Best Payroll Outsourcing Services for Your Business

Best payroll outsourcing services include Qandle, HRMantra, Keka, Zoho Payroll, & HROne. Many companies don't want the hassle of having an in-house payroll team and that's when payroll outsourcing services come in.

Connect With Your Personal Advisor

List of 20 Best Payroll Outsourcing Services

Rippling is a fully featured HR Software designed to serve Agencies, Enterprises. Rippling provides end-to-end solutions designed for Macintosh. This online HR system offers E-Verify/I-9 Forms, Multi-Country, Employee Database, Recruitment Management, Employee Lifecycle Management at one place. Learn more about Rippling

Starting Price: Available on Request

Our secure online payroll system, paying your employees has never been easier. We’ll help you get started by setting up your payroll, employees, payroll tax information, etc. Read Patriot Payroll Reviews

Starting Price: Starting Price: $17 Per Month

Recent Review

"Best decision in a long time" - Ella

Oyster Payroll is a fully featured Payroll Software designed to serve SMEs, Startup, Agencies, Enterprises. Oyster Payroll provides end-to-end solutions designed for Web App. This Payroll System offers Dashboard, Vacation/Leave Tracking, Self Service Portal, Benefits Management, Document Management and Multi-Country at one place. Learn more about Oyster Payroll

Starting Price: Available on Request

Contenders | 2023

Payroll Management Software for Small Businesses

Gusto is one of the best payroll outsourcing companies in India. It runs payrolls easily in minutes and helps with onboarding, hiring, and offering employee benefits. Gusto is an easy-to-use and reliable choice for running payrolls that are automatically calculated, error-free, and compliant. It also helps with performance tracking and report generation. Read Gusto Reviews

Starting Price: Starting Price: $40 Per Month

Recent Review

"Review for Gusto" - Junaid Ahmad

PapayaGlobal offers the best-outsourced payroll solutions for all types of employment. It automates payroll processes and helps you reduce costs and maximize efficiency. The service checks data compliance with 100% accuracy and audits preventative reports to determine payroll inconsistencies while standardizing all payroll data under a unified platform. Read Papaya Global Reviews

Starting Price: Starting Price: $20 Employee/Month

Recent Review

"review of papaya global" - Tehzeeb Raza

Remote is a global payroll outsourcing provider for big and small businesses. It offers international payroll, benefits, taxes, and more while aligning with full-local compliance. It also provides easy self-onboarding and delights remote employees, all at low flat pricing. It also reduces operational complexities with one simple invoice for all remote employees. Read Remote Reviews

Starting Price: Starting Price: $299 Employee/Month

Recent Review

"Transparent and effective with an amazing customer service " - Hanna Dazell

WorkOtter is a fully featured Project Management Software designed to serve Agencies, Enterprises. WorkOtter provides end-to-end solutions designed for Windows. This online Project Management system offers Portfolio Management, Product Roadmapping, Filtered Search, Collaboration, Capacity Management at one place. Read WorkOtter Reviews

Starting Price: Starting Price: $10 Per Month

Recent Review

"The most advanced project management software" - Mohamed Benmansour

Category Champions | 2023

Keka HR is the best employee-centric payroll outsourcing service for Indian businesses. It is a modern, fully-featured outsourced payroll provider offering a smooth user experience and simplifying complex workflows. The software automates all core HR and payroll operations to provide a hassle-free payroll processing experience in less time. Read Keka HR Reviews

Starting Price: Starting Price: $97.21 Upto 100 Employees

Recent Review

"Easy way for tracking " - Minaxi Suthar

| Pros | Cons |

|---|---|

|

Easy for applying leave and plus setting up the task and OKRs. |

Not any so far. |

|

I guess Keka as Software itself is very useful. |

I didn't find such thing yet. |

ADP's payroll outsourcing services can give you new business insights and help you adher to compliance easily. ADP's Payroll Services Saves your time and money so that you can focus on what you can do best running your business. Learn more about ADP HR

Starting Price: Available on Request

Surepayroll(Mobile Paycheck) is a one-stop solution for payroll needs. It helps in better tax filling, provides you with two-days processing time for transactions, calculates payroll automatically once you set it up, etc. Learn more about SurePayroll

