view but some measure have to be taken in order make it perfect ." - Arpit mishra

| Pros | Cons |

|---|---|

|

It's simple to operate on Tally and it's effective on daily basis use. |

my experience of over two years, I didn't dislike anything. |

|

It helps you manage accounting & payroll. |

It is Not User-Friendly. |

Category Champions | 2023

The Complete Business Management Software for SMEs

An integrated bussing accounting and management solution, BUSY is a one-stop solution for your financial and payroll needs. It offers multi-location inventory, multi-currency support, order processing capabilities, and helps you make informed decisions. Moreover, it is best suited for the FMCG, retail, manufacturing, trading, and distribution businesses. Read Busy Accounting Software Reviews

Starting Price: Starting Price: $100 Per Year

Recent Review

"User friendly " - Pawan Sharma

| Pros | Cons |

|---|---|

|

On line services required. |

Trade specific features needs improvement |

|

From the software itself we are in the position of priniting thre payment cheque . |

User Interface can be good |

Category Champions | 2023

ClearTax is providing a complete solution and free trial of taxation with expert support and freelancer for the business to guide how to save money and time. Income tax return e-filing, GST, GST compliance software, etc modules are inbuilt. ClearTax is a leading invoicing and billing software that lets you create business invoices compliant with GST regulations. It even lets you file GST returns with a single click. ClearTax also identifies errors in documents before uploading them to the GSTN portal. Thus, reducing penalties while filing taxes. Read ClearTax Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

Clear tax delivers almost everything it promises. infact the price as well is very competitive and there are tons of features. |

Only thing which i found lacking is the integrity of the software when you need it the most. During the deadline times the software practically is difficult to use due to heavy usage from all clients. |

|

Most impressive is its usefulness and also customer care support. Fast updates which can compete with department site or notifications. Reports are wonderfull |

They should bring down renewal pricing. |

Category Champions | 2023

Sage offers a complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy to use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Starting Price: Starting Price: $50.58 Per Month

Recent Review

"Excellent service" - Lynne Smit

| Pros | Cons |

|---|---|

|

It is easy to use. |

It should accommodate other languages like Afrikaans. |

|

User Interface and ease of usage |

Stable version of applications |

Category Champions | 2023

Billing, accounting and inventory software

Acme Insight is comprehensive software, specifically made for the Retailers, Wholesalers, and Distributors by considering all the complexities of their business. Varied types of useful reports and customer relationship management modules that leads your business growth. Best for electric industry tools. Read Acme Insight Reviews

Starting Price: Available on Request

Recent Review

"The best software for managing daily operations" - Supriya Verma

| Pros | Cons |

|---|---|

|

User rights with password and reported download and sharing in different formats. Attributes needed can be added or deleted in final output. |

Inventory management for Bundle items can be added and integration with tally or third party software for accounting can be initiated. |

|

Its Report section and download option which is very easy and descriptive. Can be integrated with the third-party application as well. |

The offline version and Invoice module can be updated. As per prevailing GST-based and zero tax or can be user-oriented customization for the theme of the billing. |

Contenders | 2023

Spectrum ( A Completed Tax Compliance Software 360? Solution ) is a combination of Income Tax Auditor Edition, e-TDS, Document Manager, Project Report / CMA, Form Manager and e-AIR Read KDK Spectrum Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

nothing |

customer service must |

|

nothin |

everything including updates, customer care, value for money everything is nil |

Category Champions | 2023

Best Income Tax, TDS, Audit, CMA Taxation software

EasyOffice is India's Best Taxation Software to file your Income Tax Returns, TDS returns and Audit Reports easily. EasyOffice Software meet all sorts of Taxation compliance. Trusted by Thousands of Chartered Accountants , Tax professionals & Corporate users. Read EASYOFFICE Reviews

Starting Price: Starting Price: $34.72 Per Year

Recent Review

"Easy as it's name" - Kashmira Thakkar

| Pros | Cons |

|---|---|

|

Updated software with very good features |

No |

|

Providing best professional softwares for accounting and taxation in comparative low prices than others and with easy user interface and providing quick customer support during normal working hours of chartered accountants. Happy to use software. |

Software must be cloud based so that information can be accessed from any computer by login username and password or OTP verification. |

Category Champions | 2023

Smart & Easy TDS Software for Preparing TDS Return

TDSMAN is a utility software for preparing TDS Returns in electronic format as per the guidelines of the Income Tax Department. With its default detection techniques, it helps in preparing Zero-Error TDS Returns. It is available in two editions - Standard & Professional. TDSMAN is a subscription based software and needs to be renewed every year. Read TDSMAN Reviews

