Best Accounting Software for Your Business

The best accounting software in India are Zoho, TallyPrime, QuickBooks, Xero, FreshBooks, and QuickBooks Online. Such accounting systems keep records and process business account transactions.

Connect With Your Personal Advisor

List of 20 Best Accounting Software

#1 Cloud ERP for Fast-Growing Businesses

NetSuite, the #1 cloud ERP, is an all-in-one cloud business management and accounting software that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Learn more about Oracle NetSuite ERP

Starting Price: Available on Request

Cloud Accounting Software Making Billing Painless

Freshbooks is modern accounting software that simplifies bookkeeping and captures expenses in real-time. This innovative and user-friendly accounting system enables you to manage your invoices digitally, track time, and know about your finances through detailed real-time reports. Read FreshBooks Reviews

Starting Price: Starting Price: $15.00 Per Month

Recent Review

"FreshBooks: The Simple and Intuitive Accounting Solution for Small Businesses" - Ayoub El Fahim

Melio is a free Accounting software for small businesses in the US. It allows businesses to pay vendors using bank transfers for free or through credit/debit cards, while the vendors get paid via a bank transfer or a check. Read Melio Reviews

Starting Price: Available on Request

Recent Review

"Excellent accounts payable solution that requires very little training" - Jasmin H

Category Champions | 2023

Online Accounting Software for Growing Businesses

Simple, easy-to-use, and one of the best accounting systems to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Starting Price: Starting Price: $10.4 Organisation/Month Billed Annually

Recent Review

"Zoho Bookings Schedule Good Timming" - JADAV PRAVIN

Category Champions | 2023

NetSuite, #1 cloud ERP, is an all-in-one cloud business management solution that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Read Oracle NetSuite Reviews

Starting Price: Available on Request

Recent Review

"Great ERP solution for businesses of all sizes" - Parshwa Bhavsar

| Pros | Cons |

|---|---|

|

user friendly powerful |

none |

Oracle Netsuite is the first and last business system you will ever need. For more than 20 years, Oracle NetSuite has helped organizations grow, scale and adapt to change. NetSuite provides an integrated system that includes financials / ERP, inventory management, HR, professional services automation and omnichannel commerce, used by more than 26,000 customers in 215 countries and dependent territories. Read Oracle Netsuite EMEA Reviews

Starting Price: Available on Request

Recent Review

"Oracle NetSuite aids businesses to become more efficient and intelligent" - Mohammed Mustafha

| Pros | Cons |

|---|---|

|

user friendly powerful |

none |

|

Speed |

Backup |

Sage Business Cloud Accounting software is designed to meet the needs of start-ups, sole traders and small businesses. Choose the right plan for your business that allows you to track and send invoices, track what you’re owed, calculate and submit VAT and more. You can also add Payroll as part of your purchase. Visit Sage to buy now and save, or take out a free trial. Read Sage Accounting Reviews

Starting Price: Starting Price: $4.81 Per Month

Recent Review

"Outstanding Accounting App" - Hebert Banhire

| Pros | Cons |

|---|---|

|

Automatic bank feeds. |

The product support live text chat should be reintroduced. |

|

Automatic bank feeds. |

Online text support should be brought back. |

Divvy is a fully featured Accounting Software designed to serve Agencies, SMEs. Divvy provides end-to-end solutions designed for Windows. This online Accounting system offers Staff Management, Expense Tracking, Cash Management, General Ledger, Receipt Upload at one place. Read Divvy Reviews

Starting Price: Available on Request

Recent Review

"Review for Divvy" - Amir Haseeb

| Pros | Cons |

|---|---|

|

Divvy integrates with Quickbooks which is super helpful. Divvy rewards program fits our organization much better than previous rewards programs. |

We very frequently (more than once per week, have charges declined when paying our vendors. The ACH and Bill Pay process work very, badly. |

Crunch Accounting is a fully featured Accounting Software designed to serve Enterprises, SMEs. Crunch Accounting provides end-to-end solutions designed for Windows. This online Accounting system offers Tax Management, Billing & Invoicing, Bank Reconciliation, Billing Portal, Customizable Invoices at one place. Read Crunch Accounting Reviews