Starting Price: Available on Request

Paychex Flex is a web-based human management need and access traffic of customers if they have a heavy rush on the product. In this system, only one user can use the system at a time no more users can log in that time. That's why it is a very short time wasting. It includes some characteristics like ATS, HRIS, payroll and cheap. Learn more about Paychex Flex

Starting Price: Available on Request

APS software is an innovative and easier Payroll tool. Completely suitable for small and medium size of organizations. Offers special functions like Schedule, Attendance management, Benefits management and Time management. It consuming very less time to manage all the functions Read APS Reviews

Starting Price: Available on Request

Recent Review

"The software is great to streamline the lengthy recruiting process." - Urvi Shah

| Pros | Cons |

|---|---|

|

Hiring the best minds for your company is a tough job. APS makes it effortless with its recruitment management module. Now, you can easily sort the piles of resumes s per your need. |

Mobile app layout could be improved |

Allsec processes over 1 million payslips for 500 legal entities, and 250,000 reimbursement slips for 400+ large and medium-size clients, across 36+ countries on a single integrated platform. Read Allsec HR Payroll Reviews

Starting Price: Available on Request

Recent Review

"Accent Training" - Manjunath J

| Pros | Cons |

|---|---|

|

User friendliness |

Provide it in more languages than listed |

UZIO is a SaaS-based online HR, benefits and cloud-based payroll management solution, provider. It is an ideal solution for any small to medium businesses who would like to move from paper-based tasks to a sophisticated HRIS platform. Learn more about UZIO Payroll

Starting Price: Starting Price: $4.5 Per Employee/Month

factoHR is an award-winning Best HR Platform trusted by 1500 Companies & 1.5 million employees which includes Tata Steel BSL, DENSO, Cycle Agarbatti, BSE, Murugappa, & many others who have improved their productivity by more than 70 % Read factoHR Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

Cost |

Home Page UI is completely unresponsive, no live chat. Team works with stiff timings, they dont pick any issues even after 6pm or during lunch break. Customers have to wait for them to devote time with multiple follow-up's. |

|

One of the most notable features is its attendance monitoring and geo-fencing. I can monitor my employees’ attendance and assign them geo boundaries for attendance registration. |

We went through some hardships when the software committed some errors in attendance. In addition, there were some issues with biometric integration. |

Category Champions | 2023

HRMantra is one of the most powerful payroll outsourcing services that offers a comprehensive set of payroll processing features. What sets it apart is that you can easily customize the system to fit into the most complicated pay calculations. Read HRMantra Reviews

Starting Price: Available on Request

Recent Review

"Saves time and increase productivity" - Senorita Gonsalves

| Pros | Cons |

|---|---|

|

You can easily navigate from one tab to another. Real time GPS tracking. |

Mobile application of HRMantra needs a little bit of improvement rest is fine. |

|

Software is totally customizable |

Attendance |

Category Champions | 2023

greytHR is a leading global payroll outsourcing provider to help your organization simplify HR processes and run payrolls in a single click. With its 90-day onboarding support and best-in-class services, greytHR boosts the productivity and engagement of the employees and makes clients' chores easier. Read greytHR Reviews

Starting Price: Available on Request

Recent Review

"Good Handy Software for my company" - Amrutha Rao

| Pros | Cons |

|---|---|

|

Easy to use, user friendly and all time avaible, layouts are good, handy |

Mobile app cant be added, nothing more to say, it looks pretty cool, probably i ll think |

|

Leave workflow, attendance tracking, regularisation, analytics and the mobile app. |

Occassionally seeing some minor issues in mobile app - maybe due to our bandwidth also. The new UI is good and please do add more self service tasks in the app |

Category Champions | 2023

Qandle offers terrific payroll outsourcing services for modern workplaces. The service enables you to customize payroll policies and incentives, allowing employees to view payroll-related information like CTC, payslips, tax slips, etc. It provides completely accurate payroll processing while syncing data with all HR records. Read Qandle Reviews

Starting Price: Starting Price: $0.68 Employee/Month

Recent Review

"amazing to use" - chander jain

| Pros | Cons |

|---|---|

|

This one sends me notifications about my attendance whenever I forgot to clock out and each. |