Starting Price: Starting Price: $62.5 + GST @ 18%

Recent Review

"TDSMAN software review" - Pakshal Parmar

| Pros | Cons |

|---|---|

|

The return filing features are good, it auto calculates interest and also helps in generating challans for payment.2. Also generation of Form16/ Form 16A with DSC is a smooth process |

In case of huge data, the software becomes slow the processing time is more in case of more than 2500 line entries. Also, PAN Verification is a very time consuming process |

|

Ease in tds compliance with help of these software |

Take time in report generation, import export of data is also time consuming |

Emergents | 2023

Gen GST Software is a complete package for GST e-filing & Billing, which comes with many high-end features and functionality, intended for generating GST bills, the smoother filing of GST, storing data along with attractive UI. Read Gen GST Reviews

Starting Price: Starting Price: $69.44 Per Year

| Pros | Cons |

|---|---|

|

As of now nothing is impressive of GEN GST. |

Entire Software. |

|

NOT WORKING PROPERLY AND NOT SUPPORT |

SUPPORT |

Contenders | 2023

Saral TDS is the software for electronic filing of TDS and TCS returns as per the provisions of Income Tax Act. With thousands of customers throughout India, It has been the proven best eTDS Solution for the eReturns. Read Saral TDS Reviews

Starting Price: Available on Request

Recent Review

"A must-have software for TDS and TCS returns" - Dan DANG

| Pros | Cons |

|---|---|

|

Totally value for money. Saral TDS software is very well designed. |

It is a perfectly infused with superb features. I would recommend it to all my friends |

Category Champions | 2023

100% FREE Online IT Filing Portal

The Easiest and Comprehensive IT Filing portal in India to Plan, File, and Save on Taxes. 7 minutes to complete eFiling available both on App and Web. India's 1st Form16 photo reader and Tax Optimizer. Visit EZTax.in to know more! Read EZTax Self Service IT Filing Reviews

Starting Price: Available on Request

Recent Review

"Easiest Income Tax Filing portal - I recommend " - Amit

| Pros | Cons |

|---|---|

|

Very easy, excellent interface, help for every field, great support .. and it’s Free.. we filed for 3 years in a row .. the portal is so good that it gives us Tax Optimizer report to plan for next year. |

I been filing my taxes for last 10+ years .. initially with tax consultants, later with other portals... There is nothing that I know off .. if there is one .. the form 16 image reader may not read the content in the 1st time. |

|

Easy to understand language. Good number of unique features like tax optimisation, help windows, instant calculation. |

None .. compared to others eztax.in seems to be good |

Emergents | 2023

Spectrum is a combination of Zen Income Tax Auditor Edition, Zen e- TDS, Zen Service Tax, Zen Document Manager, Zen Project Report / CMA, Zen Form Manager & Zen e- AIR. Read Spectrum Gold Reviews

Starting Price: Starting Price: $212.5 Per Month

Recent Review

"Simple and easy user friendly Software" - Manvendra Singh Bhati

| Pros | Cons |

|---|---|

|

user friendly powerful |

none |

|

The interface is very friendly. And the auto-filling feature creates a good impression |

Little complex in multi-user. Sometimes the bugs and update took to much time. |

Category Champions | 2023

XaTTaX (GST filling and reconciliation solution)

XaTTaX (GST filing and reconciliation solution) is a simple and accurate complete GST software with great user interface for all type of enterprises in India. It offers a multi-layered security mechanism, which implies that whatever transactions you process are 100% secure. Read GST Software - XaTTaX Reviews

Starting Price: Starting Price: $138.89 One Time

Recent Review

"Best GST software" - Sruthi N

| Pros | Cons |

|---|---|

|

Very useful, easy to use and time saving |

I havent faced any issue till now |

Contenders | 2023

Our Expertise in the wide range of business applications in Multi-Tier distribution Architecture and Mobile device provided innovatively and quality IT products and solution to help implementation of the agile, integration system and process that will help the business continue to grow. Read Focus ERP Reviews

Starting Price: Starting Price: $694.44 Onetime

Recent Review

"Very robust software" - Paresh Bhogi

| Pros | Cons |

|---|---|

|

The regular plan of this software is highly cost-effective and useful. We can easily do financial accounting, sales and marketing and HR & Payroll activities without any hassle and error. The report generation is prompt and accurate. |