Starting Price: Available on Request

Recent Review

"So good" - Nour Badawi

| Pros | Cons |

|---|---|

|

Ease of use |

Nothing, it is complete |

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Starting Price: Starting Price: $69.44 Per Year

Recent Review

"Easy to access" - Manisha Garg

| Pros | Cons |

|---|---|

|

Its easy to use |

No cons |

|

Import feature, Export feature, auto suggestion appears while matching and their customization report feature. Their support system is awesome. |

It is not an easy software to learn, you need to have training before using it. Professional accounting base is necessary. Although they provide videos for training. |

SAP Financials is the best and online-based accounting software. It's very simple and easy to use for clients. All the user trust on the website and put their personal data. High security provided to users and save their data. Read SAP Reviews

Starting Price: Available on Request

Recent Review

"SAP for all types of data management" - Dnyanoba Madrewar

| Pros | Cons |

|---|---|

|

SAP integration tool is used to manage all types of data along with that to automate the process of data management. It also help us to find the data quickly. We can check the data whenever we want. SaP integration tools are of many types and we can use it for variety of purposes. |

Search tools for older data and mail functionality from SAP can be improved |

|

Very good integration |

Customet support |

High Performer | 2023

ProfitBooks is largely regarded as the best Indian accounting system. The application allows you to create detailed invoices without any technical training, track inventory and manage your expenses in real-time. Read ProfitBooks Reviews

Starting Price: Starting Price: $83.32 Per Year

Recent Review

"Good inventory keeping software" - Markus Schiefer

| Pros | Cons |

|---|---|

|

The software is really straight forward and users are quickly taught in. Dashboards are designed in a clear manner so that you can read the KPI's at first glance |

I have not found any issue with the software. There was once a problem with the report formatting, but the customer service was fast at helping me out. |

|

Innovative modules with the responsive operating system. Taxation management is error-free and time-bound. Web-based development and SAAS based payment system for easy accessibility. |

Lacks good customer support. Need to improve it’s after sale service as well. |

Category Champions | 2023

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Starting Price: Starting Price: $9 Per Month

Recent Review

"A complete solution for the financial management of your company" -

| Pros | Cons |

|---|---|

|

Among its positive aspects I can say that it is easy to use and that Xero has an intuitive and easy to navigate interface.It is also an online software, which means that it can be accessed from anywhere with an internet connection.It also integrates with a variety of complementary applications and services, allowing you to automate accounting tasks and improve efficiency.It also allows you to generate accurate and up-to-date financial reports in real time. |

can be more expensive than some other online accounting software.does not have full inventory accounting handling for businesses with a large volume of inventory. |

|

user friendly powerful |

none |

Sage offers a complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy to use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Starting Price: Starting Price: $50.58 Per Month

Recent Review

"Excellent service" - Lynne Smit

| Pros | Cons |

|---|---|

|

It is easy to use. |

It should accommodate other languages like Afrikaans. |

|

User Interface and ease of usage |

Stable version of applications |

Intacct is the fast and efficient solution for the accounting. It seamlessly manages the Finance and Strategically vendor management. Automate the workflow of an entire payable process. Eliminate the valuable time of finance, and make it as productive time. Read Intacct Reviews

Starting Price: Available on Request

Recent Review

"Highly noteworthy accounting software" - Varsha Patel

| Pros | Cons |

|---|---|

|

It makes accounting accurate and fast with its comprehensive modules This Software-as-a-service system will unleash you from the burden to perform all the accounting tasks without any errors. Alongside, the speed also deserves a mention here. |

Customer care support could be improved a little |

ZarMoney is a fully featured Accounting Software designed to serve Enterprises, Startups. ZarMoney provides end-to-end solutions designed for Web App. This accounting system offers Purchase Orders, Mobile Payments, Fund Accounting, Project Accounting, Billing & Invoicing in one place. Read ZarMoney Reviews

Starting Price: Starting Price: $15 Per Month

Recent Review

"Best alternative I've found so far at this price" - Youssef

| Pros | Cons |

|---|---|

|

I found many features such as:- It has many advantages for its price category.- Good customer service.- Provides a plan for small businesses.- Suitable for those with little experience in accounting because it is easy to use and does most of the tasks. -Tools can be customized - uses artificial intelligence |