Compensation. And expenses management. |

HROne is one of the best payroll management companies that takes manual work off your plate and gives you more time to make strategies for business growth. HROne payroll outsourcing solution ensures error-free payroll and reduces post-payroll queries with timely payouts while maintaining detailed records of the entire payroll process. Read HROne - Complete HR Software Reviews

Starting Price: Available on Request

Recent Review

"HROne- The best HCM Suite" - Tarulika Jain

| Pros | Cons |

|---|---|

|

1. payroll |

engagement |

|

Attendance management and salary slip |

need to log in every time |

Category Champions | 2023

Wallet HR is a comprehensive payroll outsourcing service that offers both on-premise and cloud-based payroll software. Some of its robust functionalities include core HR activities, leave management, recruitment management, and more. Read Wallet HR Reviews

Starting Price: Available on Request

Recent Review

"easy accessibility and user friendly" - Aishwariya

| Pros | Cons |

|---|---|

|

Easy access of all modules |

no |

|

Able to get daily reports |

Need to be shorten the module |

Until 31st Mar 2023

What is Payroll Outsourcing?

Payroll outsourcing refers to hiring a service provider to manage the administrative and compliance functions related to employees’ salaries and benefits.

It is worth mentioning that payroll service providers can only handle your employees' payroll and do not act as a local employer of record for international companies. This means that to hire local employees, international companies will still need to incorporate their company in the country of operations.

The global payroll outsourcing industry is estimated to reach $10,336 million by 2023. North America and Europe are the dominant payroll outsourcing markets that account for a significant portion of the deal.

There are various payroll outsourcing packages you can choose from, ranging from simple tax, pension, and salary calculation to end-to-end logging of employee hours and issuing salary at the right time.

Categories of payroll service companies

There are basically three categories of payroll outsourcing software:

- Payroll service providers (PSPs) – in this case, the employer signs and files the tax returns. What the payroll providers do is that they prepare payroll tax returns using employers’ identification numbers (EIN)

- Reporting agents (RAs)- A RA payroll does all the work of preparing payroll tax returns using the employers’ EIN, signs, and files them.

- Professional employer or organization (PEOs) – manages all the HR-related tasks, including preparing payroll tax returns using EIN, signs, and filing the returns.

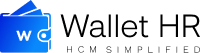

Benefits of Payroll Outsourcing

So why should you go in for Payroll Outsourcing? Well, here's why:

1. Focus Only on Your ‘Business.’

Payroll Management is one of those important tasks that do not contribute to your sales directly. You cannot ignore the endless stream of laws requiring absolute compliance when it comes to payroll matters. But you might not always be updated about the recent legislative updates. So that means, despite sapping up your attention and time, matters regarding payroll can hurtle your business down a destructive path.

With payroll outsourcing services in India, you are left to focus only on things that really matter and require your attention. It enables you to make plans that will allow your business to improve, rather than getting stuck processing payrolls or managing appointments. By freeing up your time, you might gain greater value out of that time, compared to what you are paying. What does that imply in the long run? It means you are always one step ahead of your competitors who are stuck on these mundane tasks.

2. Access to Top-Notch Expertise and Technology

There is no good reason to manage payrolls in-house. By payroll outsourcing to a good and reputed company, you can use the latest technology and expertise benefits without spending an extra dime! Employers rely on the latest, changing technology trends to operate efficiently. As the number of employees grows, so does the complexity of reporting and record-keeping.

These employees expect transparency and efficient technology use through options like direct deposit or self-service access to payroll online information. If you start handling all these payroll requests yourself, you’ll end up doing just this throughout the day while your business seeps away. Payroll outsourcing services in India help you gain access to the best technology used efficiently by trained experts. What would take you hours might take them a few minutes with the latest technology at their disposal and their arsenal of expertise!

3. Cut Down Major Costs and Reduce Risks

The latest technology and software packages are required to manage payrolls efficiently. Besides, you would also need to hire support staff to help you with managing payrolls. While hiring, experts can go a long way to help you, that option is almost always more expensive than outsourcing payroll. Moreover, an adept payroll provider can offer capabilities that go beyond what you can fathom or do on your own. At much lower prices!