They could improve the user interface |

|

Imagine how easy would the workflow management when you can assign the task as per the ability and availability of your manpower? Well, it is what Focus ERP does. It really helps you to focus on the productivity and revenue generation of you firm. |

It doesn’t come with window phone support |

Contenders | 2023

A revolutionary HR Payroll Management system that promises to take the pain out of HR Department. PayCare is a part of Intelliob Accord family of Enterprise Resource Planning (ERP) Framework. Read PayCare Reviews

Starting Price: Available on Request

Recent Review

"Well configured software useful for all platforms. " - David Pelster

| Pros | Cons |

|---|---|

|

It is easy to use, we just configured it with time, and attendance & leave policy of our company and it start responding at its earliest. It is good to secure all the time related data. It's simpler monthly and onetime payment option makes it accessibilit |

Not supportive of any of the mobile platform (iOS, Android, WinPhone, BlackBerry) |

|

Convenient to use and highly efficient attendance management software used to cater all the requirements of companies for keeping employee leave and attendance reports. It not only maintains the secure but also saves it for longer accessibility. |

Not helpful for personal level set-up. |

Contenders | 2023

CAMS Exact Indirect Taxation (GST) Solutions

CAMS-Exact India Indirect Taxation Solutions are available for CGST, SGST, IGST, UTGST, Cess, GST Compliance. CAMS is ASP (Application Service Provider) for Filing GST Returns. Read CAMS Exact Indirect Taxation Solutions Reviews

Starting Price: Available on Request

Recent Review

"Least time consuming and accurate accounting " - Harish Shukla

| Pros | Cons |

|---|---|

|

CAMS-Exact is the best to use GST software, the helped us with long GST procedures and make them easier and hassle-free. The convenient software caters all the requirement of GST filing and makes them least time-consuming. |

The wide-ranging features have no relevance for personal set up. |

|

We people are totally naïve and confused about GST, filed wrong many ties then we get to know about it 3 months ago and have been using it since then. It is a feasible app with adequate features. Its simplified use makes it enough support. |

Not accessible through Macintosh, or Web App platform. |

Contenders | 2023

Visual Udyog Automation allows SMEs to streamline their business processes, reduce costs, improve productivity, leverage industry best practices, stay compliant with tax rules and procedures and more informed decision making. Read Visual Udyog Reviews

Starting Price: Available on Request

Recent Review

"Very easy to access" - Bansidhar Agna

Emergents | 2023

We know Small to Medium businesses are the backbone of India’s economy; we know business isn’t easy, and we really admire each and every business owner for taking on the risks and challenges of everyday business. Read SMART PAYROLL Reviews

Starting Price: Starting Price: $277.76 Per Unit

Recent Review

"About SMART PAYROLL SYSTEM" - Shrikant Kulthe

Until 31st Mar 2023

What is Taxation Software?

A taxation software is a computer software meant for helping individuals, firms, and companies in tax preparation and filing returns for various types of taxes ranging from income tax, corporate tax, VAT, service tax, customs as well as sales tax. The tax filing software simplifies for you the process of filing taxes by systematically walking you through all the tax forms and guiding you through various issues, and subsequently, it accurately and automatically calculates all your tax obligations.