- It pays great attention to inventory management, but ignores other features that we need in accounting. -Although it is easy to use, it can be organized a little better. - Mobile app needs improvement. |

Bill.com is complete online-based accounting software for ACH payments, and send electronic invoices and payment reminders. It takes less time to solve the problem and unique content of the site attracts to users. Read Bill.com Reviews

Starting Price: Starting Price: $29 User/Month

Recent Review

"Pay bills using Bill.com" - Shreyas Bhuva

| Pros | Cons |

|---|---|

|

To pay bills very quickly and to track vendor ledger very effectively and it automatically process many bills for user. |

It's taking much time to load perticular page. Old Bill.com interface was much good than new. |

|

The software has a well-integrated operating system which handles all the accounting task with less supervision and it is its biggest advantage. You can easily sync with your organizational data with this software and increase your productivity. |

Highly constructive software. We are satisfied. |

Emergents | 2023

Software by Reeleezee Software Services India Pvt. Ltd.

Reeleezee stands for really easy. The user interface is simple to follow: clear input, clear language, no unnecessary accounting terms. Reeleezee developed smart solutions for scanning and taxes. Business owners with limited accounting knowledge can work with Reeleezee, an advanced and complete accounting solution. Read Reeleezee for Accounting Reviews

Starting Price: Starting Price: Available on Request

Recent Review

"Good accounting software." - Jitesh Zala

Category Champions | 2023

TallyPrime is India’s leading business management software for accounting, GST, inventory tracking, banking, and payroll. TallyPrime is one of the best Indian accounting software solutions providers, It is affordable and one of the most popular tools used by nearly 20 lakh+ businesses worldwide. Read TallyPrime Reviews

Starting Price: Available on Request

Recent Review

"Very best softare in my view but some measure have to be taken in order make it perfect ." - Arpit mishra

| Pros | Cons |

|---|---|

|

It's simple to operate on Tally and it's effective on daily basis use. |

my experience of over two years, I didn't dislike anything. |

|

It helps you manage accounting & payroll. |

It is Not User-Friendly. |

Kashoo is the easiest online software at the affordable cost for the accounting. It designed to manage the entire system of the small to medium business. It updates all the finance with real-time and manages cash flow. Read Kashoo Reviews

Starting Price: Available on Request

Recent Review

"Very user-friendly software" - Gaurima Yadav

| Pros | Cons |

|---|---|

|

This software is designed in a simple manner which makes it highly user-friendly. You need not to an accounting pro to operate it and, I believe, it is its biggest advantage. |

They should increase the duration of free-trial. |

|

No matter what is the size of your organization, you have to do effective revenue and cost management to keep a track over profit and loss. This software is a great help and achieves it effortlessly. |

We are happy with its help. |

Until 31st Mar 2023

What is Accounting Software?

Accounting software helps accountants & bookkeepers record and report financial transactions. Invoicing, general ledger reconciliation accounts payable (AP), and accounts receivable (AR) are among the recurring processes of business accounting software. Investing in an accounting system can help you streamline and automate business various functional processes, improving operational efficiency and ensuring accurate records. Accounting software can come with cutting-edge features like the depreciation of specified assets and multi-currency support, depending on its size.

Who Uses Accounting Software?

A company's accounting department varies in size depending on the size of its company and the complexity of its operations, and accountants, controllers, chief financial officers (CFOs), and other accounting department members use accounting software.

The accounting department can include one person responsible for everything or many employees accountable for a specific financial operation, including AP, AR, cash management, or expenses.

-

Accountants

Financial reporting is done by accountants using the latest accounting software, which includes forecasting, profit and loss statements, and cash flow statements.

-

Accounting Corporations

External accountants may be required to use the software of the customer or their software to help clients with their finances. Accounting firms manage finances for their customers.

-

Managers/CFOs

Using accounting software, executives ensure that controls are built into how data is compiled, assess the company's financial position, and ensure that rules are built into their system. Most executives require access to financial reports and dashboards but rarely handle transactions or other accounting tasks.