4. Avoid IRS Penalties Due to Payroll Errors

Legal requirements surrounding taxes, overtime payments, calculating employees’ portion of taxes, filing at local and state levels, unemployment compensation, wage, and hour laws, to name a few, may take up more time than you wish to spare. Despite all your efforts, you might still find your business embroiled in a dispute resolution, causing unnecessary complications, especially for small business owners. Experts in payroll handling companies make it their job to keep themselves updated on matters of legislation. With their expertise at your behest, you’ll save yourself a lot of legal proceedings and at the same time keep up with constantly changing regulations, rates, and government forms.

5. Alleviate A Source of Headache

At the end of the day, you might decide not to outsource payrolls. To aid you in the task, you train an in-house Accountant. Once trained, the accountant may decide that it’s time to leave your company searching for a better job! You’ll have to go through the entire training process all over again. Acquiring the latest versions of technology regularly and manually handling payrolls can become a nightmare. By outsourcing payroll, you are buying some snippets of peace. And that itself makes it worthwhile!

6. Offer Direct Deposits

As mentioned earlier, employees now expect direct deposits. It saves them the inconvenience of going to banks at the end of each month. Direct deposits also eliminate the step of paper handling (time-consuming and error-prone) along with the need to reconcile at the end of every month. Outsourcing payroll makes this an easy-to-achieve possibility.

While outsourcing payroll can be a boon for your business, you need to be wary before selecting a company that handles your payroll. Choose a company that is widely recommended and trusted. Look at prospective options and select the one with the highest level of experience and reputation in this field. I prefer companies that have a track record of working with businesses similar to yours.

Check out and inquire about complementary service offerings, the technology they are using for processing payrolls, and their accountant interface. Opt for a company only after ensuring complete security and satisfaction. Efficient payroll & HR outsourcing can save you time, reduce the need for in-house trained payroll staff, and appropriate software packages, and keep you compliant with the regularly updated PAYE legislation. In short, outsourcing your payroll can prove to be a truly cost-effective investment for your Business!

7. Total Compliance

Government rules and policies are always changing, and it’s difficult for small business owners to stay on top of these changes. Dealing with payroll means that you need to have a thorough and up-to-date knowledge of the current taxation policies, regulations, and legal enforcement! That is surely not an easy task – that is why it is highly recommended to outsource your payroll function for complete compliance with government policies.

Outsourcing your payroll function means that there will be no errors in your transactions; hence you will not have to give any penalties or fines if there are audits or checks by the requisite agencies.

8. Time Savings through Better Productivity:

As your business grows, the complexity of payroll processing will also increase, making it a tedious and time-consuming task. There is an immense amount of work in calculating wage deductions, benefits, managing new hires, and ensuring compliance with ever-changing governmental laws.

Outsourcing payroll to a specialized agency frees business owners and managers to concentrate on vital business functions and reduces their administrative workload to a huge extent. The various repetitive and mundane tasks of the payroll function kill productivity and waste your employees' precious time.

In other words, outsourcing payroll immediately escalates efficiency levels and makes your organization fixed on the path to success!

9. Enhanced Security:

There are severe risks of data tampering, fraud, embezzlement, and identity theft for companies having an in-house payroll software solution. There is also the chance that hackers could hack your organization’s computer servers and obtain highly sensitive employee information for personal gain.

Outsourcing your payroll function is the best way to ensure that your confidential data remains safe and secure. Professional payroll vendors have state-of-the-art security systems that can store and protect colossal amounts of company records.

Outsourcing payroll means that your organization never has to worry about data security, as you can rest assured that their strong encryption technology will keep your valuable information absolutely safe!

In-house Payroll or Outsource Payroll Services?

One of the toughest decisions for organizations is to take a call, on whether they should outsource their payroll requirements or go for in-house payroll processing. While both have their advantages, it may be beneficial for your organization to undertake a detailed study before taking a final decision.

With payroll outsourcing services in India, all the payroll information is captured on printed forms and sent to the external payroll provider. The main parent organization has no direct access to the underlying application or payroll calculations and will end up with complete paychecks. The external payroll processing provider manages the data entry, financial calculations, payroll check processing and comprehensively.

On the other hand, with an in-house payroll team, you have a unified solution that is fully accessible to your payroll staff members. Your payroll processing team captures all employee data in your internal systems, and your payroll staff manages the entire payroll process, right from data entry to funding and remittance.