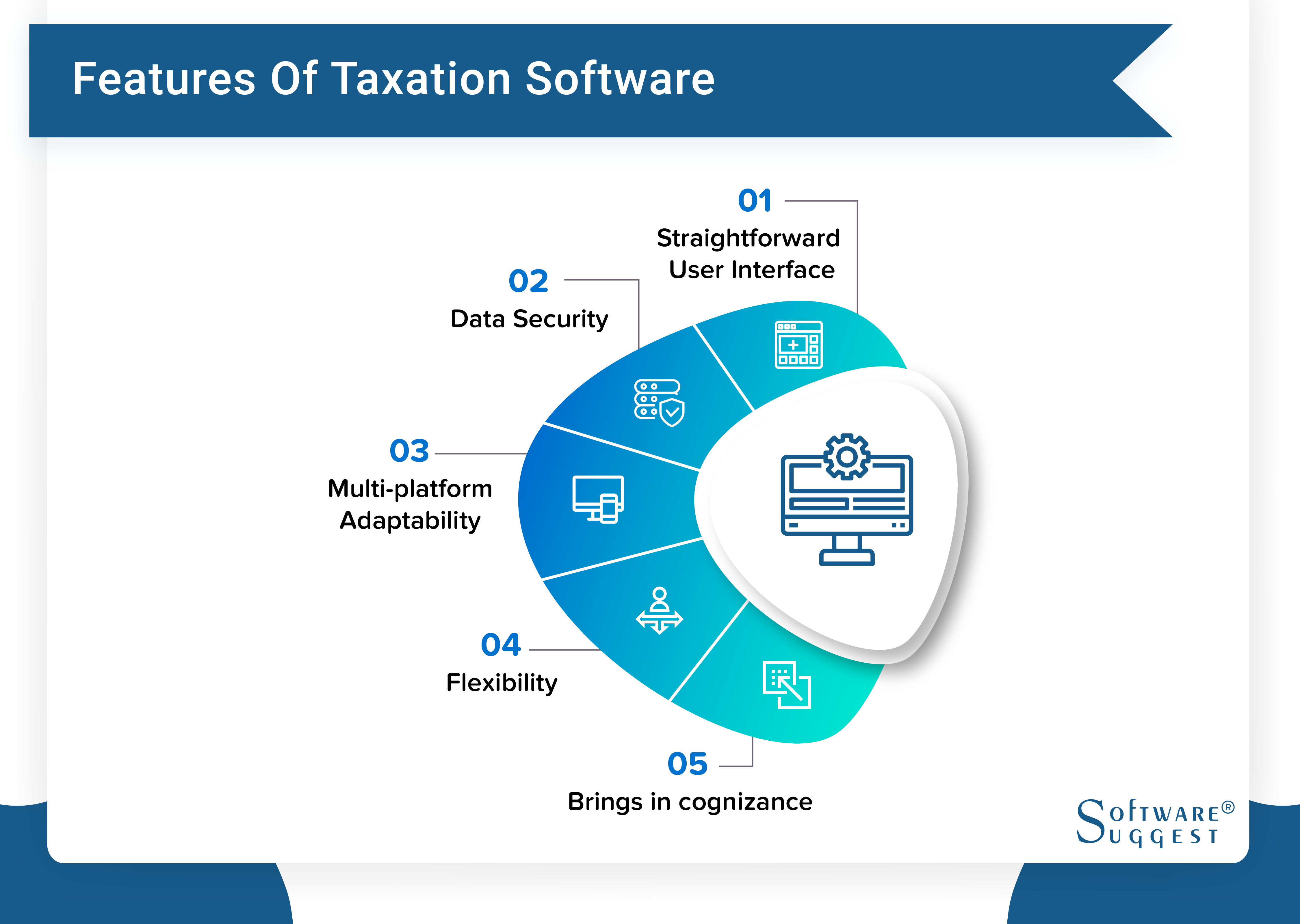

Features of Taxation Software

If you are looking for a tax return software, then here are some of the must-have features you must find in a good online tax software:

1. Informative and Straightforward User Interface

In an utterly busy life, one can find it very unpleasant to work on a tax filing software with an utterly complex user interface. A tax return software having a simple yet informative dashboard can thus prove to be the best tax software. This way, you can get the job done quickly in fewer clicks and that too very easily. Also, it’s essential for a tax return software to show you various MIS reports upfront to enable taking quick and effective decisions for your business.

2. Data Security

Currently, in the digital age, data security is one of the must-haves in every software, especially in online tax software. Owning a secure tax return software will help you in protecting your confidential business information from almost all of the potential threats.

3. Multi-platform Adaptability

The tax return software must be accessible through multiple platforms such as desktop, tablet, and mobile phones. This will ease out the process of online return filing, and you can thus comply with all government norms in a quick and timely manner.

4. Flexibility

Some of the best tax software are flexible enough to integrate with your existing systems. This feature of the tax return software will prevent the need for setting up your master data once again in the new taxation software.

5. Tax Filing Software Brings In Cognizance

The online tax software must be able to keep you up-to-date by sending you alerts of all upcoming events related to the taxation process. Thus you can rest assure that no tax-related deadlines get missed and your business can be carried on seamlessly through the tax filing software.