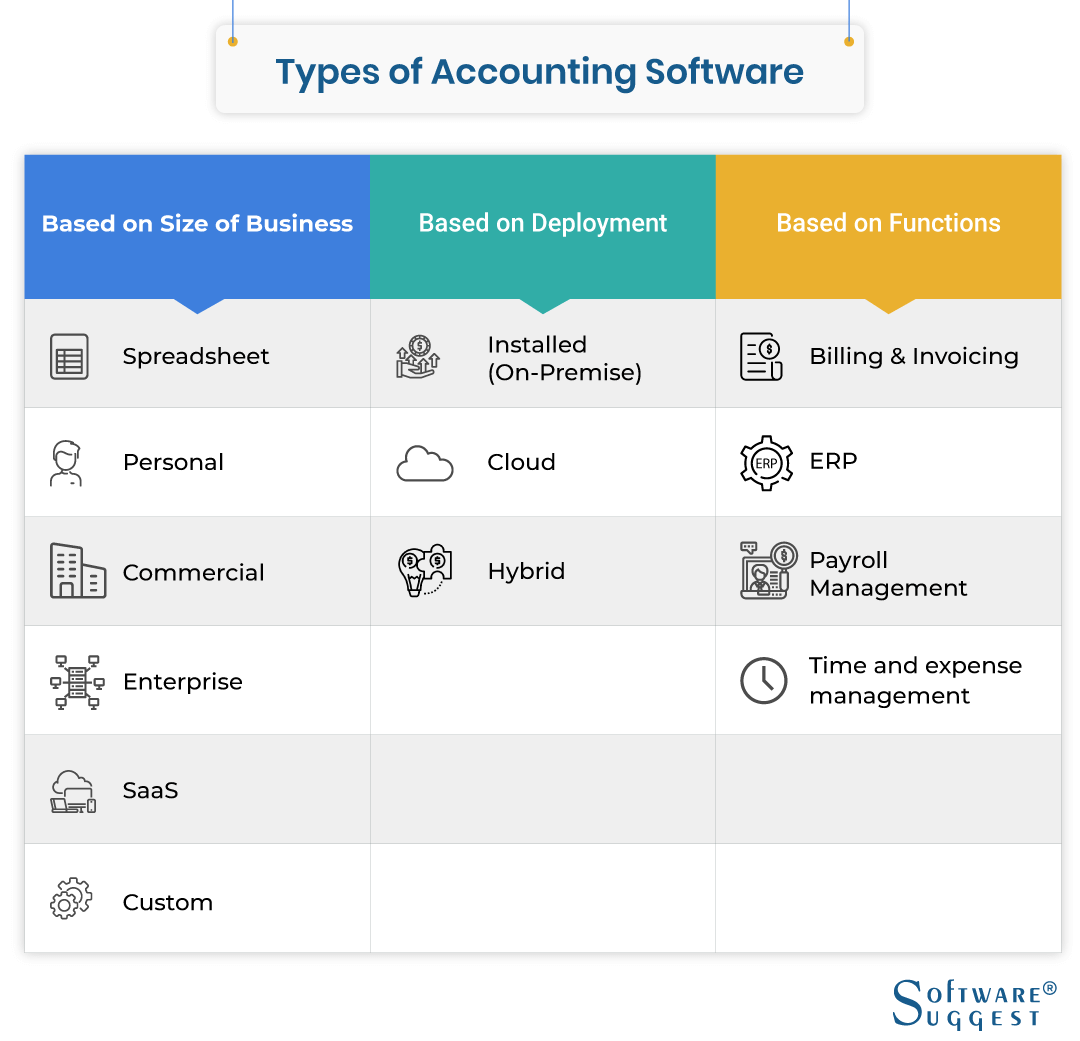

What are the Types of Accounting Software?

There are various types of accounting software available in the market that can meet diverse organizational requirements. Below are some of the types of accounting systems:

Cloud VS. On-Premises

-

Cloud

Users can pay on a usage-based basis for cloud-based solutions since they are easy to implement, do not require hardware investments, and don't require hardware investments.