To help you to design the best payroll outsourcing services in India for your small business, here are a few important questions you might want to ask:

1. Which are the steps in your current payroll processing system that cause the most difficulty?

2. How much detailed time and effort do these steps cost your company?

3. What is the impact of risk, if any, that your existing payroll processes pose to your organization?

4. Is your organization ready to hand over the control of sensitive and valuable information to an external outsourcing provider?

5. How would payroll outsourcing services impact your organization’s ability to budget and forecast salary-related information accurately?

Pros and Cons of Payroll Outsourcing

Managing the payroll function is a challenging job. However, it is a vital task that contributes to overall organizational productivity and bottom-line results. In recent times, most companies have started outsourcing payroll functions. Here is a compiled list of the pros and cons of outsourcing payroll to an external agency:

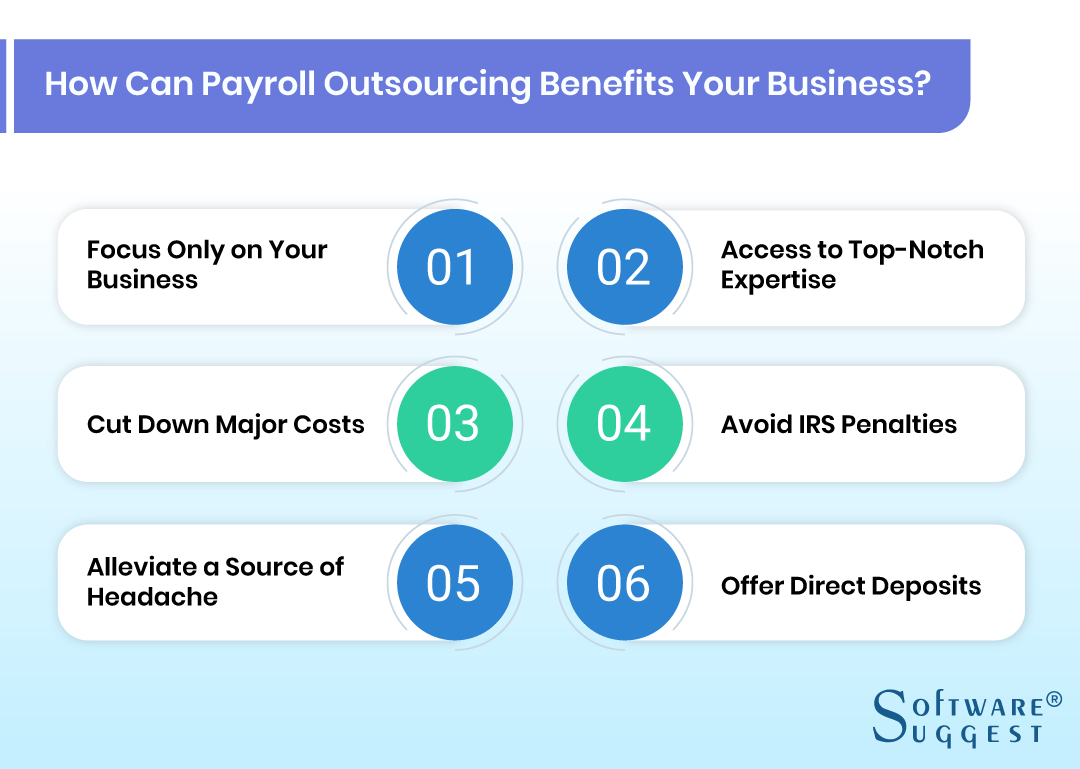

A) Pros

1. Better Expertise

Organizations that outsource payroll benefit from the experience and knowledge of subject experts. Payroll outsourcers know all the latest regulations about taxes, employee wage laws, and mandatory compliances. An external agency will ensure that companies do not face any problems in their payroll management and keep all operations in order.

2. Lesser Cost

Many small businesses may struggle with the financial aspect of conducting their own payroll activities. Hiring specialized staff members and training them in the necessary procedures leads to a heavy financial burden. It may prove to be more economically viable to outsource the entire payroll function to an external vendor. Most service providers customize the budget to suit organizations and provide substantial discounts.

3. Saves Time

Payroll is a time-consuming task. It consists of heavy manual calculations, and companies often need to manage a heavy workforce to maintain the payroll function. Outsourcing all vital payroll activities ensure that employees do not waste endless hours on tasks; rather they can focus on more productive work.