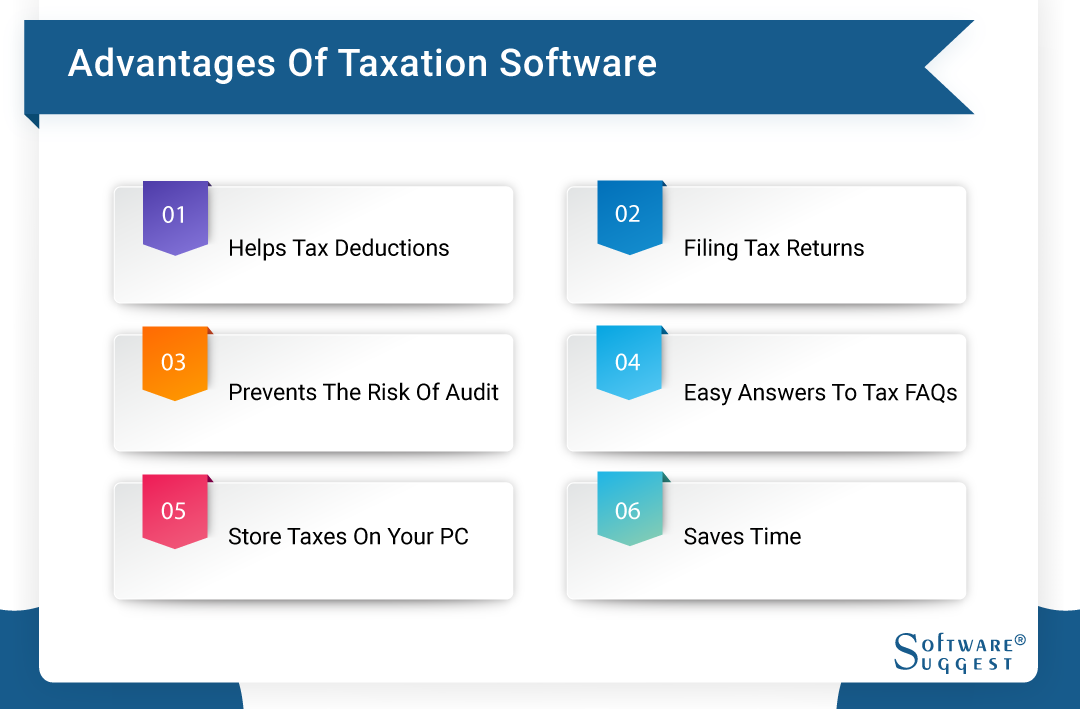

Advantages And Disadvantages Of Using Tax Software

It’s essential to determine the advantages and disadvantages of online tax software before purchasing one. Here, we have listed all the significant advantages and disadvantages of online tax software:

Advantages of Taxation Software:

1. Helps You Maximize Your Tax Deductions

With changes being made in the tax laws every year and many new types of deductions being added to the list, you are sure to miss availing some significant tax savings. A tax return software ensures that you get all possible tax deductions and thus enjoy a great amount of savings.

2. Allows Filing Tax Returns From Your PC

With the use of a tax filing software, you can quickly e-file your taxes. E-filing your taxes will enable you to get faster refunds and that too without any hassles.

3. Taxation Software Prevents The Risk Of Any Audit

A taxation software checks all your errors before you file your returns. You also get a guarantee from some software companies against calculation errors; i.e., the software company will redeem you of the penalty in case of an audit, and also pay you with additional interest on it.

4. Gives You Easy Answers To Tax FAQs

Of course, you may also get answers to tax-related FAQs through Google search. But an online tax software can give you the closest answers to your queries and even straight to the point and easy-to-understand.

5. Taxation Software Enables Storing Taxes On Your PC

It can be quite challenging to keep a record of all tax-related information such as rate of taxes, HSN code, SAC, date of applicability of tax, date of change in tax rate, b/f input tax credit amount of previous tax period, etc. But some of the best tax software in online versions allow you to store your taxes in secure servers. Thus you can access your taxes at any time, and from any place.

6. Saves A Lot Of Time

The online tax software saves a lot of your precious time; this is because, since the different tax rates are already saved in the software, you don’t need to enter them time and again and you get automatically calculated taxes. Secondly, you don’t have to go and physically submit the forms to the government offices, but you can easily do it from anywhere through the tax filing software; thus saving yourself a lot of time.

Disadvantages of Taxation Software:

1. Using Tax Filing Software Requires Computer Skills

There are many people still who don’t know how to operate various functions on the computer. For someone who doesn’t have good knowledge of operating a computer, it can prove to be a little difficult to use tax software. Thus it may take a lot of time for them to fill the electronic forms, and may not find the taxation software so useful.

Tax Software Market Trends

People all over the world are loving taxation software as it saves them a lot of time and offers a great deal of convenience while paying taxes. Apparently, the global tax software market is also expected to witness amazing levels of growth in the near future. The huge growth in the demand for IoT devices and also the availability of cloud-based software at truly economical prices are also major contributors to a boom in the tax software market.

Related Articles:

.png)

.jpg)