Cloud tools often find it difficult to provide robust offline functionality that allows users to access accounts and complete actions without connecting to the internet. Because cloud accounting is cheaper, it is usually the best option for small businesses.

-

On-Premises

Systems on-premises might be client-server tools, which require each user to install software, or they might be browser-based. Investing in hardware and IT support is required for on-premises tools, which offer additional security and can usually be customized without vendor involvement.

Based on the size of the company

A small business accounting team will typically look for a tool that offers a low-cost, easy-to-use interface that can handle billing and invoices. Most of these services are cloud-based and have mobile phone apps, offering convenience to the small business owner despite their simple, standard bookkeeping and financial reporting capabilities.

A large company needs software that can handle many complex accounts with input from multiple roles. Due to higher volumes and greater complexity, reconciliation measures should be more rigorous. Larger companies can also ensure the integrity of accounts maintained by various employees by implementing audit trails and security measures.

Suite VS. Best of Breed

There are many modules within suite systems for accounting, inventory management, expense management, time management, payroll, etc., which make reconciliations between these accounts simple and automated. In addition, more specialized companies may benefit more from a system that caters to their needs.

For example, a service provider may only need an accounting system that manages expenses; a consulting firm may only need an accounting system that includes time-tracking information.

Based on the industry

Buyers must determine if a product is specialized in meeting their industry's standards or is versatile enough to be customized to meet their needs since tax codes, regulations, and best practices differ by sector. Companies of all sizes can be affected by this, whether small businesses or established companies.

What are the Benefits of Accounting Software?

Accounting software comes packed with a host of benefits that can give your firm a distinct competitive advantage. Some of the most significant benefits of accounting software include:

1. Saves time

Accounting solution takes some time to get up and run. Still, once you do, they will save you hours of manual accounting by automating previously time-consuming manual processes. Also, it will save you hundreds of hours by taking over time-consuming manual bookkeeping and accounting processes

2. Generates financial reports quickly

You can easily download your Earnings Statement, Balance Sheet, etc., which contains key insights such as a month, quarter, or year's income and expenditures with the click of a button in accounting software platforms.

3. Promotes data accuracy

Whenever you make changes to your records, you don't have to update multiple cells in multiple sheets manually. Instead, accounting software will automatically update your financial statements and reports to reflect any changes you make to keep your data error-free.

4. Simplifies payroll

Even though you may need a technical payroll system at some moment, many small businesses use accounting software to keep track of their payrolls. In addition, using accounting software lets you automate worker payroll, estimate healthcare, and insurance contributions, and figure payroll taxes.

What are the Features of Accounting Software?

-

Financial Reporting

You can generate financial reports with any accounting program, but some programs have more basic features than others, and some require you to pay more for advanced features.

If you need precise financial reports, you’ll want to guarantee they’re present in the software application and your chosen plan. Detailed reports can assist you in making informed business decisions based on your financial data.

-

Bank Feed

This feature lets you connect your business bank and credit card accounts to receive daily transaction updates. Many people like this feature because it saves them time by not uploading transactions manually. It also lets you see a daily overview of your accounts rather than just monthly.

-

Recurring Invoices

Using this feature, you can schedule recurring charges, such as subscriptions, to be automatically billed. In addition, you can set how frequently invoices are sent, such as every day, each week, monthly, or annually, and specify an end date.

-

Integrations

It saves you a lot of time to connect your accounting software to different programs because it eliminates the need to move data between them manually. Among the popular integrations available with accounting software are payroll, payment processing, point-of-sale (POS) systems, and customer relationship management (CRM).

How to Buy Accounting Software?

Compare Accounting Software Products

Depending on the industry and the buyer's needs, the buyer might want to create a long list of business software designed to assist businesses in the particular industry, such as retail, manufacturing, restaurants, etc. For example, platforms are built explicitly for companies operating in retail, manufacturers, and restaurants and for many different types of commercial organizations.

Accounting software built for smaller businesses is often easier to use but lacks advanced features in enterprise software. After reviewing the software on the longlist, the buyer can narrow down this list based on budget. It is readily available to suit all budgets, and some general accounting applications can be downloaded for free or purchased off the shelf at a lower price.