4. Better Accuracy and Compliance

Since the payroll function involves a lot of manual calculations, it is prone to errors and mistakes. Outsourcing payroll helps ensure better accuracy, as fewer mistakes are made and operations are more streamlined. Most external payroll vendors are also well aware of mandatory compliance issues and ensure that organizations do not default on any parameters.

B) Cons

1. Lack of Control

One of the biggest problems with outsourcing payroll is that companies cannot control operations internally, as an external service provider handles the entire process. The agency that will manage your payroll activities will uphold your service level agreements; however, the organization loses all process autonomy.

2. Security and Data Breaches

Payroll activities require companies to be very careful about sensitive financial information. Since an external payroll service provider in india will be looking after your database, it is important to ensure no leaks or misuse. Your vital data should not be hacked, so it is essential to have stringent security procedures and inform your payroll outsourcer to maintain tight data-theft prevention measures.

3. Extra Costs

Sometimes organizations need to pay additional costs for services that they will not avail of. This is because service providers offer an all-inclusive package at a fixed cost. Hence, organizations may tend to increase their budget and overspend on payroll activities.

4. Incorrect Results

It is essential to choose a credible service provider for outsourcing payroll processes. If you invest with an unprofessional agency, the result may have errors, and they're also may be security lapses.

Key Things to Keep In Mind When Outsourcing Payroll

Before you outsource payroll services, you need to think carefully about your payroll strategy to ensure everything goes as planned.

1. Business Objectives:

Before you hire a payroll management provider, you need to ensure that they’ll bring value to your organization. It is worth mentioning that payroll outsourcing is not always about saving money. Your payroll outsourcing business plan may help avoid costly penalties or frustrating employees with missed paydays.

2. Engagement:

Payroll outsourcing should not be a one-sided relationship. You need to be an active participant in the payroll process. If not, things will eventually go down in the long run.

3. Integration:

Apart from your active participation, you also need to integrate it with other aspects of your business, including the HR department. This will ensure smooth management of payroll. You’ll need to establish proper communication channels between your departments and the payroll management provider.

Questions to Ask Before Outsourcing Payroll Service

Choosing the right payroll for your business organization can be a challenging task. However, asking these essential questions will surely guide you and keep you on the right track so that the right decision can be taken for maximum organizational benefit:

- Which payroll outsourcing processing company will suit your organizational requirements?

- What payroll service provider will provide additional support?

- Will the company provide the required support via phone calls, email, and live chat?

- Is the external payroll provider absolutely confident about the complete security of organizational sensitive data, and what steps will they take to prevent any loss of payroll-related information?

- Who will have permission to access the payroll information of your company?

- Can the payroll service provider customize their value offerings to suit your exact business requirements?

- Will they hire a payroll outsourcing company to offer your organization the freedom to manage your account flexibly?

- Who are the external payroll processing services providers' clients, and are they happy with their experience?

- What is the subscription fee for payroll outsourcing companies?

- Are there any hidden or repetitive costs?

- Is external payroll outsourcing companies using the most advanced technological tools?

- Is their platform technically sound, and is there scope to scale up the operations if required?

- Does the outsourcing payroll processing provider for small businesses include any useful add-ons?

- Is there a clearly defined service level agreement between the payroll processing outsourcing firm and your organization?

- Will the company respond quickly to support calls and fix errors for better functionality?

When to Outsource Payroll?

There’s no one answer to this question. It depends on several factors, including the number of employees and the complexity of labor laws in your state/country of operation.

While small businesses leverage payroll outsourcing services more often, large enterprises can also benefit from it.

Although the reasons may vary, here are some common grounds when you’d want to outsource your payroll.

- Managing your payroll is becoming a headache.

- You don’t have a complete understanding of the compliance and labor laws of the state/country.

- Your company has been penalized for non-compliance with payroll laws.

- Employees have been receiving incorrect salaries very often.