Selection of Accounting Software

Negotiating a contract is an important part of any business relationship. Whether it is about performance protection, security protection, or just ensuring that both parties agree on what they want from each other, gathering all the relevant information is essential before signing off on the deal.

Best Accounting Software for Small Businesses

Here is a list of accounting software in India for your business:

-

Sunrise

Invoicing, recurring invoices, costs, estimates, and much more are all possible with Sunrise, the most used accounting software in India for lone entrepreneurs and small companies. In addition, a new feature called Capital Health has recently been added to Sunrise, which improves the account balance visualization, and other accounting categories improvements have also been made to the app.

Features

- Tax & Cash Management

- Spend Management

- Purchasing & Multi-Currency

- General Ledger

- Expense Tracking

-

Zoho Books

Zoho Books is the cloud accounting solution for growing businesses. With Zoho Books, you can simplify company transactions, track revenue and costs, automate business operations, and connect with other enterprise systems, such as CRMs and inventories.

Using automation features such as reminders for payments, scheduling reports, and setting triggers for certain workflows, business owners can save a lot of time from repetitive bookkeeping tasks.

Features

- Customizable Invoice Templates

- Online payments & Transaction approval

- Recurring expenses

- Inventory tracking

- Schedule & Customize reports

-

Microsoft Dynamics 365

As a comprehensive business administration solution, Microsoft Dynamics 365 Business Central links small and midsize businesses' finance, sales, and operations teams to a single, user-friendly application, enabling them to accelerate deployment and adoption with a step-by-step onboarding process, contextual next-best action intelligence, and interoperability with Microsoft 365 applications.

Features

- Finance management

- Purchasing and payables

- Inventory management

- Service management

- Supply planning and availability

-

Wave

Using Wave Accounting, businesses can streamline bookkeeping by invoicing, billing, tracking payments, managing payroll, processing credit cards, and scanning receipts. In addition, to improve efficiency and accuracy in bookkeeping, businesses can manage all bank account and credit card information in real time with Wave's bank reconciliation tools.

Features

- Invoicing

- Billing & payment tracking

- Payroll management

- Credit card processing

- Receipt scanning

-

myBillBook

myBillBook is amongst the top 10 accounting software in India. A company owner can set up role-based approval protocols for different data users using myBillBook's data security tools. In addition, the log management tools on myBillBook provide executives with real-time visibility into everyday workforce movement. Experts can also monitor and track production processes to identify bottlenecks.

Features

- GST Invoicing/Billing

- Analyze business reports

- Customized bills and invoices

- Flexible printing options

- Barcode scanning

-

Vyapar

One of the best accounting software in India, Vyapar, is used to manage a company's day-to-day business activities. A few of the features of Vyapar are easy and fast billing, bar-code generation, free transaction messages, payment mode selections, printing and sharing invoices, etc. Some include other accounting categories such as billing, accounting, inventory management, online sales management, etc.

Features

- Invoice History & Creation

- General Ledger

- Billing & Invoicing

- Financial Reporting

- Income & Balance Sheet

-

NetSuite

Thousands of organizations use NetSuite to automate key processes and gain real-time visibility into operations and financial performance by automating core processes. Organizing accounting, goods, production, supply chain, and warehouse processes are more comfortable with a single, integrated suite of applications.

Features

- General Ledger

- Cash Management

- Accounts Receivable & Payable

- Tax Management

- Fixed Assets Management

-

Xero

A double-entry accounting solution for small businesses, Xero supports sales, assets, accounts, costs, inventory, and payroll. In addition to providing great reports and cutting-edge analytics, Xero also offers tools to track projects. As part of its automation processes and improved connectivity with financial websites, it makes good use of artificial intelligence.

Features

- Send invoices

- Bank reconciliation

- Pay bills & claim expenses

- Accept payments & Track projects

- GST returns

-

AlignBooks

One of the best accounting software in India, AlignBooks aspires to help CAs and enterprises of all sizes. With AlignBooks, you can save money on LAN infrastructure, anti-virus protection, and data backups compared to other tools.

In addition, for customers who want to maintain multiple company accounts simultaneously, the offline version provides a smart solution.

Features

- Inventory management

- Expense tracking

- GST invoice generation

- Payment tracking

- General ledger

-

Sap ERP

SAP ERP Financials Management application provides a general ledger, journal entries, cost accounting, budget management, financial reporting, multi-currency support, and many other features. SAP ERP is a fully functional ERP solution that enables tracking, management, analytics, reporting, compliance, and collaboration.

Features

- Accounting

- Purchasing and Inventory Control

- Fixed asset management

- Banking and reconciliation

- Financial reporting and analysis

-

BlackLine

BlackLine automates workflows, delivers a safe, centralized workspace for period-end accounting movements, and facilitates financial reporting so that accounting and finance can handle and control the end-to-end financial close process. As a result, teams can focus on analyzing discrepancies and identifying new ways to create value for the organization.

Features

- AR intelligence

- Cash application

- Collections management

- Credit & risk management

- Disputes & deductions

-

Freshbooks

FreshBooks is a small business accounting software product that is well-suited to freelancers and independent contractors. With its powerful invoicing feature and customizable invoicing, it stands out from the competition. Invoices are sent on the go, receipts are scanned, and mileage is tracked; inventory is tracked for billable items; no double-entry accounting reports are included in the least expensive plan.

Features

- Invoicing

- Time and expense tracking

- Simple project management

- Accounting applications

- Accurate Payroll Information

-

QuickBooks Online

QuickBooks Online is one of the best accounting software for small businesses. Upon completing the 30-day free trial, monthly subscription plans start at $25 per month and offer more advanced features such as inventory management, time tracking, more users, and cash flow.

Features

- Cloud Accounting

- Invoicing

- Online Banking

- Cash Flow Management

- Time Tracking

-

TallyPrime

Business management software TallyPrime enables businesses to manage all business functions through a single application, including invoicing, accounting, inventory, banking, cash flow, credit management, taxation, payroll, and cost management.

With TallyPrime, you can manage multiple business functions in an integrated manner, eliminating complexity and allowing you to focus on growing your business.

Features

- Invoicing & Accounting

- Inventory Management

- Insightful Business Reports

- GST/ Taxation

- Credit and Cash Flow Management

-

Sap Business One

SAP Business One is an incorporated enterprise management solution for small and medium-sized businesses. You can access the SAP Business One software in the cloud or on-premises.

You can streamline and manage your vital business processes with SAP Business One in one integrated package. As a result, you can monitor every aspect of your business more effectively and make better decisions. This includes finances, customer relationships, warehousing, reporting, and purchasing.

Features

- Purchasing and Inventory Control

- Procurement

- Master data management

- Warehouse and accounting integration

- Accounts payable

-

odoo ERP

Open-source, Odoo software includes hundreds of expertly designed business applications that are fully integrated, customizable and open-source. Among Odoo's intuitive database options are CRM, Sales, Projects, Manufacturing, Inventory, and Accounting, to name a few.

As a result, Odoo is a comprehensive software package that meets the needs of all businesses, regardless of size (or budget).

Features

- Accounts Receivable

- Clean customer invoices

- Credit Card Payments

- Control supplier bills

- Automate bank feeds

-

Sage Intacct

Sage Intacct is a flexible business accounting software with excellent accounting abilities for hundreds of companies worldwide. Sage Intacct offers lots of core accounting applications, such as a general ledger, AP, AR, cash management, etc., to any accounting department or finance team,

Features

- Dynamic Allocations

- Revenue Recognition

- Multi-Entity and Global Consolidations

- Vendor Payment Services

- Spend & Inventory Management

-

FreeAgent

FreeAgent is a highly regarded online accounting tool exclusively for SMBs, independent contractors, and bookkeepers. FreeAgent helps thousands of freelancers and businesses keep track of their finances.

FreeAgent aids business owners in handling day-to-day administrative tasks, such as controlling spending, managing RTI-compliant payroll, and time tracking, as well as preparing and sending invoices and keeping track of cash flow.

Features

- Custom invoices

- Profit and loss statements

- Automated bank feeds

- Offers PayPal, Stripe, and GoCardless Integrations

- Timesheet reporting

Comparison of Top Accounting Software

We researched and compared 20+ accounting software companies before selecting the top five best suited for small businesses. We evaluated capabilities and price tags, as well as industry suitability. Here are our top five software for small businesses.