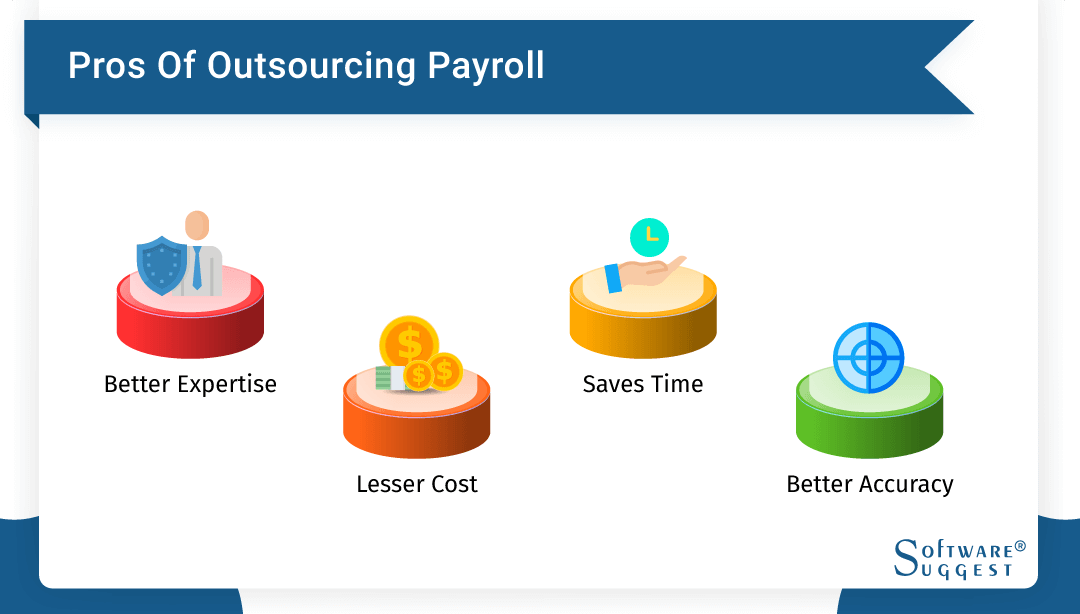

Buying Tips for Online Payroll Outsourcing Services

There are hundreds of payroll outsourcing companies (if not thousands). You need to be extremely careful when choosing your payroll provider. That’s because there’s money involved.

You don’t want to partner with a payroll outsourcing company that has a history of calculating incorrect payrolls or misrepresenting benefits. This will not only affect your company’s reputation as an employer but will also bring you to the government’s notice.

Here are four key points you should consider when choosing a payroll outsourcing company.

- Their price compared to other providers

- The integrity and scope of their service

- The reputation of their business

- Security, privacy, and reliability of the provider

Why is this particularly important? Because you are exposing confidential information to third parties: Names of your employees, their social security numbers, addresses, and bank account numbers.

To be on the safer side, take a financially strong provider with good controls in place. You don’t want to find yourself in a blind where your provider may steal your money. Or face an IRS action because at the end of the day, whether your provider steals your money or not, you’ll have to shoulder the responsibility of filing your tax returns.

Additionally, follow these tips to narrow down your search.

1. Look for a Stable Provider

Make sure to choose a market leader in India's payroll outsourcing services with a good reputation and a satisfied client list. To ensure long-term stability, a payroll service provider in india should ideally sustain at least a hundred clients who avail of their services.

2. Ensure the Finances Are in Order

It is important to be completely thorough in appraising the first paychecks issued through the payroll outsourcing services and the finances paid to cover legal tax obligations.

3. Evaluate the Pricing over Time

Make sure that you are not swayed by payroll outsourcing services that waive off initial charges upon sign-up. This is because the prices go up or start accruing after around six months to a year of payroll service. Keep a keen eye on pricing and always do a detailed market comparison to gain maximum financial benefit for your business organization.

"Business is all about people." Having a satisfied and motivated workforce is the key to achieving success in any business. Employees work hard to ensure your business runs seamlessly. So, it is essential to pay them appropriately.

In addition to wages, you also need to regularly pay accurate taxes to the state to continue running your operations. These payroll tax laws are subject to frequent changes, making payroll processing difficult, and you often find your business penalized for payroll errors.

It is easy to understand that payroll is a crucial part of any business organization. Despite its importance, it is an undisputed fact that payrolls chug up huge amounts of time that could be devoted to other more important business matters. To avoid this mundane task from clogging up your schedule, "outsourcing" has emerged as a significant alternative to eliminating payroll processing difficulties and challenges.

.png)

.jpg)

.png)