Here are our best picks with details (free trial, pricing, and benefits) to make your selection process easier.

|

Accounting Software

|

Free Trial

|

Starting Pricing

|

Key Benefit

|

|---|---|---|---|

|

14 Days

|

Rs 5000 Per Year

|

Best for Small Businesses

|

|

|

14 Days

|

Rs 0 for Startups |

Best for SMBs

|

|

|

30 Days

|

Rs 1200 Per Month

|

Best for Invoicing and Billing

|

|

|

14 Days

|

Custom

|

Best Accounting ERP tool

|

|

|

Free

|

N/A

|

Free Accounting Solution

|

Challenges with Accounting Software

There are some potential limitations and challenges of accounting software that business owners and executives should be aware of before investing in one for their business requirements. Some major challenges of accounting software include:

-

Internationalization

Businesses can't just use any accounting service if they want to conduct transactions outside their national borders. The best accounting tools must be able to handle transactions in different currencies and languages.

-

Compliance

Accounting standards and financial regulations vary widely; not all accounting systems comply with all of them. Usually, basic financial statements and reports are provided for compliance purposes, but buyers need to ensure that industry-specific compliance features are included.

-

Access to Sensitive Data

Bank accounts, credit card information, and other confidential information, such as social security numbers, are stored in accounting systems, along with personal and business financial data.

Therefore, it is crucial to ensure that a limited number of users can only access this type of information and that it is protected from external threats like viruses and hacking attacks.

Accounting Software Trends

In the world of technology, things move fast, and accounting software is no exception. As part of this change, accounting solutions are becoming more affordable, automation features are being introduced, and integrations are being added. Below is a list of the top accounting software trends for 2023:

-

Bots and artificial intelligence (AI)

The use of artificial intelligence or AI for accounting is still in its infancy, but more and more vendors are adding it to their services. Most of these vendors released automated assistants that help accountants with their daily tasks utilizing machine learning and artificial intelligence.

Accounting intelligent assistants can benefit all types of businesses, including freelancers and small businesses.

-

Two-tier implementation

It is common for companies to use two different accounting solutions and ERP systems to manage their finances due to the limitations of some accounting solutions and ERP systems.

A manufacturer, for instance, might choose an ERP system with robust production capabilities but weak accounting capabilities and another accounting solution to meet their needs.

Accounting Software Related Research Articles:

- 10 Top Accounting Software for Mac

- 12 Accounting Practices That Will Damage Your Business

- Emerging Trends in Accounting

- Benefits of Integrating Accounting Software with Timesheets

- Benefits of Hotel Accounting Software

- Improve Productivity Using Accounting Software

- Why Mobile Accounting Is the Future for CPAs

- Differences Between ERP Accounting Software

- Excel Alternatives for Accounting

- Excel Accounting Software - The Ultimate Guide

- Using Excel for Small Business Accounting: Advantages & Drawbacks

- Impact of Blockchain on the Accounting Profession

- What Is Ledger In Accounting – Types, Format, Purpose, Examples

- How to Start an Accounting Firm: Checklist for Successfully Starting a Firm

- Key Internal Control Checks for Your Accounting Software

- 8 Free Accounting & Billing Software for India GSTN

- 8 Accounting Cycle Steps: An Easy Layman’s Guide

- Account Reconciliation: Process and Best Practices

- Accounting Information System (AIS): Definition, Function & Types

- What Are Adjusting Entries? Benefits, Types & Examples

- Integrated Accounting System: Features and Benefits

FAQs of Accounting Software

Accounting Software in following cities

Accounting Software in following industries

- Accounting & CPA

- Agriculture

- Banking

- Construction

- Consulting

- Distribution

- Education

- Engineering

- Food & Beverage

- Healthcare

- Hospitality

- Insurance

- Legal-Law Firm

- Manufacturing

- Pharmaceuticals

- Property Management

- Real Estate

- Retail

- Transportation

- Farming

- Financial

- Sales

- Service

- Garment

- Fitness

- Government

.png)